Alexandria Real Estate Equities – Fast Paced Demand Growth Serving Research And Innovation Tenants – Alexandria Real Estate Equities, Inc. (NYSE:ARE) | Seeking Alpha

Alexandria Real Estate Equities (ARE) is able to deliver faster FFO growth than other Health Care REITs through portfolio concentration in specialized office and laboratory properties in top US technology and life science markets. Rent roll-ups keep same property NOI growing at a time when occupancy across almost all markets exceeds 97%. While other large Health Care REITs are also investing in life science properties, scale is far below Alexandria’s, positioning Alexandria as the preferred pure play portfolio and property manager. Investment in development pipeline will add 15% to total office and laboratory portfolio space by the end of 2020. Despite significant stock price performance outperformance year to date for 2019, Alexandria is still attractively valued when portfolio development and dividend growth are taken into account.

Portfolio Concentration in Top Tech and Life Science Markets

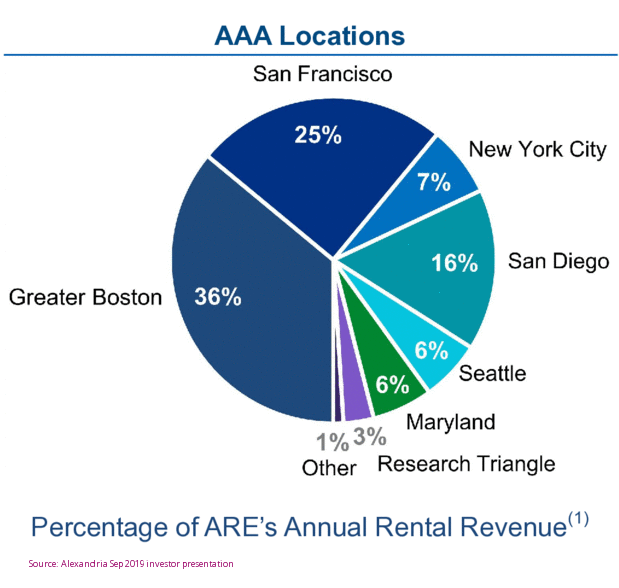

Alexandria’s current 24.5 MSF portfolio of specialized office and laboratory building is located in the top 7 markets in the US for pharmaceutical research and technology innovation. With 36% of total rents earned in Greater Boston and 25% in San Francisco, Alexandria also receives triple net-leased rents from properties in San Diego, New York City, Seattle and Maryland.

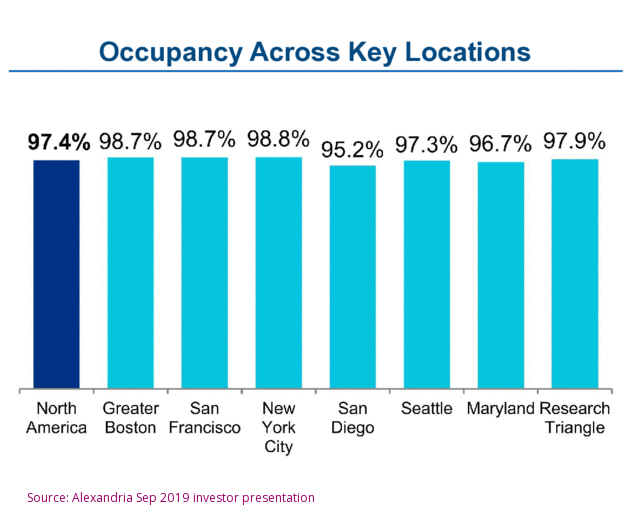

With total occupancy of 97.4% as of June, 2019, Alexandria discloses occupancy by market, demonstrating the top 3 markets show occupancy exceeding 98.5%, while the rest all exceed 95.2% occupancy.

