Agriculture Innovation – Corteva Is A Hidden Gem (NYSE:CTVA) | Seeking Alpha

Agriculture has been the cornerstone of my research since 2020. After the pandemic, I turned bullish on energy, agriculture, and related industries. I invested in fertilizer companies, machinery companies, and railroads that ship fertilizers, grains, and finished products.

One company I did not cover is Corteva (NYSE:CTVA).

That is now going to change, as the company has been on my radar for a while. Although the company is operating in a competitive industry, it is one of the largest global producers of seeds and crop protection.

People who play Farming Simulator (I play it a lot) may be familiar with the brand, as it has a partnership with the company.

The only reason I’m bringing this up is because the company is a major partner thanks to its ability to innovate. It is also flying under the radar on the stock market. I expect that gamers are more familiar with the stock than the average investor (I’m partially kidding here).

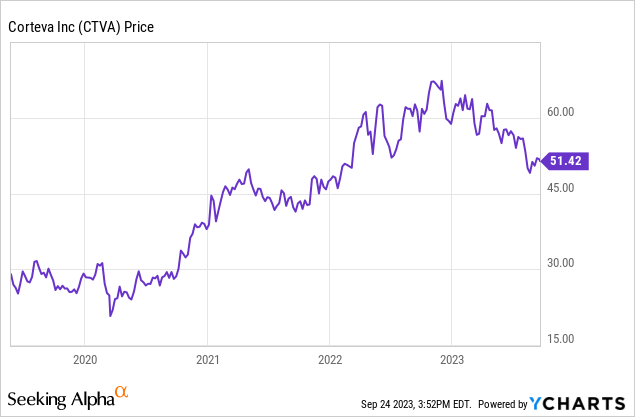

As the company has lost roughly a quarter of its market cap since last year, it’s time to dive into the details. I believe in a future of agricultural inputs, especially in light of inflation and tight global food supply that requires the use of GMOs.

So, without further ado, let’s dive right in, as we have a lot to discuss!

I Found Another (Important) Anti-ESG Theme To Invest In

Sometimes, people ask me why I do not invest in cigarettes. After all, I heavily invest in other themes that aren’t highly popular with certain parts of the Western population, including fossil fuels and defense companies.

Well, let me add another theme to that: agriculture tech.

Earlier this year, Bloomberg wrote an article focused on the shift in ESG standards. After all, the war in Ukraine showed how important energy and defense companies are (in case anyone needed proof).

I don’t invest in defense companies because I want war. I invest in them as innovation is the best way to prevent wars. I don’t invest in energy because I want energy prices to fly but because I believe it’s needed to protect prosperity.

I invest in agriculture for the same reasons.

According to the Bloomberg article I just mentioned:

The need to feed an expanding population while cutting agriculture’s high greenhouse gas emissions means farming must become more efficient. The increased use of genetic technology in seed manufacture is one solution. Yet GMOs remain a bugbear for many ESG funds, which are wary of the unintended consequences of intervening in the food chain (the so-called precautionary principle).

To put things into perspective, the global grain-to-use ratio is at the lowest level since the 1996/1997 crop year.

Nutrien Ltd.

With that in mind, Corteva is a giant in its industry. On June 1, 2019, the company became an independent company from DuPont de Nemours, a corporation that has split up since then.

The company has two business segments.

Corteva

However, the company is not only selling seeds and chemicals but also innovating to address the aforementioned issues like food shortages and the fact that central banks cannot print arable land.

On September 17, the Wall Street Journal published a very important article on the massive developments that are going on in our food supply chain.

Wall Street Journal

According to the article, the company has captured more than half of the soybean market in the United States. Together with the German giant Bayer (OTCPK:BAYZF), the company owns 70% of all corn and soybean seeds planted in the United States.

This is largely attributed to its strategic focus on biotechnology. By developing and introducing innovative biotech soybeans, particularly the Enlist E3 variety, Corteva has redefined the dynamics of the soybean market.

Enlist E3, built around a herbicide known as 2,4-D choline, addressed a significant issue faced by its competitors: the problem of herbicide drift.

Herbicide drift is the movement of pesticide away from the target area in the atmosphere. The three main forms of drift are droplet drift, vapour drift and particulate drift. Droplet drift is the main cause of off-target damage.

Studies and fieldwork by university agricultural researchers substantiate that 2,4-D choline does not suffer from the drift problem that plagued other herbicides like dicamba.

In other words, the Enlist E3 soybean-and-spray combination has become a game-changer for farmers seeking an effective solution to combat hard-to-kill weeds without the concerns of drift.

The absence of spraying limitations in comparison to its competitors has made Enlist E3 a compelling choice for a substantial number of farmers.

