Agility vs. innovation: how SME and enterprise marketers have responded to Covid-19 [survey] – Econsultancy

New research from Econsultancy and Marketing Week’s ongoing surveys on the business impact of Covid-19 reveals differing approaches between SMEs (<50m annual revenue) and enterprise businesses (>£50m annual revenue) on responses to the virus, plans for H2, and staff attitudes.

Here are some of the key findings from the survey of more than 1,000 marketers…

67% of enterprise businesses have changed customer policies

When it comes to combatting the effects of the outbreak, Econsultancy research reveals that enterprise businesses are taking more concrete steps in their approach to preserve contracts and revenues.

Sixty seven percent of businesses with more than £50m annual revenue have Taken Action to “Change customer policies”, and 66% have “Changed vendor policies” (Fig 1). On both counts, this is 26 percentage points higher than the figure for SMEs.

Figure 1

44% of SMEs are increasing budget and priority of product launches in H2

While enterprise businesses have been forced to take action such as changing T&Cs, waiving fees or extending payment terms, SMEs have shown a stronger focus on product launches and marketing campaigns as their vehicle for recovery.

Considering budgets and priorities for H2, SMEs are seeing an increase from H1 for “Product or service launches” (44%) and “Marketing campaigns” (42%), compared to only 26% for both figures for enterprise businesses (Fig 2).

Although thin on the ground, green shoots of recovery are marginally more prevalent amongst SMEs around budgets and staff. Twenty one percent are increasing their focus in H2 on “Marketing budget commitments” and 16% on “New hires”, vs 14% and 9% respectively for enterprise businesses (Fig 2).

Figure 2

96% of enterprise businesses and 90% of SMEs say lockdown has increased the priority of digital transformation

All business sizes seemingly understand the value of strategic initiatives, with over half (55%) increasing their focus on strategic initiatives such as digital transformation and restructuring from H1 to H2.

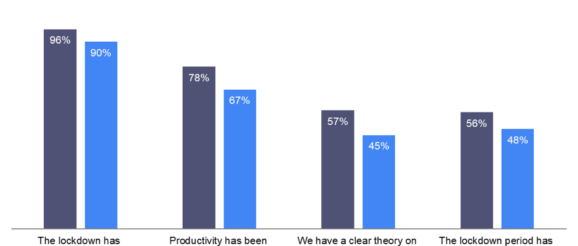

It is no secret that many industry sectors have seen an enormous acceleration in the use of digital channels by consumers as a result of Covid-19. Businesses need to have the capacity in place to meet the surge in consumer demand, and such strategic initiatives in place to make the most of it. Ninety six percent of enterprise businesses and 90% of SMEs say “lockdown has increased/emphasized the priority of digital transformation”.

Figure 3

56% of directors at enterprise businesses say lockdown has been their most innovative time at the company

Enterprise businesses in particular are recording a spike in innovation, with 56% of senior decision makers (Director and above) agreeing that “The lockdown period has been the most innovative I have experienced at the company”. As well as this, a clear vision is noted, with 57% in enterprise businesses agreeing that “We have a clear theory on how our sector is going to evolve post-lockdown” vs 45% agreeing amongst SMEs.

The overwhelming consensus is that lockdown has had a positive impact on productivity, too. Seventy eight percent of those working in enterprise businesses agree that “Productivity has been stable/improved during lockdown” alongside 67% working in SMEs (Fig 3).

The views of senior decision makers are matched amongst practitioners (manager seniority and below) on productivity with the majority identifying that they are “more efficient when working from home than in the office”, 76% of enterprise businesses and 75% of SMEs regarding the statement as true (Fig 4).

Figure 4

But what is the cost of this uptick in productivity? The human impact is noted by the majority, with intrusion on home life, and longer hours being recorded when working from home. Particularly amongst enterprise businesses, 79% say it’s true “I work more hours when working from home”. Seventy percent say “Remote work inevitably intrudes on personal life”, vs 59% in SMEs.

Despite the infringements on home life, the appetite for returning to the office doesn’t appear to be there. Only 23% & 30% from enterprise and SME businesses respectively say it’s true they “Can’t wait to get back to the office”.