Demand for space is vibrant in the top research markets, supported by buoyant stock market valuations for pharmaceutical and biotech companies. Even the government sector now appears well funded, as passage of the Budget Act of 2019 removed automatic spending cuts through sequester. This looks like a good time for venture stage companies to raise money for technology innovation, adding to the number of publicly traded biotechnology and technology companies.

Sources of Revenue by Types of Tenants

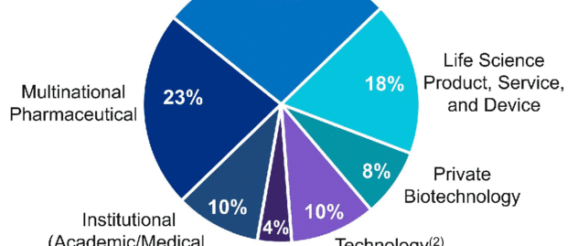

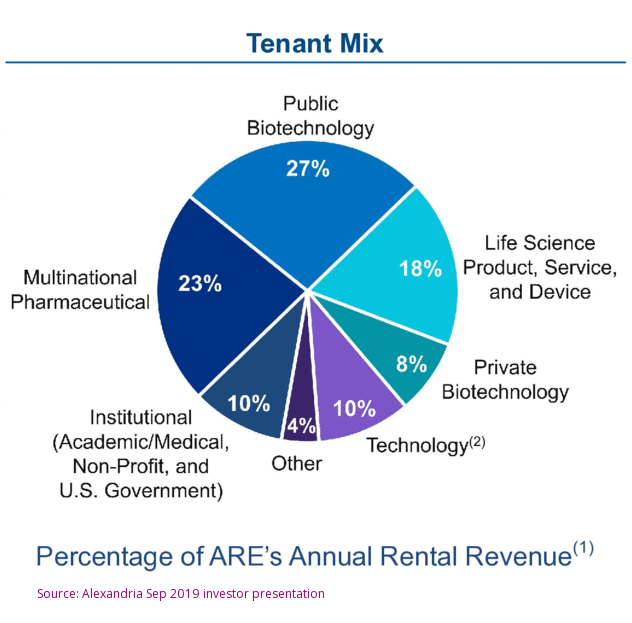

Biotechnology companies are the largest class of tenant for Alexandria, including 27% contributed by publicly traded biotech firms and 8% by private biotech tenants. Multinational pharmaceutical companies are the next largest category of tenant, contributing 23% of total rents. Medical device companies contribute 18% of total rents.

Academic, institutional and government tenants contribute only 10% of total rents for Alexandria, the same amount contributed by technology companies with no life science exposure.

Competition and New Investment for Life Science Properties

Alexandria Real Estate Equities pioneered the concept of dedicated investment for life science tenants in 1994, building its current portfolio of 25 million square feet of net-leased space over 25 years of active development. Health Care REIT investors may remember a strong #2 among life science REIT portfolios, called BioMed Realty Trust (BMR), that merged with Blackstone Real Estate Partners VIII in January 2016 for an $8 billion valuation. That #2 portfolio has now grown to 11 million square feet of space under Blackstone’s ownership.

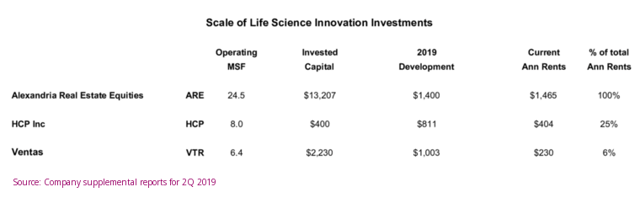

The table below summarizes scale for current publicly traded REITs that have decided to focus investment in life science properties for a least a portion of their portfolios. The list below includes HCP Inc. (HCP), with 8 million square feet of life science space, and Ventas (VTR) with 6 million square feet of space.

Scale in life science investment for Alexandria Real Estate Equities dwarfs the other 2 Health Care REITs. Alexandria already has more than $13 billion invested in life science and tech properties, compared to $2.2 billion for Ventas and $400 million for HCP. Ventas now draws only 6% of total rents from life science, while for HCP contribution from life science is 25% of total rents.

