US industrial policy’s mixed messages for global innovation | East Asia Forum

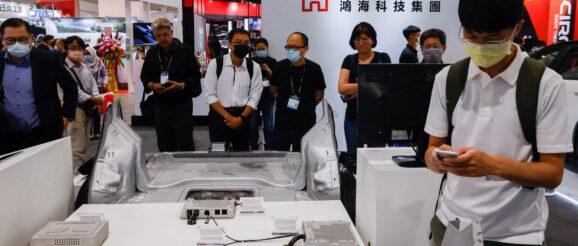

US industrial policy’s mixed messages for global innovation Authors: Samuel Hardwick, ANU, and Jason Tabarias, Mandala Though geared mainly at domestic outcomes, the rise of industrial policy in the United States is affecting global supply chains, especially in Asia. To the extent that they boost investment in the green transition, these policies are globally valuable. Yet they also contain discriminatory measures that harm Asian economies and, arguably, the United States itself. One searing assessment comes from South Korea’s Hankyoreh newspaper: ‘The US is morphing from a guardian of free trade into a disrupter … despite being the leader of today’s international trade order, [it] is perfectly willing to dispense with those principles when they no longer seem to serve its national interest.’ These comments refer to two controversial laws: the 2022 Inflation Reduction Act (IRA) and CHIPS and Science Act . The IRA offers upwards of US$360 billion in incentives, primarily tax credits, focused on electrification and green industries. These include extensive local content provisions. For example, to obtain a US$7500 electric vehicle (EV) credit, the EV and most of its battery components must be assembled in North America. Critical minerals in the battery must also be largely sourced or refined domestically or from FTA partners. While the policies aim to draw economic activity and supply chains away from China, they have mixed impacts on other Asia Pacific economies, such as Australia, Japan, South Korea and Taiwan. Australia, a critical mineral mining powerhouse and US FTA partner, is well-positioned to take advantage of the package, especially in minerals with battery and EV applications. But the picture is more complex for globally integrated Australian firms. Worldwide minerals production and processing often involves China and other nations without US FTAs, excluding them from IRA subsidies. Large capital requirements and long lead times to develop new mines and processing plants also limit the US policies’ influence. Japan and South Korea occupy a different place in the EV value chain. Both are major players in anode and cathode materials, behind only China. All three countries are net exporters of batteries and EVs. When the IRA was announced, Japan lacked a qualifying trade agreement with the United States. This raised concerns about the law’s impact on Japanese EV component supply. In response, the United States negotiated a critical minerals agreement with Japan, enabling Japanese firms to benefit from the IRA. Japan also instigated its own legislation and policy for green transformation, which includes government financial support for decarbonisation largely via green hydrogen initiatives. Given the scheme’s requirement that final assembly take place in North America, EV tax credits also caused tensions with South Korea. The Biden administration partly allayed concerns by outlining a second track of credits for leased vehicles, which omits requirements on country of origin. This second track will partially offset some of the IRA’s trade-diverting effects. For globally integrated South Korean EV and battery firms, which source raw materials from countries without qualifying agreements with the United States, uncertainty remains. Like some global Australian firms, the extent to which these manufacturers will be eligible for IRA benefits — and the long-term effects on the country’s minerals, battery and EV industries — remains unclear. For Taiwan, the CHIPS Act, a division of the much larger CHIPS and Science Act, is perhaps more relevant than the IRA. The CHIPS Act allocates US$52.7 billion to boost US semiconductor manufacturing. Most of this expenditure is for fabrication facilities, with US$11 billion for chip research and development (R&D). There are limits to how much semiconductor, battery or EV production can be shifted to the United States from East Asia, due to divergent costs of labour, land, regulatory compliance and construction. Construction costs for US manufacturing plants alone are estimated to be ‘four to five times greater’ than in Taiwan. CHIPS Act subsidies are still smaller than reported Taiwanese, South Korean and Chinese support programs. Even IRA-scale financial incentives are insufficient to reorient supply chains in which China, or any country, has overwhelming advantages. Subsidies shift decisions at the margins, but some facilities will remain too expensive or the lead times too long to set up domestically. There is also emerging evidence of skilled labour shortages in key US states associated with semiconductor manufacturing, which might have impacts for adjacent sectors, labour costs and the ability to deliver on CHIPS Act and IRA policy goals. Many aspects of these US efforts have merit, not least the significant investment in R&D and infrastructure to address the climate crisis. The trouble with policies like the IRA and CHIPS Act is the cost and risk that comes with preferences for domestic tradeable goods over cheaper or superior foreign equivalents. For the United States, these preferences are not optimal for achieving the core objectives of bolstering national security and fighting climate change, especially over the longer term. Achieving these objectives will become even costlier if other countries launch similar provisions. For the rest of the world, the US policies are another step away from its leadership of a functional multilateral trading system. While this system could be indispensable in building a greener global economy, in a more inward-looking world, the most effective technology and knowhow for reducing emissions will take longer to spread. There are better ways to achieve US goals. But with a potential second Trump presidency looming, are these politically realistic? The value of US industrial policies depends on how we view their flaws — as strategic blunders or unfortunate but necessary compromises. Samuel Hardwick is a Research Scholar at the Arndt–Corden Department of Economics, in the Crawford School of Public Policy, The Australian National University. Jason Tabarias is a Partner at the economics, strategy and policy consulting firm Mandala.