Bank of Canada Assesses DeFi’s Innovation and Challenges on Financial Markets

Bank of Canada Assesses DeFi’s Innovation and Challenges on Financial Markets

The Bank of Canada published a staff analytical note that mirrors the development of decentralized finance (DeFi) alongside possible routes of wider market regulations.

The staff note released on Oct 17 shows the development stages of the cryptocurrency market, its benefits, challenges facing traditional finance, risk, and possible impact on financial markets alongside regulations.

Per the report, crypto assets were initially developed as a payment system deployed on the blockchain before diversifying into new fields of financial services.

To achieve its decentralization aim, it uses smart contracts doing away with third parties to settle multiple transactions, creating a service eventually spiraling into a $2.9 trillion market cap before major platform collapses and regulatory hurdles sent prices plunging.

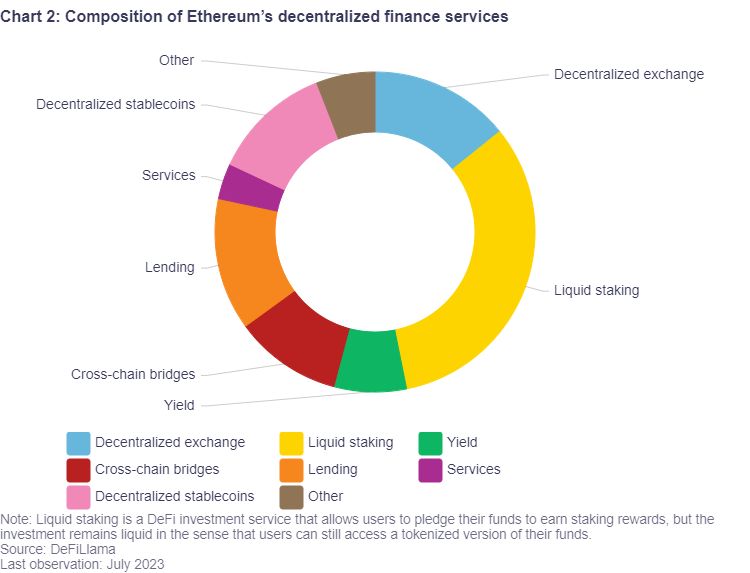

From non-fungible tokens, decentralized stablecoin, and leading services, a whole new niche has rolled out with the asset class alongside new risks in the present market.

From non-fungible tokens, decentralized stablecoin, and leading services, a whole new niche has rolled out with the asset class alongside new risks in the present market.

Bank of Canada points to benefits

One benefit of the ecosystem highlighted by the bank is the composability of smart contracts making it easy for more companies to create services.

This is due to the open-source nature of their code allowing developers to collaborate and build on top other networks.

The bank also listed increased service offerings, increased competition, and transparency as reasons for making the ecosystem more attractive than traditional finance products.

Determined to end financial monopolies, cross-border payments of most services allow for payments between countries, and with the rise of interoperability, users enjoy seamless experiences without struggling on multiple platforms.

DeFi can also reduce frictions in the financial markets faced with limited and opaque transactions with various chains offering new utilities. Furthermore, the market brings about increased transparency by leveraging blockchain technology as it cuts off traditional intermediaries that may be corrupt, placing actual powers in the hands of customers.

Market risks and regulations

Despite the numerous benefits of decentralized finance, it poses several risks to global financial markets including limited tokenization, high concentration, and unregulated centralized bodies.

“Only tokenized assets can be recorded on the blockchain and interact with smart contracts. However, few real-world assets have been tokenized thus far, resulting in a self-referential system mainly focused on speculative crypto trades. The contribution to the real-world economy remains minimal.”

On centralized systems creeping into the space, although the sector claims to be decentralized, certain players remain heavily centralized which poses a risk to stakeholders if not properly regulated.

This is borne out of the complexities of managing private keys and other services in releasing the popularity of centralized exchanges. The collapse of FTX in November is a typical example of unregulated centralized players opening up risks in the sector.

The bank suggests adequate regulations pointed at all channels to block the activities of bad actors in the industry including how they interact with traditional finance.

Recently, the association of Canada’s securities regulators clarified its stablecoin regulation stating the process concerning their issuance and trades without being caught in the web of securities.