6 Top B2B Fintech Companies and How Digital Innovation Made Them Successful

In 2022, the B2B fintech sector in Europe attracted four times the investment compared to its B2C counterpart.

Investors find B2B fintech companies attractive because they have a greater revenue potential, focus on specific niche markets, and always aim to differentiate themselves from the competition through innovative features and products.

But not all B2B fintech companies are created equal. Some focus on creating unique products, while others find new, untapped markets and serve their needs with the help of the latest technology. In all cases, digital innovation is key to the success of these companies. Companies that are more innovative—like these six successful UK companies—are more likely to thrive in the competitive fintech landscape.

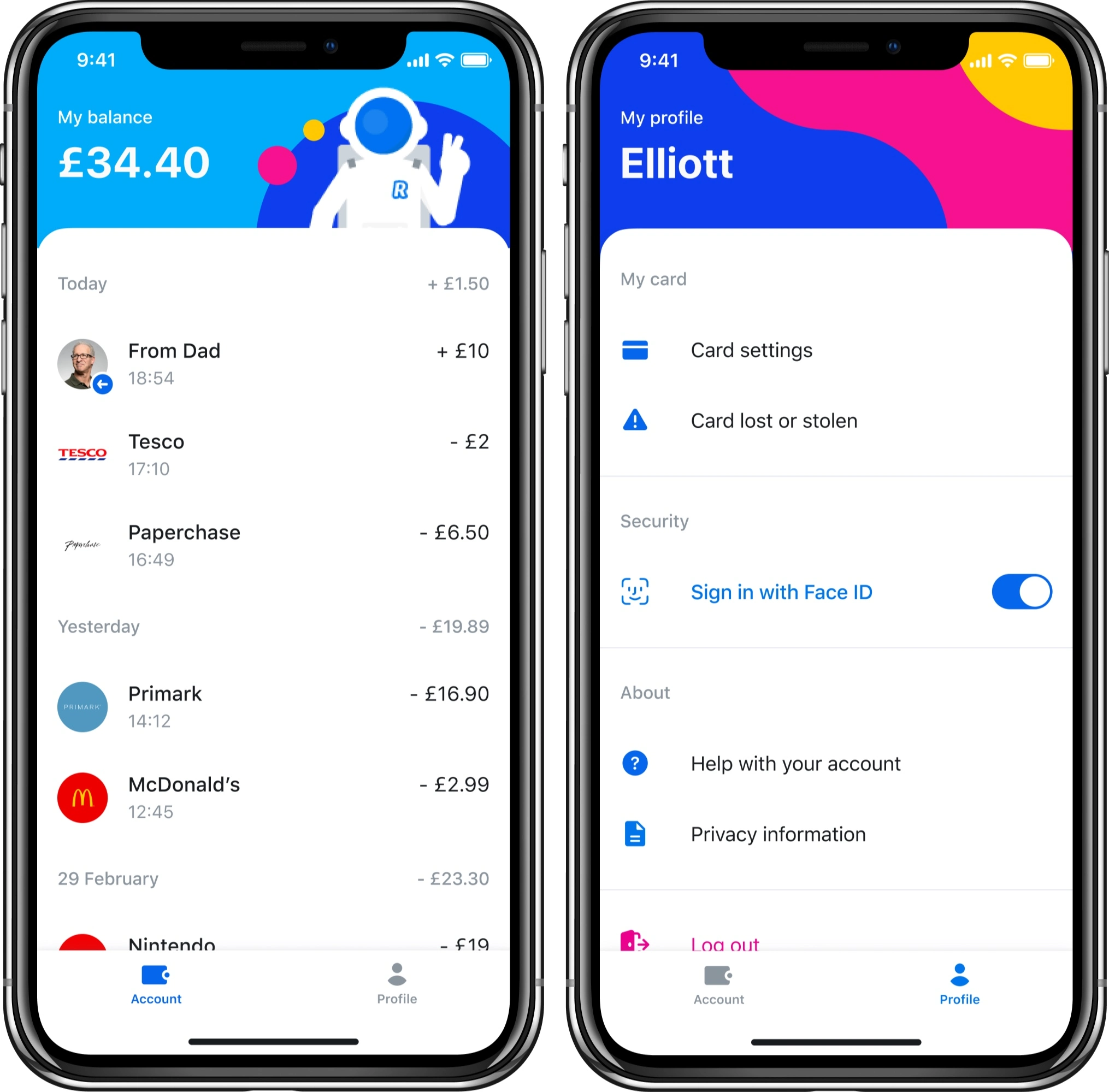

1. Revolut

Revolut identified the need for the use of digital technology and mobile apps to make banking easier for users more than a decade ago. In the early 2010s, the founders of Revolut saw that smartphone adoption and use were on the rise and that there was a market for digital banking apps.

They started working on a digital banking app and launched it in 2015. Its primary appeal was the ease of sending and receiving money, cryptocurrency, and P2P payments all over the world. It offered all transactions at interbank exchange rates and charged no fees on currency exchanges.

The app quickly gained popularity because it was easy to use and was a faster and more secure alternative to conventional banking. The app, and the services offered through it, are a good example of using digital innovation to win over a largely untapped market.

Revolut’s B2B products include standard banking services with support for crypto and more than 25 currencies for teams as well as customizable payment systems and gateways.

Revolut also offers a prepaid debit card in over 30 countries. The company is currently valued at $33 billion.

Revolut’s success can be attributed to identifying market trends, prioritizing user experience, implementing innovative features, and continuously improving the application. Even though the company captured the market early, it didn’t lose its market share to similar products. That’s because it kept improving its app and used the latest technology—case in point—its use of machine learning technology for fraud detection and prevention back in 2018.