Commitment to development spending and acquisitions will bring HCP’s investment to $1.2 billion by the end of 2019. Ventas will increase life science investment through new developments of its Wexler portfolio to $3.2 billion during 2019. Alexandria Real Estate Equities, in contrast, will invest $1.4 billion for new developments during 2019, to be followed by even larger investment during 2020.

Capital requirements are so high that these expensive, high end office and laboratory developments can be developed only by institutional quality Health Care REITs and real estate funds. Please note that all 3 of the Health Care REITs included in the table above are large cap REITs included in the S&P 500 Index. Welltower (WELL), the largest Health Care REIT, chose to divest its 49% interest in 7 life science buildings located at MIT’s University Park, a mixed-use life science campus, located in Cambridge, MA to Forest City Enterprises, Inc. (FCEA) for $574 million in June 2015. I think it is unlikely that another such specialized publicly traded competitor will emerge for Alexandria Real Estate Equities, unless BioMed Realty were to spin out from Blackstone at some future date.

Stock Price Performance, Yield and Growth

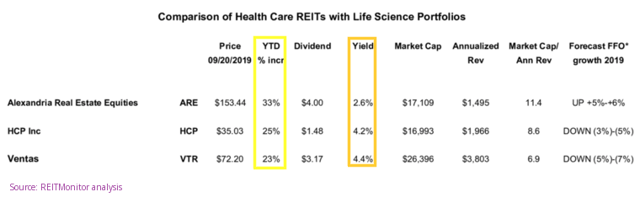

The table below compares Health Care REITs with life science investments on the basis of recent stock price performance, dividend yield, and management guidance for FFO growth.

Alexandria Real Estate Equities has outperformed both HCP Inc. and Ventas year to date for 2019, up 33% compared to 25% gain for HCP Inc and 23% for Ventas. Alexandria trades at a lower yield, 2.6% compared to 4.2% and 4.4% for the other Health Care REITs. Alexandria shows a higher multiple of market cap relative to annualized revenues, at 11.4 times, compared to 8.6 times for HCP and 6.9 times for Ventas. The last column, showing management guidance for 2019 FFO growth, explains the higher valuation for Alexandria Real Estate Equities. Management of Alexandria Real Estate Equities is confident of 5%-6% FFO growth during 2019, while both HCP and Ventas are expecting FFO decline, as a result of recent and pending divestitures.

Capitalization of FFO for Health Care REITs

My favorite valuation measurement for REITs is capitalization of annualized FFO, comparing the ratio of total capitalization (adding debt and non-trading equity to market cap) to current annualized FFO. On this basis, Alexandria Real Estate Equities has the highest capitalization of FFO, but not excessively so, if portfolio expansion and FFO growth is taken into account.

Alexandria is capitalized at 31.4X annualized FFO, compared to 27.8 times for HCP and 26.1 times for Vencor. With FFO growth of 5%-6% for Alexandria, compared to FFO reduction of (3%)-(7%) for HCP and Ventas, the growth disparity for a single year should make up for the difference. HCP’s guidance for lower FFO during 2019 indicates a fourth sequential year of FFO reduction. For Ventas, 2019 will be the second year in a row of FFO reduction.

Outstanding Dividend Growth

Alexandria Real Estate Equities has provided significant dividend growth to its investors in recent years. Dividends increased 8% for 2019, after a 9% dividend increase for 2018 and a 6% increase for 2017. Ventas, in contrast, increased dividend distributions by less than 1% for 2019 and only 1% for 2018. HCP is the laggard in dividend distribution. HCP Inc., due to the magnitude of spin-outs and divestitures, now pays a dividend 32% below what it distributed to investors in 2014.

