With $20B Raised Globally in the First Half of 2021, Health Innovation Funding Shows (More) Record Growth Post COVID | by StartUp Health | Jul, 2021 | StartUp Health

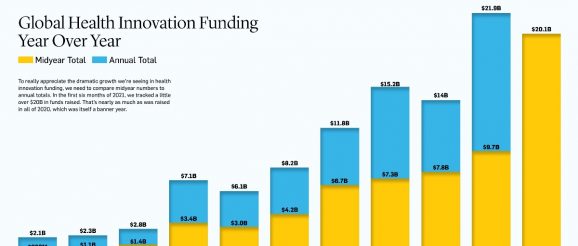

Funding announcements in health innovation have been coming in hot and fast these days. It’s easy to lose perspective about where we’ve come from and where we’re going. This 2021 midyear StartUp Health Insights Report (something we’ve been doing for a decade) is an essential opportunity to step back, take a beat, and view the market with a longer lens. What’s the 10,000-foot view? We also take this opportunity to look at funding trends from a health moonshot perspective. Are we investing in the tools and services that will increase access to care, cure disease, lower cost, and achieve the other global goals that can improve the lives of billions of people? Let’s look at the numbers.

The Covid comeback from a year ago has continued and accelerated

One year ago, in the 2020 StartUp Health Insights Midyear Report, we closed out the most-funded six-month period on record. That report came at the height of the first wave of the COVID-19 pandemic, back when all bets were off. Lockdowns caused markets to freeze, and it was anyone’s guess how quickly they’d thaw.

Now, looking back, it seems almost obvious that health innovation bounced back quickly. After all, in a contactless, virus-filled world, what do we need more than telemedicine, remote monitoring, and app-based mental health? But at the time, it was anything but certain. Early in the pandemic, in analyzing the first quarter’s banner funding, MedCity News wrote that “faced with a global pandemic, the trend is unlikely to continue.” As famed investment analyst, Yogi Berra put it, “It’s tough to make predictions, especially about the future.”

After a moment of panic (for pretty much every market on every continent) health innovation began an upward climb in both adoption and investor interest. That up-and-to-the-left trajectory kicked off one year ago, continues today, and has accelerated significantly.

Topping the largest deals list in the US was the $540M raised by Noom, the behavior change app helping people “lose weight and keep it off.” This comes as little surprise because for the last few years we’ve witnessed a race to see what company can bring evidence-based behavior change to consumers in a scalable way. This is low-tech territory (“eat this, not that”), but the potential impact couldn’t be higher. Whoever can crack the code on things like weight loss, sleep, and exercise can save or improve millions of lives while reducing healthcare costs by untold billions. While Noom tops our list today, it’s just one of many entrants taking a crack at the daily behaviors that contribute to obesity, type 2 diabetes, and heart disease. Where the sector will shake out, or how it will consolidate, is still anyone’s guess.

Other notable mega deals for the second quarter of 2021 include Lyra Health’s $387M, raised to expand their mental health programming for employees. This raise serves as a nod to the toll that COVID-19 has had on employee wellness and mental health writ large. No longer is it sufficient to rely on a mental health hotline buried in that employee handbook that gets 2% utilization. Companies like Lyra (and StartUp Health portfolio companies Rose Health, Hurdle, and wayForward) are presenting novel, tech-enabled solutions to meet employees where they’re at in their burnout, anxiety, and stress.

“Employers are now listening to their employees and adding robust mental health care offerings to meet growing expectations,” says Kavi Misri, CEO and Founder of Rose Health, which joined the StartUp Health portfolio in 2020.

Swedish startup Kry raised $312M to expand its telemedicine offering in Europe. The company saw a 100% increase in adoption last year, even though healthcare usage was down overall. Post-pandemic, when people play catch-up with their health and come back to providers en masse, Kry will be ready with a new way of doing business.

Two deals topping our lists focused on upgrading how people get their prescription drugs. In India, PharmEasy raised $323M to expand the availability of their pharmacy app, while in the US, Capsule raised $300M to do similar work. Two deals that topped $200M focused on rethinking how insurance is handled. Collective Health raised $280M for their platform that combines online benefits management with virtual care services that keep employees healthy. Alan, a startup based in France, raised $220M to expand its insurance tech platform that is designed for the European markets. This single-payer environment hasn’t encouraged a lot of insurance innovation in the past, so we’ll be watching to see how Alan marries the worlds of government-run healthcare and independent, tech-enabled apps. What will the European version of insurance tech look like, and could it serve as a leapfrog moment for American insurers?