Microsoft and IDC Joint Study Examines Culture of Innovation in the Financial Industry

Despite the challenges and disruptions of COVID-19, the regional Financial Services Industry (FSI) has continued to forge ahead and accelerate the pace of digitisation in response to the pandemic, according to the joint study by Microsoft and IDC.

Unveiling the FSI findings of the culture of innovation study in conjunction with Singapore Fintech Festival 2020, the Microsoft and IDC’s study found that more than 6 in 10 (66%) FSI organisations are accelerating digitisation of their businesses. This figure rises to 86% amongst FSI leaders, organisations who have the most mature culture of innovation, defining their ability to drive sustained innovation.

Based on the survey of 597 regional business decision makers in FSI across 15 markets in Asia, within a 6-month period, before and since COVID-19, the sector was found to be ahead in its ability to innovate in response to challenges. Specifically, 70% of all FSI organisations in Asia Pacific say that innovation is now a necessity and almost all FSI leaders (96%) agree and are actively putting this into practice.

Connie Leung

“One thing is clear, the industry’s rapid response reflected in the increase of maturity in adopting a culture of innovation, across people, process, technology and data practices, has paid dividends,”

explained Connie Leung, Regional Business Lead, Financial Services, Microsoft Asia.

“FSI leaders, in particular, expect to thrive amid the crisis, with 53% of them expecting to increase their market share despite the pandemic and 86% further accelerating digitisation in response to the crisis. We are definitely seeing this take shape within the industry, with organixations like Bankwest, investing in self-service solutions to improve the customer experience at a time where customers are expecting meaningful connection despite social distancing,”

Apart from relying on innovation, the study also revealed that FSI organisations are deriving high revenue shares from digital products and services. This stands at 39% currently and is forecasted to rise to 52% in three years. This is much more so for FSI leaders, where this stands at 47% today and expected to rise to 57% in three years.

Assessing the Innovation Maturity of Financial Services Organisations

During COVID-19, financial services organisations matured in their approach toward innovation. This has included the swift pivot of business processes to raise customer experience and centricity and embracing data management insights to enhance the speed and quality of decision making. In addition to that, these organisations have integrated cloud technologies to ensure business continuity during a time of remote working and living.

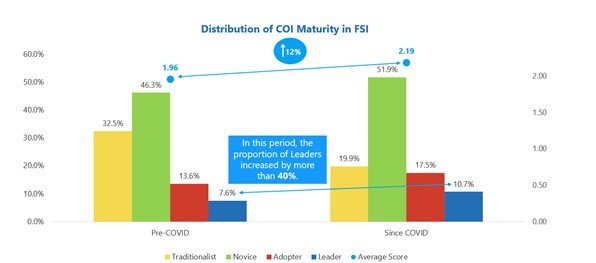

The study confirmed this, and found that in the span of six months, Asia Pacific’s FSI organisations have matured in the culture of innovation by 12%, which indicates an increased ability to drive sustained innovation.

Growth in Culture of Innovation Maturity

FSI organisations have improved their sentiments on innovation with 61% of FSI leaders agreeing that innovation is easier since COVID-19. Other FSI organisations have also embraced a more positive stance, with 52% agreeing with this statement.

Michael Araneta

“FSI has maintained its lead, based on our findings, and was assessed to be the most innovative vertical, with the highest culture of innovation maturity score, and the highest proportion of leaders and verticals,”

said Michael Araneta, Head of Financial Insights, Asia Pacific.

“What has been most interesting is that large FSI organisations, the incumbents, are not necessarily laggards in the space but on occasion, credible leaders with a mature culture of innovation. On the flipside, the prospects of some challenger banks are already dimming in some markets, as they have not been able to address sources of funding despite previously having good prospects when it came to their services in payments, and lending,”

Best practices from FSI Leaders

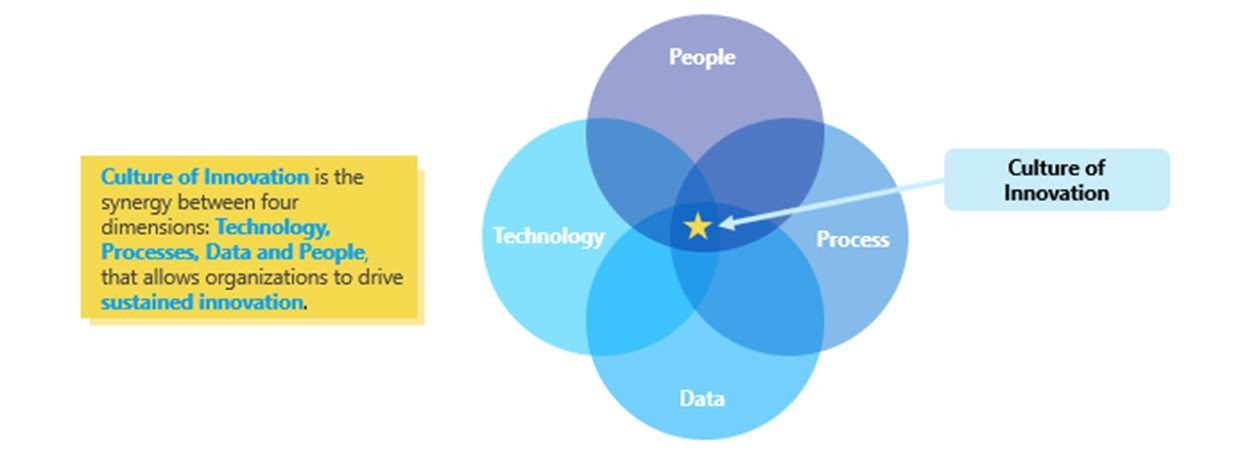

The study revealed the best practices that organisations can adopt, referencing the culture of innovation framework, for progress across people, process, data, and technology.

Culture of Innovation Framework

Specifically, organisations are encouraged to leverage platforms to drive transformation. As FSI organisations continue to forge ahead and integrate technology in their operations as well as products and services, moving mission-critical business processes and workloads onto cloud platforms will be key to ensure that innovation scales. Technology architecture will also need to be well-integrated to effectively enable transformation, which will be a key measure of technology Return on Investment (ROI).

Companies should also enhance their people’s capabilities through enterprise-wide skilling initiatives. A diverse cross-industry, multicultural and multi-generational talent will be key in generating new and disruptive ideas. Beyond that, FSIs need to champion a culture that embraces collaboration, especially with third parties, to create new value.

FSI oragnisations can utilise data for extreme personalisation and rapid value creation. Investing in data will not only enable FSIs to enhance and differentiate products and services, but with trust, privacy, and security paramount for their businesses, a well-integrated data architecture will enable the building of accurate, trusted and secure data sources for reliable decision-making when it is needed most. This will enable personalisation and real-time insights.

These organisations should also consider integrating automation within processes to empower continuous innovation. Automation will be key especially for business processes that have high implications to customer experience, to accelerate the enablement of enterprise-wide collaboration and knowledge sharing. Processes will also need to account for a way to ensure a formal and systematic approach to driving innovation and incorporating this within operations for sustained impact.

The post Microsoft and IDC Joint Study Examines Culture of Innovation in the Financial Industry appeared first on Fintech Singapore.