2020 Novarica Impact Awards Range from APIs to College Innovation Labs – Novarica

2020 Novarica Impact Awards Range from APIs to College Innovation Labs

Last week, Novarica announced the winners of our ninth annual Novarica Research Council Impact Awards. In each of four categories, voters selected insurance technology projects that demonstrated excellence in execution and generated strong business impact in their respective companies.

The 2020 winners (and their categories) are:

- Amerisure for its Agile practice group (IT practice)

- COUNTRY Financial for its college partner innovation lab (IT practice)

- Everest Insurance for its Everlink API library (core)

- Everest Re for its NLP-based incoming email automation platform (digital)

- Merchants for its online quoting system and legacy integration via API (digital)

- Neptune Flood for its AI-based flood risk rating engine (data and analytics)

- ProSight for its core cloud upgrade and legacy system retirement (core)

- Shelter for its cloud-based risk scoring application (data and analytics)

Only insurer CIO members of the Novarica Research Council vote for Impact Award winners, which makes it the largest purely peer-juried award in insurance technology. It also means winning is true recognition from peers who know how difficult these projects are to execute.

This year’s winners span a broad range of companies and initiative types. But all eight shared characteristics common of all impactful projects: clear articulation of target value and benefits, consistent executive support, effective multi-stakeholder communications during the project, and swift resolution of inevitable challenges.

Novarica launched the Impact Awards to provide insurer business and technology leaders with concrete examples of IT initiatives that delivered real business impact. Measuring the value of such projects continues to be a challenge for many insurers. Novarica’s Three Levers of Value framework can help here: According to the framework, the three ways to create business impact with technology are to (1) sell more; (2) manage risk better; and (3) cost less to operate.

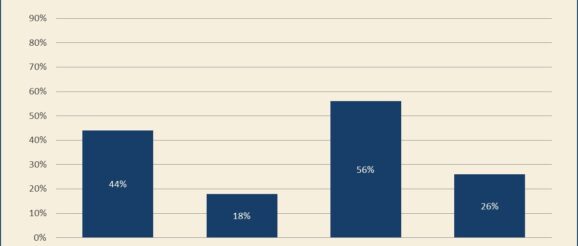

Looking at the last five years of Impact Award winners, it’s most common for insurers to realize value through cost savings tied to productivity gains, though these are usually not tied to hard dollars. Insurers also frequently create value by selling more, often by enabling straight-through processing and creating online sales platforms.

It’s been less common for insurers to create value by managing risk better, but that may be changing as insurers get more comfortable with data and analytics—more than half of the Impact winners that created value in this area are from the last two years.

Case studies for all winners and 20 other IT projects considered for the Impact Awards are collected in this year’s Insurance Technology Case Study Compendium, and more than 100 case studies from the last five years are available in Novarica’s research library.

About Matthew Josefowicz

Matthew Josefowicz is the President and CEO of Novarica. He is an expert on insurance and financial services technology, with two decades of experience advising CIOs on IT strategy and solutions. He has written more than 100 reports on insurance technology issues and is the lead moderator of the Novarica Insurance Technology Research Council. Prior to launching Novarica in 2007, he founded and led the global insurance group at analyst firm Celent and worked at D. E. Shaw & Co., LP. He holds a BA magna cum laude in Classics from Brown University. He can be reached directly at [email protected].