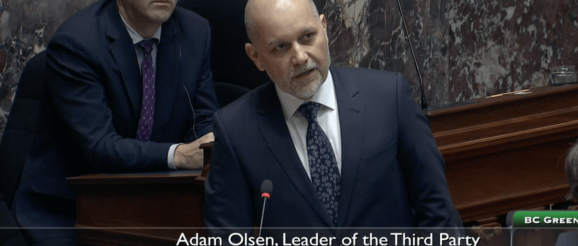

Fumbling with the future of innovation in British Columbia – Adam Olsen, MLA

Yesterday I was hoping to get an answer to a straightforward question about the BC NDP’s commitment to innovation, technology and the knowledge-based economy. I asked the Minister of Jobs, Economic Development and Competitiveness about whether three longstanding tax credits for the film industry (worth approximately $640 million) were part of the $700 million allocated to innovation in the government’s own economic framework and Budget 2020.

I received a confounding response. You can see it here.

This is no small matter. Governments around the world are aggressively positioning themselves to be at the forefront of these emerging economic sectors. We lose ground everyday British Columbia fails to develop a clear vision and strategy to position ourselves.

What’s at the heart of my concern is that the BC NDP government is not only failing to develop a coherent plan to capitalize on our strategic advantages, but apparently they have buried their inaction under the rhetoric of big budget numbers to make us all believe that they are taking action.

Either they can’t (or they are choosing not to) answer how they got to a $700 million number that they themselves published in their economic framework. Let’s be clear, this is their own number in an area of their budget that they claim is a key opportunity for “quality economic growth.”

So, today I ask the Minister again.

[Transcript]

GOVERNMENT SUPPORT FOR TECHNOLOGY SECTOR AND INDUSTRY TAX CREDITS

A. Olsen:

The future prosperity of our province is in innovation, technology and the knowledge-based economy. Governments around the world know this, and they are aggressively positioning themselves by making strategic investments.

Yesterday I asked a question to try to get a better understanding of where British Columbia is at. So I’ll ask a very important question about innovation funding again.

In the economic framework, the Deputy Minister to the Premier cited an investment of “more than $700 million to technology programming.” In Budget 2020 that was introduced last week, the Finance Minister identified investing in technology and innovation as one of its key areas for sustainable growth.

I’m trying to reconcile what this government says it’s doing with what is really happening. So to the Minister of Jobs, Economic Development and Competitiveness: does the $700 million in technology programming include the Film Incentive B.C. tax credit, the production services tax credit and the interactive digital media tax credit?

Hon. M. Mungall:

Thank you to the member again for asking this question. It was very difficult to get an answer out yesterday, due to the opposition’s heckling, so let’s try again today.

Everyone knows in British Columbia that the tech industry is a very important part of our economy. In creative tech, for example, the video games, the animations, the CGI that we see in our movies — a lot of that’s being done in British Columbia. But that’s not the only place that tech exists in our economy.

We have artificial intelligence. We have life sciences. We have clean tech, tech like the work that Saltworks is doing to help reduce the environmental footprint in the mining world. There is so much going on. So when we looked at that $700 million, what fed into it was the variety of programs that tech, throughout all of British Columbia, is able to access.

Specifically to the member’s question, I mentioned yesterday that, yes, the interactive digital media tax credit is included in that $700 million that we identified. But when he looks at the budget, there are a few envelopes that then further break down into a multiple variety of tax credits. In those envelopes, we have the digital animation, which we did use to include in that $700 million, as well as the visual effects tax credits. Those all form part of the budget line items that the member is talking about.

Mr. Speaker:

Leader, Third Party, on a supplemental.

A. Olsen:

This has been a relatively frustrating experience to get what should be a fairly simple answer.

The reality that we’re dealing with here is that when you say that there’s $700 million going to technology, to include about $637 million of tax credits — which are really important actually, which are critically important to the respective sectors, which include thousands of jobs in the film industry that we should not be positioning ourselves to lose…. We need to be clear about where the money that British Columbians are sending to this government is going. We can’t say….

Interjections.

A. Olsen:

That’s never happened before.

I just want to ask…. I need to ask this question. Isn’t it misleading to inflate the innovation spending numbers with tax credits that already exist?

Interjections.

Members. Minister.

Members, if we may hear the response to the question.

Hon. M. Mungall:

I would say that it’s prudent for a government to look at the variety of programs, tax credits, operating expenditures that it has to support a sector of its economy. That’s the prudent thing to do. That’s what we’ve done, so that we know how we are supporting technology and its growth in this province. We know what we’re doing, so that we know what we can do to improve on that.

This government is committed to seeing the technology sector grow throughout this entire province. It creates family-supporting jobs wherever it lands. We want it to land not just in the Lower Mainland but throughout the province. B.C. has a bright future with the tech industry. We’re going to make that happen.