Revolut’s success is a prime example of how technological innovation can help companies achieve great success.

2. Wise

Wise took an age-old, tried-and-tested business model and modernized it. The founders realized that banks charge a hidden fee by offering less favorable exchange rates. They created an MVP using the Grails framework, with one of the founders writing the first few thousand lines of code himself. They spread the word through unpaid marketing campaigns to get their first few users.

The company started with a peer-to-peer model and cut out bank exchange fees entirely by matching people that wanted to transfer money from one country to another with others that wanted to do the opposite. When a match was not available, Wise used its own funds.

The company grew slowly for the first two years, but aggressive marketing campaigns, where it targeted banks for not being transparent, helped it get new customers. As it grew, the company switched to a microservices architecture for scalability. It also formed partnerships with challenger banks from all over Europe and integrated its app with their partners as well as Facebook Messenger. This use of API integrations helped the company increase its reach and cater to a wider audience.

Soon the founders realized that they could target the B2B market as well. The company offered borderless accounts to businesses and freelancers and enabled companies to make international payments through its API. These features, coupled with the company’s great reputation and marketing strategy, helped Wise become successful.

Its B2B products include a payment system for businesses, business debit cards and employee debit cards, and the Wise platform—a cross-border payment solution for businesses. The company is currently worth $6.6 billion.

Wise’s journey showcases the power of modernizing a traditional business model with the help of digital technology. Without tech, a peer-to-peer model is just the centuries-old Hawala system. With tech, it becomes a billion-dollar business operating globally.

The fact that the founders were quick to launch an MVP and switch from a monolithic structure to microservices as soon they faced increased traffic shows their proactive approach. They focused on digital innovation as much as their business model and marketing strategies and succeeded on all fronts.

