Bloom partners with American Express Middle East to bring blockchain innovation to region as part…

Bloom partners with American Express Middle East to bring blockchain innovation to region as part of ACCELERATE ME

Bloom, a blockchain solution for secure identity and inclusive credit, has announced a collaboration with American Express Middle East to help drive fintech innovation as part of American Express Middle East’s ACCELERATE ME program.

Bloom is excited to be a part of the launch of the very first global corporate fintech program in the region, ACCELERATE ME. Nest and American Express Middle East will be running the first program focused on delivering innovative digital solutions to customers and business partners in the Middle East.

Bloom is enabling the region to introduce new approaches to credit scoring using non-traditional sources of data. Bloom is working to bring a secure, data driven approach to risk assessments in order to streamline the process.

Mazin Khoury, CEO of American Express Middle East, shares, “We are delighted to be launching ACCELERATE ME at this time, and to be able to give the powerful backing of American Express Middle East to some of these powerful new ideas. We continuously strive to put innovation at the forefront of everything we do, and are excited to create new and stimulating partnerships that can become a catalyst for growth for both American Express Middle East, and for the cohorts participating in the ACCELERATE ME programme.”

American Express Middle East is one of the founding partners of Bahrain Fintech Bay, a premier FinTech Hub in the Middle East. They are leading the way in creating a platform for startups to gain access to new markets, resources, and the opportunity to bring innovative solutions to the ecosystem.

“Bloom sees substantial potential in expanding to the Middle East. Government support for startups and a strong momentum for innovation from companies like American Express Middle East give entrepreneurs the opportunity to rapidly expand into new markets. We are thrilled to be a part of this.” shares co-founder Jesse Leimgruber.

About Bloom

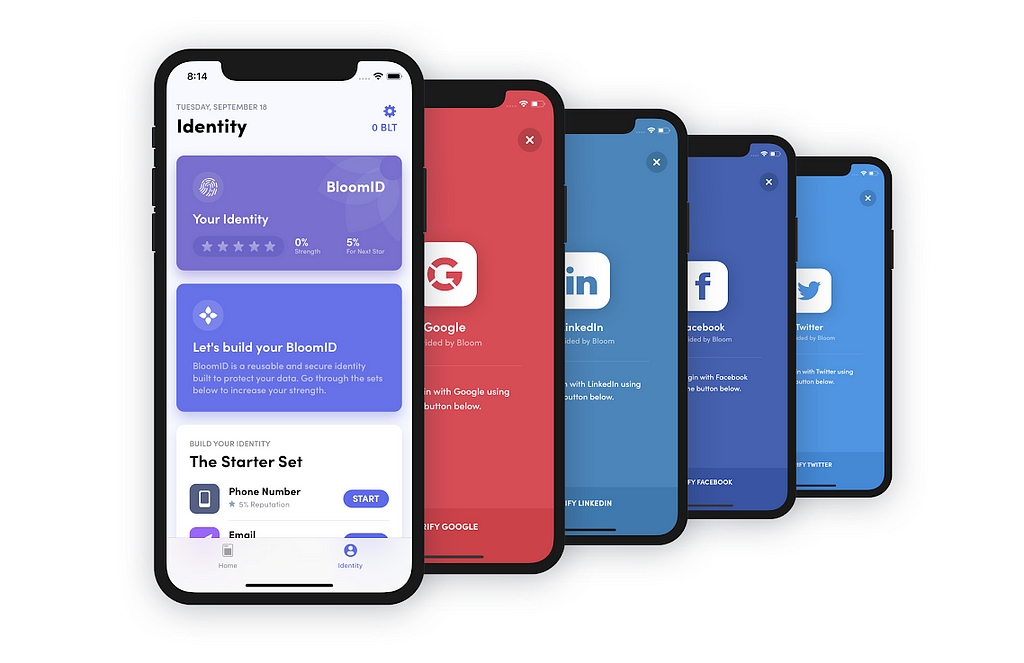

Bloom utilizes blockchain technology to bring non-traditional data, multi-signal identity verification, and secure data sharing to lending processes and credit scoring. Bloom recently announced other partnerships to streamline the loan application process and improve the customer journey by allowing consumers to securely fill loan applications with verified identity and financial data.

Bloom is a blockchain solution for secure digital identity and credit. Bloom’s solution provides consumers with a secure method to authenticate identity and financial information without exposing their personal information, and provides partners with a smart and seamless digital lending experience for customers, greatly improving the onboarding process and reducing overhead.

By decentralizing the way sensitive consumer information is shared between untrusted parties, the system reduces risk of identity theft and minimizes costs associated with customer onboarding, compliance and fraud prevention. With Bloom, individuals own and control their data, which is encrypted on their local devices. Using Bloom, consumers can build a secure and reusable digital identity that can be used to quickly and easily apply for credit in regions all around the world.

About American Express (Middle East) B.S.C.©

American Express (Middle East) B.S.C. © — American Express Middle East (AEME) provides reliable, flexible, tailored and rewarding solutions for its Cardmembers, merchants and business partners.

American Express began operations in the MENA region in 1959 and set up its first office in Bahrain in 1977. In 1992, AEME was established in Bahrain as a joint venture company owned by American Express and Mawarid Investment Limited. Today, American Express Middle East employs more than 500 staff in the region, covering its consumer card, corporate payments and merchant businesses across all the Middle East and North Africa region.

American Express is the Card for those individuals who value world class service, rewards, access and peace of mind wherever they are in the world. Operating across the Middle East and North Africa region, the company issues dollar currency Credit and Charge Cards: The Centurion® Card, The Platinum Card®, the American Express® Gold Card, the American Express® Platinum Credit Card, the American Express® Gold Credit Card and the American Express® Card. American Express Middle East also offers a range of local currency-denominated Credit Cards to give Cardmembers across the region even greater flexibility. American Express Middle East also offers a range of corporate expense management solutions including The American Express® Corporate Card and Business Travel Account, helping companies achieve savings, financial control and the opportunity to collect rewards.

To find out more about American Express Middle East please visit:

Bloom partners with American Express Middle East to bring blockchain innovation to region as part… was originally published in Bloom on Medium, where people are continuing the conversation by highlighting and responding to this story.