CCUS, nuclear, industrial heat, hydrogen, smart grids: “large unit” innovation needs more support – Energy Post

How do we accelerate innovation across all technologies? Simon Bennett at the IEA breaks down the task into “small unit” and “large unit” challenges. The first is easier and moves faster. Thanks to their small size and unit cost, heat pumps, EVs and solar panels benefit from mass production, mass deployment (100,000 to 100m units/year globally) and large customer markets with fierce competition. They can also easily leverage other fast-evolving sectors like communications and smart technology. “Large unit” size technologies offer a much bigger challenge. Think CCUS, nuclear and industrial heat. With 50 MW to 1 GW of energy throughput, combined new deployment totals only around 50 units/year. Hydrogen and smart grids also fall into this category. Here, governments will have to take on a significant proportion of the costs and risks of early commercial projects, sometimes for well over a decade. Take CCUS: demonstration projects can cost $1bn, take over five years from investment decision to getting results, and currently have a market value lower than their costs.

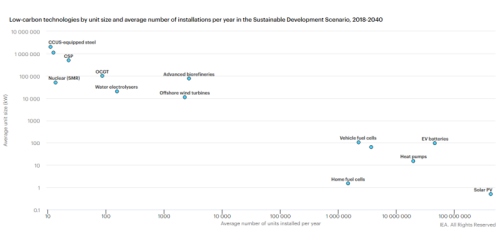

How do we accelerate innovation across all technologies? Simon Bennett at the IEA breaks down the task into “small unit” and “large unit” challenges. The first is easier and moves faster. Thanks to their small size and unit cost, heat pumps, EVs and solar panels benefit from mass production, mass deployment (100,000 to 100m units/year globally) and large customer markets with fierce competition. They can also easily leverage other fast-evolving sectors like communications and smart technology. “Large unit” size technologies offer a much bigger challenge. Think CCUS, nuclear and industrial heat. With 50 MW to 1 GW of energy throughput, combined new deployment totals only around 50 units/year. Hydrogen and smart grids also fall into this category. Here, governments will have to take on a significant proportion of the costs and risks of early commercial projects, sometimes for well over a decade. Take CCUS: demonstration projects can cost $1bn, take over five years from investment decision to getting results, and currently have a market value lower than their costs.

The last 200 years of the history of energy could be characterised, without too much exaggeration, as five or six long periods of disruption and uncertainty, punctuated by moments of stability. The energy sector is technology-intensive, and it has passed through several innovation-led transformations in the last two centuries: first to coal and steam, then oil and motive power, and electricity and automation.

Technology, social preferences and economics, when they align, are powerful threats to the status quo.

A new phase of technology-driven transformation is currently emerging – propelled by advances in digital technologies, mass manufacturing and environmental awareness. However, the breadth and pace of these changes are not yet enough to reach sustainability goals. The Sustainable Development Scenario of the IEA World Energy Outlook requires deployment of a wide range of improved technologies, across all sectors. In many cases, the pace of technology improvement needs to increase sharply to improve competitiveness, reduce transition costs and tackle so-called hard-to-abate emissions in a timely manner.

*STEPS = Stated Policies Scenario

Future tech breakthroughs are not factored into IEA scenarios

For the moment, only 7 of 45 critical clean energy technologies are “on track” to reach the deployment projected in the Sustainable Development Scenario; performance and cost improvements are needed.

The Sustainable Development Scenario does not assume any breakthroughs that would lead to deployment of technologies not yet demonstrated. Certain breakthroughs, like the holy grail of cold fusion, could have transformative impacts, but they are highly uncertain. It is hard to spot them in advance and it is even harder to justify their inclusion in World Energy Outlook scenarios. As in the past, most energy innovation will go to continuous improvements to existing ways of doing things and adapting them to new uses. Occasionally, new ideas from the lab will lead to step changes in performance and bring technologies to their economic tipping points more quickly.

Solar PV, nuclear, gas turbines, LNG, hydraulic fracturing all debuted in the 1950s

While it can take two to three decades to move from first commercialisation of energy technologies to a modest market share, and further decades to reach maximum deployment, most of the clean energy technologies deployed in the Sustainable Development Scenario are already well advanced. In fact, many of the technologies that play a major role over the outlook period can be directly traced back as far as an intensive period of post-war energy innovation in the 1950s. In that decade, solar PV, nuclear, gas turbines, LNG and hydraulic fracturing all made their debuts on the energy scene.

For established technologies with high potential for improvement, there is a need to accelerate market uptake and improve their performance and costs, for example by incentivising better or cheaper components and designs. For technologies that have not yet been commercialised, such as steel smelting with integrated CCUS and low-carbon cement production, a different set of policies will be needed.

What policies can help accelerate new technologies?

Though it is a simplification, it is helpful to think of the two main drivers of new technologies as “resource push” – i.e. priming the pump by allocating finance and skills according to priorities – and “market pull” – i.e. harnessing the capacity of markets to innovate to capture market share and revenue. In addition, successful national innovation ecosystems also benefit from policies that manage the flow of knowledge between researchers and users, plus consideration of social and political support.