Risk of Renting to Biotech and Technology Tenants

With 35% of total rents sourced from biotechnology tenants, management of Alexandria Real Estate Equities may hear concerns from time to time over exposure to a stock market segment notoriously susceptible to variable investor confidence. Although biotech stock market valuations usually move up or down in concert, exaggerating complementary movements in pharmaceutical stocks, concern for a landlord relates more to adequacy of previous financings relative to time to market launch for new drugs. Most of the top biotech tenants for Alexandria Real Estate Equities have achieved billions of dollars in revenues and global recognition. Tenants such as Celgene (CELG)(contributing 2.5% of rents), Amgen (AMGN) (1.5% of rents) and Illumina (ILMN) (3.2% of rents) are such examples. No one expresses concern over tenants such as these.

Unproven publicly traded biotech tenants may encounter investor scrutiny over specific controversies relating to their individual product developments. For example, the high cost of new drugs is a particularly sensitive issue going into the Presidential election of 2020. Investors should know that a publicly traded biotech tenant bluebird bio, Inc. (BLUE), contributing 1.9% of Alexandria’s rents, is raising questions by a decision to price its first product at $1.8 million per patient, read about it here.

Bluebird’s Zynteglo is an “orphan drug” for patients with a rare blood disorder, transfusion dependent beta thalassaemia. Bluebird hopes for FDA approval of Zynteglo sometime during 2020. Management’s proposal for “installments of $356,567 per year for 5 years” is unlikely to resolve the marketing difficulties for such a high priced therapy.

More typical of a “untested” publicly traded biotech tenant might be Moderna (MRNA), now trading with a market cap of $5.9 billion. Moderna contributes 1.9% of total rents for Alexandria Real Estate Equities. Moderna’s messenger RNA technology has spawned more than a dozen vaccines for infectious disease and for cancers, but none has progressed past Phase 1 clinical trials. Moderna’s only product in Phase 2 trials is VEGF-A for myocardial ischemia. Years of development lie ahead before Moderna will generate revenues from product sales. Still, investors should take comfort from Moderna’s cash position of $1.4 billion as of June, 2019, compared to current rents of $25 million annually. Moderna’s research collaborations with AstraZeneca, Merck and Vertex should help with future financing requirements, while awards from The Bill & Melinda Gates Foundation and DARPA enhance credibility.

Technology tenants with no life science exposure present a similar range of low risk to great future uncertainties. The best known technology tenant for Alexandria Real Estate Equities is Facebook (FB), contributing 1.6% of total rents. Facebook is not viewed as any kind of credit risk. In contrast, Uber Technologies (UBER) contributes 2.0% of rents. Uber Technologies, a recent IPO with current market cap of $56 billion, terrifies some investors by higher than expected losses (running at same rate as revenues as of 2Q 2019), almost the same as current cash position of just below $12 billion. Uber Technologies will need to raise more money in less than 1 year from now.

Let’s also consider a private technology tenant, Stripe, Inc. Latest round of financing for Stripe was $250 million, bringing the venture stage valuation to $35 billion. Stripe contributes 1.6% of total rents for Alexandria Real Estate Equities. A “fin-tech” start-up at a time when “fin-tech” is hot, Stripe earned this high valuation by enabling developers to reach APIs to clear payments from global companies. If it were to come public today, Stripe might get a higher valuation than Uber Technologies. Is Stripe a good tenant for Alexandria Real Estate Equities ? Looks fine to me.

I conclude that “high risk” biotech and technology tenants represent a relatively small portion of total rents for Alexander Real Estate Equities, but a high percentage of investor questions. Alexandria’s leading position in the fast paced growth market of life science and technology innovation provides investors with an enduring REIT vehicle. I see Alexandria Real Estate Equities as a clear Buy recommendation, delivering portfolio expansion that will drive continued FFO and dividend growth. In contrast, I see HCP Inc. and Ventas as secondary players in life science centers, far behind Alexandria’s stature in new developments and current investment. Due to current phase of divestitures, forecast for FFO reduction for HCP, Inc. and Ventas earn only a Hold recommendation at this time.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.