Transitioning to a post-pandemic environment powered by innovation and performance- The Asian Banker

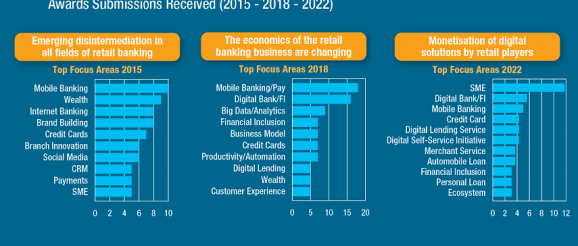

Several things stand out when we compare the submissions from 2015, 2018, and 2022. One, digital and mobile initiatives are a key part of what everyone is looking at. Also, SME (small and middle-sized enterprise) banking has moved way up in the ranking than it was before — it’s now the top area that banks are focusing on. Notably, there’s a lot of innovation happening in this space. Credit cards, surprisingly, are making a comeback and becoming more important as well. Some of the key trends are the disintermediation in all fields of retail banking as more fintechs come into the competitive landscape. Banks are looking at monetisation of those digital solutions whereas it was just providing a digital solution in the past. Now, it is how do we turn that into money and interest.

The top 10 retail banks showed how really good the initiatives made by these banks are. For example, the banks which are doing really well on digital journey and digitization include ICICI Bank of India as well as CTBC Bank and E-Sun of Taiwan, especially in digital sales. Banks can use these rankings to look at who did well and gain insight by looking more deeply at the top players on how they leveraged their success. The second-generation digital-only banks have consolidated their position. To cite an example, aiBank, WeBank, and MYbank integrate with WeChat pay or other solutions to offer broader solutions. The pandemic has moved digital along much faster than expected. Looking back in 2019, it was moving along more slowly. There are also some technologies that are coming in like blockchain which has become more prevalent in the China market as well as cryptography which slowly coming in. We observed that new solutions being developed faster and cheaper which use blockchain technology.

In wealth management, in Taiwan and India in particular, there is the shift towards digital wealth, especially for the next generation is more important than the past. We also observed that managing and mitigating risk, especially fraud and promoting financial education is still of the utmost importance.

The recent BankQuality Consumer Survey report revealed the most recommended retail banks across the Asia Pacific such as kakaobank from South Korea and Bank Central Asia of Indonesia. Some of the key themes that came out of the survey are the hyper-personalisation that we already heard from several big banks. The ability to offer hyper-personalised recommendations enabled by cloud infrastructure gives banks an opportunity to be more agile, integrating lifestyle services, such as DBS Bank from Singapore.

The inaugural top 100 digital-only banks ranking showed that most came out from China. We observed that the top 10 banks in the rankings which are profitable have been around longer. Some banks like kakaobank have been around for quite a while, which has taken a massive share in South Korea over the past five years. lf we are looking at successful funding, kakaobank has done some really good things while WeBank for balance sheet and financials. If we look at the global scale, WeBank is number one because they have done a lot of integration Cth WeChat pay and some other services. Ally Bank followed second, which focuses on Gen Z and millennial consumers by bringing tailored products and services for them.

Looking at the whole top 100 ranking, the top 100 are over $2 trillion in aggregated assets. Only 29 digital-only banks are profitable and the rest of them are not. It takes a while to turn that around which is quite challenging as raising capital over the past couple of years has been difficult. What we also observed in terms of the transition that financial institutions go through is the shift from highly commoditised business when you are just doing payment or making deposits to bringing more intuitive products and services.

SME is at the top of our list this year and it was something people are now focusing on. Financial institutions are looking more at the sustainability of NMEs. Banks are now providing better lending opportunities and managing cash with seamless and convenient services. For example, banks digitise the workflow process behind the scenes to make the processing faster and better and the onboarding process more convenient. It’s nice to see how the banks performed well in SME banking. For example, E- SUN bested in risk management, OCBC of Singapore dominated in process and automation. Each of us can learn from that for our SME business. Ping An Bank streamlined its online application customer experience by usin6 OR code and simplified filtering page design in 2021. The bank leveraged on big data and AI technology to accomplish the credit evaluation in minutes. The bank’s SME digital active ratio is at the highest among its peers, and its market share increased. UOB’s core cash management package (invoicing/collection) is already deployed across five core markets. Other 13 beyond banking solutions will be in service in 2022. UOB is in the process of integrating its collection, robo-wealth advisory, small business loan and BizSmart services into a curated suite of integrated business management solutions in one platform. UOB’s financing solutions are offered through direct referral approaches via its ecosystem partners. ICICI Bank’s iMobile Pay enables users to link multiple bank accounts. Users can transact using any of the linked accounts with a single unified payments interface (UPI) ID which is generated at the time of linking the first account. ICICI Bank provided hyper-personalised experience for its consumers with several initiatives. The bank also launched iPal Chatbot.

There is also a rapidly shifting landscape by way of new competition from fintechs and payment platforms that are becoming increasingly entrenched in their respective markets. We observed the sustained growth of alternative lenders. Looking at the Indonesia market, the fastest growth among fintech players are in lending. Buy now, pay later (BNPL) has come up with some new models in Australia, Southeast Asia, and other markets. It became a new competition for incumbent banks. However, it can be an opportunity for these banks to do partnerships with these alternative lenders. Conventional retail banks stand to lose cheaper deposit funding to non-bank providers of digital services. The maturing of artificial intelligence (AI) and blockchain is enabling more personalised, efficient services, and digital currencies, we talked about in the payments section with CBDCs. About the digital banks that are all bringing in deposits, that take away some of the cheaper deposits that the Fls have, and some of the changes that will come with CBDC is it’s something we need to be aware of and prepare for. Finally, there is increased consumer and regulatory pressure on financial institutions to offer “green” products and to achieve publicly disclosed emission-reduction goals.

For example, some banks have launched green products for consumers, and they can invest in managed bonds that are providing sustainable financing. It’s relatively new, but consumers are pressing for green, eco-friendly ESG (environmental, social and governance-compliant) solutions, and regulators are putting on the pressure as well. And there are opportunities for leaders to take advantage of ESG or for the laggards to fall behind because of it. So tremendous opportunities in sustainability, digitisation, mobile personalisation are among some of the key trends going forward.