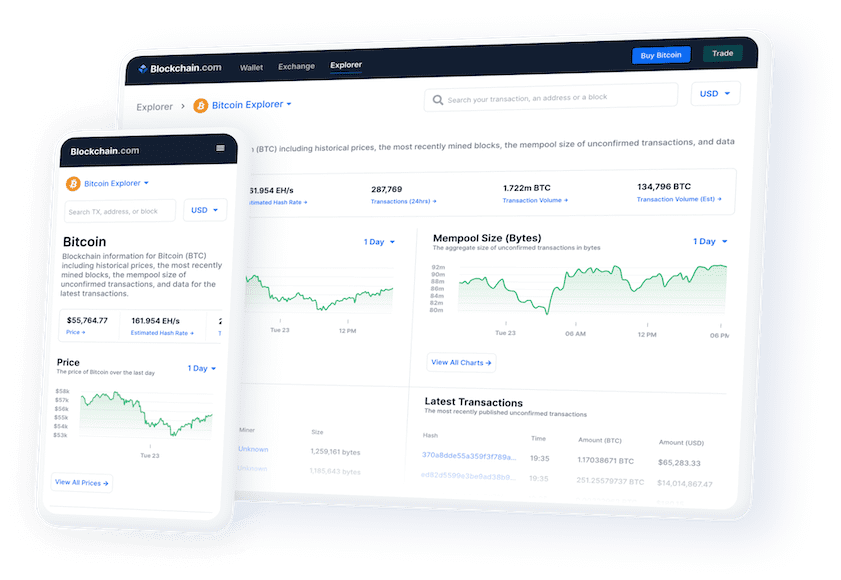

3. Blockchain.com

Blockchain.com started as a Bitcoin blockchain explorer and saw the potential in creating a cryptocurrency wallet, which led to explosive growth in the early 2010s. Its blockchain explorer enabled users to examine transactions and study blockchain, and it also offered an API that helped companies build on Bitcoin.

Giving its users access to such a vast database through an easy-to-use interface helped the company build trust, so when it launched its own crypto wallet, it became widely adopted. The company also partnered with Checkout.com last year to help its users convert fiat currencies into crypto easily. It is also planning to launch its Visa card in the US.

The company’s B2B products include Bitcoin and Ethereum, USD Coin, Tether, and more than 300 altcoins through its platform called Radial. Even though we are going through a crypto winter, Blockchain.com is likely to be valued at $4 billion.

Blockchain.com’s journey exemplifies the success of recognizing the potential of blockchain technology and leveraging it to build innovative products. The world’s biggest database on blockchain led to a digital wallet, and the digital wallet led to a Visa card, cementing Blockchain.com’s position as a leader in the crypto industry.

4. Paddle

Paddle was founded in 2012 to help SaaS companies in subscription management, renewals, and reporting. The company also built regulation compliance, fraud detection, and payment routing into its platform, giving SaaS companies all the features they need for payment management and transaction monitoring.

By offering a complete payment infrastructure, it takes away the need for SaaS companies to maintain a separate tech stack just for payment management. For example, a SaaS company that uses Paddle doesn’t need a fraud detection system, compliance software, and invoicing software, among others. Instead of dedicating resources to managing and integrating a vast technology stack, these companies can simply use Paddle to handle payments and focus on their core products.

Paddle was valued at over $1.4 billion in 2022 and continues to grow as new subscription-based software companies adopt the platform.

Paddle’s success story showcases the value of identifying technological problems and solving them for specific markets. The company consolidated the features offered by multiple tools on just one platform and secured its position as a market leader in its niche.

5. Thought Machine

Thought Machine identified the need for legacy banks to modernize their digital infrastructure back in the early 2010s and created a banking platform called Vault to do just that.

Through Vault, Thought Machine gives legacy banks everything they need to move from legacy banking systems to a modern, cloud-native core banking platform. The platform enables banks and financial institutions to provide their customers with secure and personalized banking services while also streamlining their internal operations.

Vault is built on modern technology and architecture, which allows it to provide scalability, flexibility, and resilience. The platform is designed to handle high volumes of transactions, support multiple currencies and languages, and seamlessly integrate with other banking systems. It offers advanced capabilities, such as real-time data processing, artificial intelligence, and machine learning. These features enable banks to provide personalized experiences to their customers and create their own innovative financial products from within the platform.

Thought Machine was valued at $2.7 billion in 2022.

