Analysis: Cryptocurrency experts tell Senate innovation requires regulation | Modern Consensus.

A week after the U.S. government’s inaction on cryptocurrency regulation drove Jeremy Allaire to move most of his company out of the U.S., the Circle chairman and CEO told congress why.

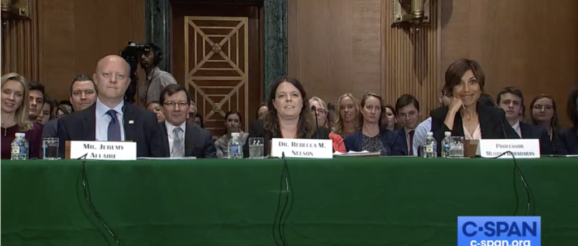

Sitting in front of the Senate Banking Committee on July 30, Allaire said that given the choice between the “comprehensive regulatory framework” of Bermuda’s “forward-looking Digital Asset Business Act” and a U.S. Securities and Exchange Commission (SEC) “forced to apply federal laws written in the 20th century to technology created in the 21st,“ his American company had chosen to leave.

“We’re in the process of moving our international facing products and services out of the United States,” said Allaire. “Without a national policy framework for digital assets, I’m concerned that the United States will not be the world leader in this critical new technology. It will continue to fall behind, and it will not fully reap the benefits of the economic transformation that digital assets will bring.”

Circle has been one of the most aggressive companies in the cryptocurrency space when it comes to embracing regulation. The financial services company was one of the first to earn one a New York Department of Financial Services BitLicense. Widely considered the gold standard in U.S. cryptocurrency regulation, the BitLicense allows Circle’s Poloniex exchange to operate in New York. The company will retain offices in Boston and continue to serve Poloniex’s U.S. customers, albeit with more limited services, Allaire said in a July 22 blog post announcing the move to Bermuda.

While Circle’s departure is a blow to the U.S. blockchain FinTech industry, the fact that Allaire was speaking in a formal Senate hearing is a sign that political leaders are coming around to the view that to remain a leader in the blockchain industry’s leading sector—finance—the rules of the road can no longer be made up on the fly by an alphabet soup of agencies such as the SEC and the Commodity Futures Trading Commission (CFTC).

“Congress should adopt national policies that define and establish digital assets as a new asset class, including appropriate rules and exemptions,” Allaire said. It is vital, he noted, “that we allow innovators room to grow in the United States.”

Is innovation a four-letter word?

With Tuesday’s hearings held in the aftermath of back-to-back hearings on Facebook’s Libra project in the House of Representatives and Senate two weeks ago, it’s fair to say that the social media giant’s plan for a cryptocurrency that could be instantly available to 2.7 billion people has brought the issue of regulation to the forefront in the U.S., as well as in Europe and in Asia.

While the attention is welcome, the hostility that came with Facebook’s involvement is not.

Facebook CEO Mark Zuckerberg—who last week promised to work “however long it takes” to win over Libra doubters—thought better of the company’s “move fast and break things” motto five years ago. But what can be seen as a reckless attitude towards innovation, particularly in the financial arena, is now attached to cryptocurrencies.

Sen. Sherrod Brown (D-Ohio), who in the July 17 Senate hearings cited that motto to accuse Facebook of everything from breaking American democracy to inciting genocide, was back on the attack on July 30.

“Look around to what happens when big corporations say they want to innovate,” said the Senate Banking Committee’s ranking minority member in his opening remarks. “Before they blew up the economy in 2008, bankers were pitching an innovative new product called sub- subprime mortgages… They wrecked the economy.”

Adding that he is “all for innovation, especially if that innovation delivers on its promises of improving people’s lives,” Brown said, “[t]he big tech companies, the Wall Street banks are hiding behind innovation as an excuse to take over important public services we all benefit from and should all have a say in. There are some things, our currency, our payment system, the protection of our savings accounts that everyone in the country has a stake in. We shouldn’t be handing those kinds of public resources over to wealthy special interests so they can squeeze more profits out of ordinary Americans.”

Even the normally exuberant Republican members were taking a cautious approach to cryptocurrency innovation. The Committee chairman, Sen. Mike Crapo (R-Idaho) said that the “U.S. welcomes responsible innovation, including new technologies that may improve the efficiency of the financial system and expand access to financial services.”

Yet he qualified that by saying, when it comes to both Libra and other cryptocurrencies, “our overriding goal is to maintain the integrity of our financial system and protect it from abuse.”

Following the regulation

While some cryptocurrency exchanges like Binance have been very open about globetrotting in search of a light regulatory touch for years, Circle’s planned departure for Bermuda showed that at least some entrepreneurs are searching for strong regulation, Allaire argued.

