Reinsurers continue to lead the way on innovation: AM Best

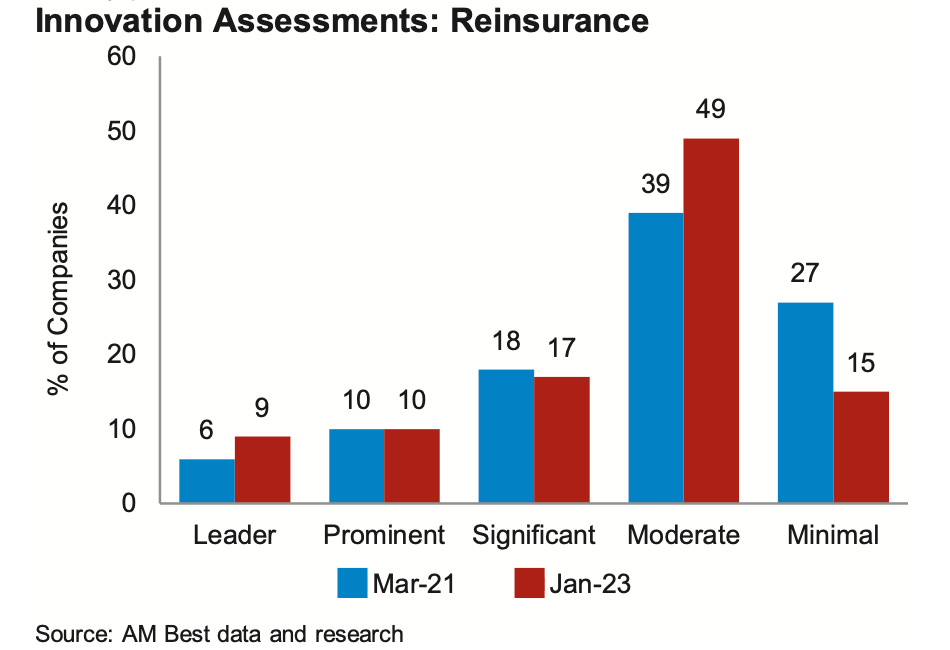

Analysis by global ratings agency AM Best finds that reinsurance companies lead the way on innovation, with efforts continuing to pay off more than three decades after initially developed following the severe natural catastrophe years of 1989 through 1992.

In a recent report, AM Best highlights that the straightforward composition of most reinsurance contracts lends itself readily to innovation, driven by the fact ceding firms manage a lot of the complex underwriting and claims functions.

In a recent report, AM Best highlights that the straightforward composition of most reinsurance contracts lends itself readily to innovation, driven by the fact ceding firms manage a lot of the complex underwriting and claims functions.

At the same time, offshore domiciles have embraced innovation which has enabled reinsurers to craft terms and conditions and alter rates that incorporate the results of advanced risk modelling, contingent pricing, and novel and new ways of navigating challenging exposures.

“Reinsurers are one or more steps removed from the ultimate policyholder and therefore have had to innovate in areas of enterprise risk management, portfolio construction, and risk accumulation,” said Edin Imsirovic, director, AM Best. “This has become evident recently with the series of significant natural catastrophic storm activity which has been exacerbated by secondary perils and heightened inflation.”

Ultimately, AM Best finds that reinsurance firms have thrived following recent large events because of their use of sophisticated risk and economic capital models that measure and manage capital to a high level of precision.

“The more successful reinsurers have used prudent modeling—along with analytical judgment—to achieve operating results that exceed their cost of capital over the long run,” explains AM Best.

Over the last 25 years, AM Best notes that competition has intensified, but adds that innovative risk modelling, risk accumulation, as well as pricing tools have informed underwriting decisions on both account and aggregate bases.

The result is a significantly improved operating performance outlook for the next year or more, as reinsurers take advantage of hard market conditions and rising demand for protection.

“Additionally, reinsurers have made significant strides forward by matching informed risk modeling with third-party capital in sidecars, cat bonds, and other insurance-linked securities (ILS) structures that are now being developed and used by relatively small reinsurers. These strategic partnerships benefit reinsurers by providing flexible off balance-sheet capital, while the capital providers benefit from a more informed view of risk,” says the ratings agency.

The post Reinsurers continue to lead the way on innovation: AM Best appeared first on ReinsuranceNe.ws.