As a result, Corteva predicts that Enlist E3 will supply at least 55% of soybeans planted in the U.S. this year, with expectations of further growth to about 60% of the U.S. soybean market next year.

With this in mind, at the recent annual Morgan Stanley Laguna Conference, the company elaborated on its plans to grow. After all, it is currently struggling with some headwinds.

In the second quarter, organic sales saw a decline of 4% compared to the previous year.

However, despite this, earnings grew by 2%, with operating EBITDA margin expanding by nearly 140 basis points.

In contrast, the first half witnessed a 2% growth in organic sales. The seed business saw a significant increase of 8% in net sales, reaching over $6.9 billion.

On the other hand, crop protection net sales experienced a decline of 9%, amounting to more than $3.9 billion.

Factors influencing these numbers included volume fluctuations due to strategic portfolio actions and the exit from Russia.

Seed volumes dropped by 5% due to these actions, while crop protection volumes plummeted by 16%, which included a 5% headwind from strategic portfolio exits.

The exit from Russia, in particular, represented a 3% headwind for the Seed segment.

Looking ahead, the guidance for Crop Protection segment net sales was revised, now expected to be in the range of $17.9 to $18.2 billion, indicating a 3% growth at the midpoint.

Operating EBITDA for the same segment is projected to be between $3.50 and $3.65 billion, indicating an 11% growth rate over the previous year at the midpoint.

Furthermore, the operating EBITDA margin is expected to experience more than a 130 basis points expansion over the prior year, reaching 19.8% at the midpoint of guidance.

To go back to the aforementioned conference, the company emphasized three key factors that position Corteva well for 2024: the recent acquisitions in biologicals, new and differentiated products, and the robust Spinosyns franchise.

The biological acquisitions are performing strongly and are expected to continue growth into the next year.

Additionally, a higher percentage of revenue derived from differentiated products (expected to increase to 60%) is anticipated to positively influence both revenue and gross margin.

Finally, the Spinosyns franchise, although currently less than 5% of Corteva’s revenue, is expected to see growth and benefit from the rotation practices of farmers.

This is what the company said in 2019:

With unique and consistent global brands, farmers can be confident that products labeled with Qalcova active or Jemvelva active demonstrate the benefits of Corteva Agriscience’s exceptional research, development and testing,” said Santosh Mangalam, Global Portfolio Leader, Corteva Agriscience. “They’ll also be able to better recognize the high-quality active ingredients from Corteva in a growing insecticide market.

So, what about the valuation?

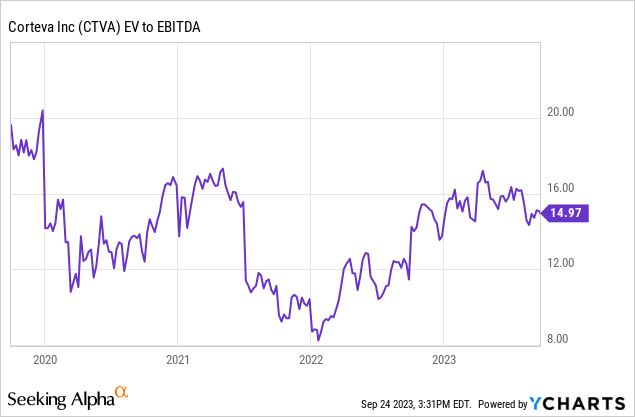

Since its spinoff, the company has traded close to 13x EBITDA.

I believe this valuation is very fair, as the company is expected to maintain high-single-digit annual EBITDA growth, even in an environment of subdued prices. While I haven’t put a number on it, I expect the company to do much better over the past few years.

Leo Nelissen (Based on analyst estimates)

With regard to its net debt, the only reason why the company has positive net debt is because I added minority interest and pension-related liabilities. The company has negative net debt, meaning it has more cash than gross debt, excluding these items.

Using a 13x multiple, the company’s fair stock price is $75. This implies close to 50% in potential upside.

The current consensus price target is $69.

Having said that, recessionary risks and lower crop prices put pressure on the company’s business. I do not rule out a move lower to $40 in case the economy gets really ugly.

I’m not saying it will happen, but investors need to keep that in mind.

In a world striving for sustainable solutions, agriculture stands as a key theme.

Corteva, a giant in the industry, caught my attention due to its focus on innovation and rapid market share gains.

As we confront challenges like food scarcity and limited arable land, investing in agriculture solutions becomes crucial.

The Enlist E3 soybean is Corteva’s game-changer, addressing key issues plaguing the industry. With its strategic vision and growth plans, Corteva seems positioned well for 2024 despite recent hurdles.

In this evolving landscape, Corteva is more than just an investment-it’s a glimpse into a future where agriculture meets innovation to feed a growing global population.

Going forward, I’ll see how I can fit this stock into my portfolio, depending on potential buying opportunities.