Policy certainty

Market forces are among the most efficient ways to drive innovation. However, unlike for previous transitions, markets for many clean energy technologies need to be shaped by policy goals, not just by cost or convenience. For “market pull” to be effective, innovators, users and investors must all trust that the impetus shaping these markets will be long lasting and global. To this end, the Sustainable Development Scenario charts a course of progressive policy strengthening and alignment across all clean energy domains over several decades. Entrepreneurs can raise finance more easily and at lower cost if future markets are more certain.

Small unit size innovations: heat pumps, EVs, solar panels

Another way in which the energy technology landscape is changing is the penetration of modular technologies that have small unit size, especially for energy end-uses. These include heat pumps, electric vehicles or solar panels that promote switching from fossil fuel to electricity inputs. Their attributes are significantly different from the types of technologies that have dominated energy supply over the past century.

In the Sustainable Development Scenario, products with large unit sizes are installed in double-digits per year, while small products are installed at annual rates up to one billion. Fuel cell, battery and solar PV units are designed for energy throughput of just 0.1 kW to 500 kW and are deployed at rates of 100,000 to 100 million units per year globally. They benefit from innovations in mass production, electronics and standardised installation, enabling faster innovation.

Market forces can be especially effective for driving innovation in these types of technologies, with the private sector taking a major role. Uptake of mass-produced consumer products is more responsive to changes in prices, policies and social preferences. More factories are built to meet global demand for these items and industrial competition leads to faster turnover of products. New generations of these technologies hit the market every few years, with associated innovative improvements. In some cases, mismatched investment and consumption cycles can lead to oversupply and intensive competition for market share.

Leveraging other fast-evolving sectors: communications, smart technology

As the size and turnover of the market rises, the private incentives for improving the technologies increase. This is especially the case where developments can piggyback on other fast-evolving sectors, such as communications and smart technology, as is the case for batteries and sensors for energy efficiency and demand response. Private investment is also likely to flow more readily where consumer energy products can be differentiated for various users, as with cars, or where end-user data can be commercialised.

Case study: solar PV

These dynamics were at play in the impressive scale up and cost reductions for solar PV in the last decade. This was the first time that mass-produced, small unit size technologies became significant in the energy supply landscape. Furthermore, because capital costs dominate total solar PV costs, these costs reductions from manufacturing scale-up had a disproportionate impact on electricity supply costs compared to traditional energy technologies requiring fuel inputs. Keeping costs on a downward trend will require a similar mix of incremental innovations in technology, manufacturing and installation, alongside public “resource push” for new approaches with potential for step-change improvements, like thin, flexible, printed PV cells. Governments can also help avoid market concentration, incentivise entrepreneurship and encourage international collaboration to boost the global component of the learning rate.

Large unit size: a much bigger challenge

However, the Sustainable Development Scenario cannot be achieved without a range of critical technologies that do not fall into this category and where governments would need to play a much more central role. New nuclear designs, CCUS and low-carbon industrial processes have units designed for 50 MW to 1 GW of energy throughput; deployment is up to around 50 units per year. Like many of the technologies that have dominated energy supply over the past century, much of the innovation is in materials and chemical engineering.

CCUS, nuclear, hydrogen, smart cities, industrial heat

These complex, large-unit-size technologies require associated infrastructure and can represent a high investment risk for existing operators. These technologies require more capital to be put at risk in an early stage of the innovation chain and often face an uncertain regulatory outlook, for example for safety management. CCUS, nuclear, hydrogen and integrated smart city solutions fall into this category due to their costs, situational specificity and value chain complexity.

For nuclear innovation, the timescale of the development cycle is long due to the need to develop new qualification programmes and regulatory frameworks, which requires appropriate financial conditions. In the case of CCUS, demonstration projects can cost around $1 billion, take five years or more from investment decision to gaining results, and currently have a market value lower than their costs (based on prevailing CO2 prices).

For these technologies, governments generally have to take on a significant proportion of the costs and risks of successive early commercial projects, sometimes for well over a decade. More strategic “resource push” approaches are required, involving public R&D grants, tax credits, loans, knowledge sharing and even equity investments. Strong signals that this support will continue over the longer term is essential.

Matching each technology with policy

Regardless of the technology type, the Sustainable Development Scenario requires “resource push” and “market pull” approaches, as well as knowledge management and creating socio-political support. Strategic prioritisation of energy R&D and innovation policy towards long-term national priorities creates an opportunity to tailor the balance between these approaches to the attributes of the technologies. In addition to unit size and modularity, technologies and their components can vary in their compatibility with local infrastructure, their dependence on improvements in other technologies and their level of interaction with final consumers.

At a higher level, this process benefits from long-term international, national and sectoral visions, each linked to the identification of innovation gaps, as well as market support for clean energy solutions, including financial penalties for polluting technologies, and an enabling environment for entrepreneurship. Governments in particular have a unique opportunity to set the direction of the research agenda through smart policies and funding that crowds in private sector finance for innovation, for example by redirecting CO2 pricing revenues to clean energy research grants, loans and other instruments.

Despite the best efforts of governments and engineers, the adoption of cleaner and more efficient technologies by users is often messy, unpredictable and prolonged. To some extent this is unavoidable, but well-aligned incentives across the innovation supply chain – from R&D to knowledge diffusion, deployment and iteration – can help smooth and speed up this process.

Simon Bennett is an Energy Technology Analyst at the IEA

This article is published with permission