Highway construction: Innovation is the name of the game – The Financial Express

It has been estimated that the process friction arising from inefficiencies in India’s logistics infrastructure consumes around 14% of the GDP, as against 8-9% for developed nations.

It has been estimated that the process friction arising from inefficiencies in India’s logistics infrastructure consumes around 14% of the GDP, as against 8-9% for developed nations.By Elias George

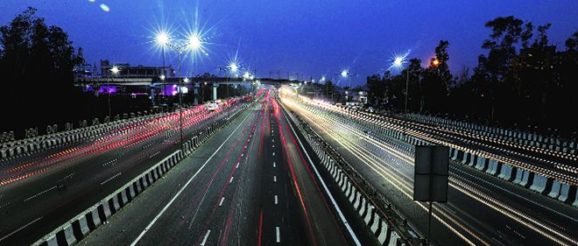

As carriers of around 85% of India’s passenger movement and nearly 60% of freight traffic, our road networks are essentially the country’s central nervous system. We possess the second largest road network in the world, with a highway density that equals that of the United States, and is four times that of China. However, the state of our roads is far from being compatible with the country’s basic mobility requirements, be it in terms of volumes, quality or safety. Our national highways (NHs) comprise only around 2% of the total road network but carry around 40% of the traffic. Hence, improving this component of our road system is vital.

The pace of construction of NHs has gained impressive momentum recently, growing by 70% over 2015-2018, compared to the previous four years. The road ministry has set a construction target of an additional 60,000 km over the next five years. This would entail a funding commitment of `4 trillion annually till 2024, which would have to be met through extra-budgetary resources, primarily private capital.

The National Highways Authority of India’s (NHAI’s) first foray into the domain of public-private partnerships was the Build Operate Transfer (BOT) model, which saw a spurt of growth in the first decade of the 21st century. However, debt leverage problems of infrastructure companies, and the related lending issues of banks saw the acceptance of this funding model decline, whereupon the NHAI introduced the Hybrid Annuity Model (HAM), wherein 40% of the construction cost is contributed by the government.

While the HAM model is now predominant, other imaginative funding models need to be brought into play. The NHAI has had initial successes with the asset-recycling paradigm when it introduced the Toll Operate Transfer (TOT) model. The third round of bidding is now underway, but it is clear that reliance on the TOT model alone may not suffice to meet the capital expenditure needs of the NHAI.

It may therefore be desirable for the NHAI to explore other funding avenues. For example, securitisation of toll revenue, as well as value capture financing, whereby the enhancement in property values around new or improved stretches of roadway can be tapped by the government.

In respect of fresh road asset creation, a number of issues that bedevil the ecosystem need to be tackled, including burgeoning land costs arising from the amended Land Acquisition Act, the time taken to obtain approvals, the uneven quality of project reports, as well as local issues. Additionally, there is a compelling need to make the transit experience on our highways more comfortable and safe. This can be done by deploying systems and tools that incentivise a shift from private vehicles to public transport, such as enabling first and last mile connectivity, as well as technology-enabled, user-centric solutions.

IT-enabled solutions are also vital to enhancing road safety, as well as inducing efficiencies in road asset management.

It has been estimated that the process friction arising from inefficiencies in India’s logistics infrastructure consumes around 14% of the GDP, as against 8-9% for developed nations. The need to augment and improve India’s highway system, using the cost-benefits that are now possible with sensible policy tweaks and by deploying increasingly affordable new technology, has never been more compelling.

The writer is National Head, Infrastructure, Govt. and Healthcare, KPMG in India

Get live Stock Prices from BSE and NSE and latest NAV, portfolio of Mutual Funds, calculate your tax by Income Tax Calculator, know market’s Top Gainers, Top Losers & Best Equity Funds. Like us on Facebook and follow us on Twitter.