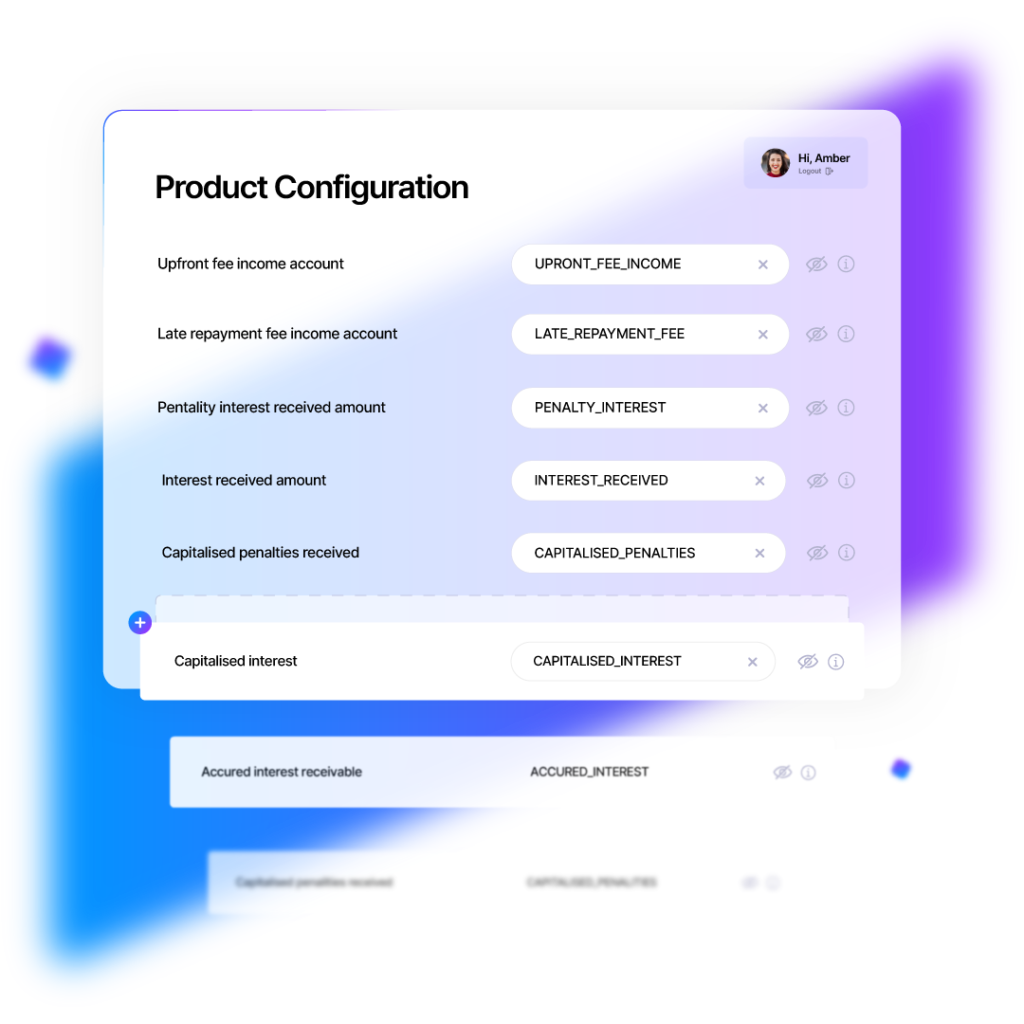

6. LeaseQuery

LeaseQuery was founded in 2011 as an accounting software that provided journal entries and forecast reports to businesses that needed to understand the financial impact of their lease portfolio. With time, the company added new features and started to help businesses meet regulatory compliance.

The company also offers an integration hub that connects its software applications to all kinds of Enterprise Resource Planning (ERP) programs and databases, and it migrated its legacy lease accounting software to modern architecture with Devtech’s assistance.

LeaseQuery caters to tens of thousands of accounting professionals across the public and private sectors—a feat that would have been impossible without the use of digital technology. Instead of offering accounting services the conventional way, the company chose to create a software to offer its services at scale. It now has more than 2,000 customers.

Innovation is the only way to thrive in fintech

Every fintech company discussed in this article identified a problem to solve and a market to cater to and then used the latest technology in the most innovative way to achieve its goals. In an environment where new competitors emerge every day and technology evolves at a rapid pace, the B2B fintech market will continue to see exciting and highly innovative digital products.

Want a software expert’s perspective on your B2B fintech infrastructure and products? Partner with Devtech to find creative ways to improve your products.

The post 6 Top B2B Fintech Companies and How Digital Innovation Made Them Successful appeared first on Devtech.