A look at martech investment and innovation

At CabinetM we define martech broadly.

For us, as a martech management platform, it’s any product that supports developing and managing the customer experience or contributes to acquiring, engaging and retaining customers. This eliminates artificial lines between marketing, sales and customer success or between adtech, salestech, etc. However, the reality is we add any product to our directory of 15,000+ products that a customer wants to include in their martech stack. As a result, we sometimes stray slightly beyond the boundaries of our own definition.

To manage a directory of this size means keeping track of many things: new products, new categories, acquisitions and name changes, and company and product implosions. We used to publish this quarterly and our newest MarTech Innovation Report just came out. It’s not gated, so you can download without triggering annoying emails and phone calls!

What’s clear from our data is that martech continues to be a healthy industry.

Read next: 5 steps to martech stack success

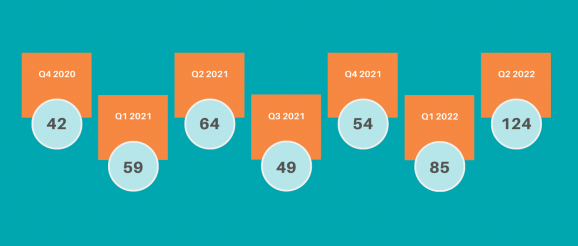

New product announcements jumped to 124 in Q2 2022, up from 49 in Q1 and by far the most in the past two years. These cover a wide range of product categories, but the top five of these are remarkably consistent – advertising, analytics, segmentation, customer engagement and experience, and data management.

Innovation is driven by investment. While some say there are too many martech solutions and the sector is over-invested, that’s not what the money shows. We are still seeing significant investment activity in established players and startups. We believe we are reaching a peak point with regard to the number of companies. In the U.S., we are seeing close to an equal number of companies/products entering and exiting the market each year.

Innovation and investment

In looking at investment amounts, we saw a significant dip in Q2 2022. This dip aligns with the general downturn in investments reported by the New York Times on July 7th. According to the New York Times “investments in U.S. tech start-ups plunged 23 percent over the last three months.”

At the other end of the spectrum, acquisitions have stayed steady over the last seven quarters with an uptick this year. Across the last seven quarters the most common categories of companies that were acquired were:

- Advertising

- Analytics

- Audience segmentation

- Campaign management

- Content marketing

- Conversational marketing

- Customer journey/lifecycle management

- Customer engagement

- Customer experience

- Customer service

- Data management

- Events

- Marketing automation

- Payments

- Personalization

- Product life cycle management

- Productivity and workflow

- Social media

- Video

- Web performance and security

In addition to tracking external martech trends, we also look at data from the nearly 1,000 stacks managed on our platform. This helps us see which products are most popular and which products surround key anchor platforms. The stacks range in size from 25 to 250 products, are a mix of B2B and B2B, and are in different stages of documentation. Once you move beyond foundational platforms (CRM, CDP, Marketing Automation etc.) stacks quickly start to look very different; the long tail of products found in stacks is very long. We’re routinely asked what products typically sit alongside the larger platforms. To that end we’ve started to catalog the top products that surround major platforms. Our first Stackmate Report was released last month and covers marketing automation platforms. This is also an ungated report.

Get the daily newsletter digital marketers rely on.