The Senate Banking Committee’s second witness, Dr. Rebecca Nelson of The Blockchain Association, said that regulation has helped some jurisdictions get out ahead of the U.S.

In response to a question by Sen. Jon Tester (D-Mont.), Nelson said that some countries are becoming hubs by “using regulation as a way to attract cryptocurrencies to their borders.”

This doesn’t necessarily mean increased regulation, she remarked, adding that clarity is key.

“By giving regulatory certainty to consumers and businesses in the cryptocurrency market,” said Nelson, these countries are “getting out in front and attracting cryptocurrencies to their jurisdictions.”

She gave the example of Switzerland, pointing out that it has addressed money laundering issues with cryptocurrencies and “provided guidance on how initial coin offerings (ICO) should be treated in regard to securities regulations,” said Nelson. “They provide guidance on what kind of licenses cryptocurrency industries need to operate within Switzerland. It’s not that these countries are trying to shirk regulation. They’re trying to provide certainty while also balancing innovation to encourage the adoption of crypto[currency].”

Allaire added Bermuda, Singapore and, recently, France to that list, saying they are “introducing tailor-purposed definitions of digital assets so that issuers can feel comfortable with their obligations, [so] there are investor protections … and security and the like.”

And, he added, “they don’t try and jam these into the respective classifications we have today.”

Regulation requires definition

To provide that certainty, Allaire argued that regulators must properly define the various types of cryptocurrencies rather than lumping all of them into the securities category like the SEC does.

This effectively means many are not usable by Americans as it places big limits on their usefulness, he added. For example, every time you buy a coffee at Starbucks with bitcoin in the U.S., you technically have to declare the sale of the cryptocurrency as a capital gain or loss—depending on the price of bitcoin when it was bought and sold—to the IRS.

“There’s a fundamental mismatch between the regulatory structure and guidance that we have here and the nature of these digital assets,” said Allaire. “I believe we need new definitions of digital assets as a new asset class. and that there are circumstances where there are investor protection considerations, there are trading and market considerations, and there are also circumstances that have to do with utility, commodity, and end user usage. And you have to be able to define these in a way where that can work.”

Allaire mentioned how non-currency tokens that are being used in blockchain projects involving everything from voting to healthcare records.

“The breakthrough here is that we have a public, secure, tamperproof infrastructure that’s evolving and emerging for recordkeeping and processing of data, that is more resilient and ultimately more private than some of the infrastructures that we have today,” said Allaire.

But, he added, those digital assets “also may be associated with some financial characteristic. The coupling of the utility and financial characteristics is part of what makes these innovative. It’s the definitions there that I think really need to be more clearly defined in the United States.”

Trustless is not riskless

Another witness speaking at the Senate Bank Committee’s July 30 hearing was Mehrsa Baradaran, a banking law expert and professor at the University of California, Irvine School of Law.

Returning to the 2008 banking crisis, she reminded the elected officials that Satoshi Nakatmoto’s 2009 Bitcoin whitepaper, which created cryptocurrencies, came on the heels of that crisis.

Americans frustrated by banks’ “reckless risk-taking and predatory practices … were frustrated again by government bailouts that seemed to save just the perpetrators of the crisis,” she said. “Is it any wonder that as so many people lost trust in the system, they enthusiastically embraced bitcoin and new alternative, non-sovereign currencies introduced on the heels of the crisis?”

Baradaran added that while no one wants to stifle innovation or see the U.S. fall behind, “[i]t’s the innovator’s job to imagine a bright and better new world of disruption and change that will benefit everyone. It is a regulator’s role to imagine a what could go wrong, to create system wide crisis that could hurt everyone. When it comes to regulating finance, an ounce of prevention is much better than a trillion-dollar bailout.”

Beyond that, she added, a market based on digital assets wouldn’t be all that different than the fiat-based market it seeks to replace.

Arguing that the problems of the unbanked and the high fees they pay that Libra and cryptocurrencies like Ripple (XRP) on are “not technological problems [but] policy problems,” Baradaran said that the focus on blockchain technology is a “red herring.”

Cryptocurrencies, she said, “create new, money-like instruments that are tradable and have inherent value. This is not significantly different from derivatives markets, commercial paper markets, repo markets, even historic markets and private bank notes.”

While none of the existing cryptocurrencies like Bitcoin currently have the scale to present a systemic threat, “if their ambitions are believed, they will” warned Baradaran.

“It doesn’t matter what technology undergirds it, what matters is the risk presented. And there’s nothing about the blockchain that diminishes these risks.”