Bridging Growth and Innovation: Insights from Claret Capital and Botify (Sponsored) | EU-Startups

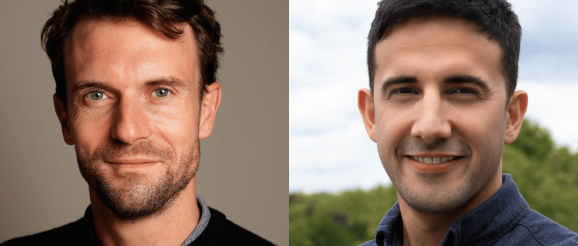

In this interview, we had the pleasure of having Antony Baker, Principal at Claret Capital Partners, and Adrien Menard, Co-Founder and CEO at Botify, to unveil the dynamics of venture debt in the tech ecosystem and the evolving landscape of SEO. This conversation explores the synergy between financing strategies and digital marketing, offering an inside look at the minds shaping the future of tech and online visibility. We explore what venture debt funding involves, how lenders decide which businesses to support, and the milestones that mark Botify’s success in the digital space. Adrien and Antony share their advice on fundraising, insights on the importance of timing in seeking capital, and discuss what excites them for the future. This conversation is not just about financial mechanisms or marketing platforms; it’s a narrative of how strategic partnerships can drive innovation, growth, and success in the competitive tech landscape. Join us as we explore the journey of Claret Capital and Botify, their contributions to the tech ecosystem, and their vision for the future. Let’s dive into it! Antony, could you start by providing us with an overview of Claret Capital Partners’ focus and the funds’ investment strategy? Claret Capital backs innovative growth-stage tech and life sciences businesses throughout Europe – through the Claret funds, we provide venture debt funding primarily to support organic growth and finance M&A opportunities. This type of funding allows entrepreneurs and their shareholders to grow their companies whilst minimising dilution. Investment is provided in the form of flexible term loans, which have a fixed timeline for repayment over 3-4 years, and modest equity kickers. And Adrien, for those who might not be familiar, could you provide a brief overview of Botify, and how you and your co-founders came up with the idea? Botify is an organic search performance marketing platform. Our mission is to make organic search the most impactful channel for every business. This is really the initial idea behind Botify. We want every business to benefit from the sustainability and profitability of the organic search opportunity as the Return on Organic Search Spend (ROSS) will on average be 3x higher than the Return On Ad Spend (ROAS). Both approaches are also very complementary. Antony, what specific criteria would a venture debt fund look for in SMEs when deciding to provide growth capital? Are there any qualities or factors prioritised in particular? At a high level (although there are exceptions) businesses that are the right fit are those that are revenue generating, with a track record of sustained revenue growth, and have good business models with strong margins that demonstrate product-market fit, pricing power, and ideally a decent level of forecastability. The slightly more nuanced bit – and where a lot of focus is pointed – is in selecting the right timing. There are periods in a growth company’s lifespan where it makes sense for that business to take on less dilutive capital on its journey to profitability – that’s where a venture debt fund can come in. On the contrary, ex-growth or shrinking businesses, with weak or falling margins are tough for a growth debt investor. Very high-burn businesses can also be trickier if there is a lack of efficiency, and absolutely if the business appears structurally loss-making. Could you highlight some of the most successful investments in the Claret funds’ portfolio – both past and present? Claret funds have made around 180 investments to date since 2013 so it’s difficult to highlight all of them! Amongst these, there are some extremely well-known names across the European tech and life sciences sectors, such as Job&Talent, Wefox, Holidu, and Butternut Box, and obviously, one of the more recent investments we are excited about is Botify, a leader in its space. As Antony says, Botify has become a leader within the search landscape – Adrien, would you be able to shed light on some of the key milestones for the business to date? We are a global, enterprise software company founded in France, but since entering the U.S. market in 2016, we have additional offices in NYC and Seattle, as well as London and Sydney. Currently, our U.S. clients account for more than 60% of Botify’s revenue. We have about 500 customers globally and 300 employees. Our growth should accelerate even further in 2024 with the company being profitable. Antony, what advice would you give to entrepreneurs and investors looking to grow their companies with minimal dilution? As I mentioned before, I would advise that companies and their investors consider whether the timing is right when seeking this type of capital. Secondly, venture – or growth debt – should be used to get successful, growing companies from one point to the next in their journey, whilst minimising dilution. It is not a last resort, and should not substitute equity where equity cannot be obtained. In that scenario, it just makes a weak situation even worse, when the opposite should be true – lower dilution and more control over ownership will be amplified when layering debt into the higher-performing companies. Similarly Adrien, you have historically successfully raised a number of equity rounds – what made you pursue venture debt for the first time, and when doing so, what did you look for in a partner? As a CEO, one of your key responsibilities is to finance the ambition you have for the company and to make sure you have enough investment capacity to grab the opportunities ahead of you. And you have to play with the tools available to you! In the current market environment, we saw venture debt as a fantastic and complementary tool to give Botify the capacity to keep investing in the necessary projects that are going to make Botify stronger and bigger in the coming years. What’s the number one piece of advice that you would give to other tech business leaders and entrepreneurs as they look to raise capital in 2024? This is a question I’m very often asked about and I always answer with the same idea in mind: building a strong SaaS business takes some time! It requires a non-negotiable focus on clients’ satisfaction and retention, and a capacity to demonstrate that you can grow sustainably and profitably. Once you have that, you can find the right financial partner eager to finance your growth plan! Antony, why do you think venture debt/growth debt has become increasingly popular in 2023, and what role does Claret play in this trend? Everyone is well aware of the significant increase in equity capital in the market during 2021 and 2022 – and even more so of the reduction in the availability of that capital in the last 12 months or so, coupled with a big retrenching in the perceived valuations of tech businesses. This has resulted in a stronger market for venture debt, and one which we fully expect to continue soon. The acquisition of Kreos by Blackrock in 2023 also put a big institutional stamp of approval on the asset class. Greater visibility and adoption of the capital, as well as growing numbers (and types) of vendors in the market, make it an increasingly mainstream part of the long-term fundraising toolbox for entrepreneurs. The Claret funds reached a huge milestone in 2023, investing their €1 billionth, and will continue to play a major role in the growth-stage investment landscape in 2024. To finish this conversation, Antony what excites you most about the venture debt market in Europe in the coming year? The last 12 months or so have seen a huge focus on efficiency and profitability where companies adapt to a scarcity of capital in the market. The knock-on effect is that many are now adjusting their models in a way that lands them right in the sweet spot of what a venture lender likes to back. So we are very excited about the businesses in the portfolio today and the ones we expect to meet during the next 12 months and beyond. And Adrien, what excites you for the future?, what’s next in SEO? SEO is the perfect illustration of a vibrant space where innovation is the norm. Generative AI is of course going to transform the way information can be found online and the way software is being used by enterprise marketing organizations. I could not be more excited about what is ahead of us in the organic search and I’m glad to see that Botify’s solutions and innovations are leading the way in these changes. 2024 and beyond should be extremely interesting.