Decentralization Is The Innovation

This article was originally published Caleb Fenton on Substack.com.

It is republished here with permission from the author.

Bitcoin is new and interesting because it’s decentralized — no one is in charge and no one can be in charge. This is an extreme design decision with serious trade-offs which almost no other crypto projects have attained. In this post, I’ll explain why decentralization is special and how to evaluate how decentralized something is.

What is Decentralization?

Simply put, it means there’s central authority like a company, person, small group, etc. who’s “in charge”. In a decentralized system, everyone who participates influences what the rules are. This may seem strange but it’s just like language. There’s no King of English, no President of grammar, yet we all somehow agree on what words mean. We come to a consensus without anyone deciding the meaning of words by fiat. The concept is simple, but the implications are profound.

Why is Decentralization Special?

Decentralized systems are incredibly durable — they’re hard to change and even harder to shut down. Continuing with the language analogy, you might think dictionaries define words, but they merely record usage. They’re descriptive rather than prescriptive. If you want to coin a new word or change a words meaning, you have to get enough people to agree to go along with it, and this can take years.

This is annoying because it’s hard to “fix” all the the weird words and spelling rules, but it’s also great because no one can easily “attack” English by redefining or deleting words. However, words still change in meaning over time but it takes a while to get enough consensus. For example, in English, the prefix “in-” usually means “not”. This rule is generally consistent and people like it, so eventually the word “inflammable” changed from meaning “can burn” to “can not burn”. Don’t believe me? Check out this video from 1937 about the Hidenburg to hear it used in the old way:

“Inside the silver envelope are 16 separate gas bags — each filled with hydrogen — a highly inflammable gas.” — 0:33

In Bitcoin, changes that make sense are adopted but it takes a few years for everyone to debate the issue and for consensus to be achieved.

The exception to slow change is when there’s an extremely natural and acceptable change which attains a rapid and overwhelming majority consensus. For example, you probably remember when the verb “google” was coined. The search engine was such an amazing success and everyone loved it and used it all the time, and the language needed a word that meant “searched for something online”, so that was coined quickly. In the same way, if a security flaw was discovered in Bitcoin, the community would rapidly converge on a solution and would rapidly adopt it, because there is a huge need.

I would absolutely love to geek out about linguistic oddities like the history of inflammable, how data, media, and agenda are all plural, why we have ruthless but ruth is gone except for in names, why methodology is a stupid word, the debate on using impact as a verb, and so on, but I’ll spare you and just stick to Bitcoin. You’re welcome!

There were several attempts at a digital currency before Bitcoin such as DigiCash and e-gold but they were all centralized. As soon as they became popular and started to threaten the monopoly on money or regulators, they were swiftly and easily shut down. In many ways, Bitcoin isn’t the first cryptocurrency; it’s the last. Bitcoin has survived over 13 years, mostly unchanged, despite relentless attacks and attempts at subversion from extremely well-funded and powerful groups. And it did this because the protocol and the community have embraced decentralization.

Is Decentralization A Spectrum?

Centralization is appealing because it makes everything easier and faster. The argument in favor of centralization is that with just a little centralization the design constraints are significantly reduced which allows for things like scaling and neat features and it’s also a lot easier to make quick, decisive changes in the future. For example, Rome was normally decentralized in the form of a republic but in times of crisis they would centralize under an elected, temporary dictator who could cut through the red tape and get shit done. I’m just one person, I don’t know everything, and the market will ultimately decide who the winner is, but I think this is a disaster if the goal is to become a global monetary standard or a threat to any government anywhere.

I believe decentralization is more like a step function — like being pregnant. You’re either highly decentralized or you’re centralized with coercible points of failure. If there’s a throat to choke, it’ll get choked. Decentralization isn’t important until you’re attacked either internally or externally, and you’re not attacked until you’re a big enough target. If a submarine has a hole in it, it’s not a problem if it’s floating on the surface. In fact, you can argue that the hole is useful because it lets fresh air in, it’s not too hard to pump the water out, designing a pressurized submersible vessel is really hard, etc. However, if you want to go deep into a mysterious trench at the bottom of the ocean full of giant monsters, your submarine will implode way before it gets there. Bitcoin assumes it’s going to the bottom of the ocean.

How Is Bitcoin Decentralized?

Bitcoin is developed under the assumption that it will be attacked by the most powerful organizations on the planet. This has led to a design which:

- allows anyone to run a fully validating node on cheap hardware with limited internet connectivity

- respects and incentivizes miners who invest a lot of money into securing the network by being predictable and not making their investments obsolete by suddenly changing rules or algorithms

- carefully considers the game theory, incentives, costs between all the various stake holders in the network

The stake holders can be broadly defined as:

- Bitcoin developers — Developers who maintain the core software, debate technical merits of changes (many of which aren’t controversial)

- Wallet developers — Have the difficult task of making bitcoin easy to use for normal people while keeping up with the insane rate of change

- Miners — Invest large amounts of money and energy into mining equipment to secure the network and are in turn rewarded by the network with fees and newly created bitcoin

- Node operators — Validate, relay, and store transactions. If you wanted to delete bitcoin, you’d have to shut down every single node. All miners are necessarily node operators.

- Users — People who store their value and transact in bitcoin. These are merchants, customers, non profits, charities, etc.

Bitcoin developers control the code, but they can’t change Bitcoin’s rules in a way the other groups don’t like because the other groups could choose not to run the new code. In the same way, miners provide value by securing the network, but they can’t just decide to give themselves more Bitcoin or node operators could say their transactions are invalid and users could simply not use the work from those miners. It’s a system of carefully considered checks and balances and no one group controls everything. If people don’t like how bitcoin works, they’re free to fork at any time and make a competing protocol.

What About Other Crypto Projects?

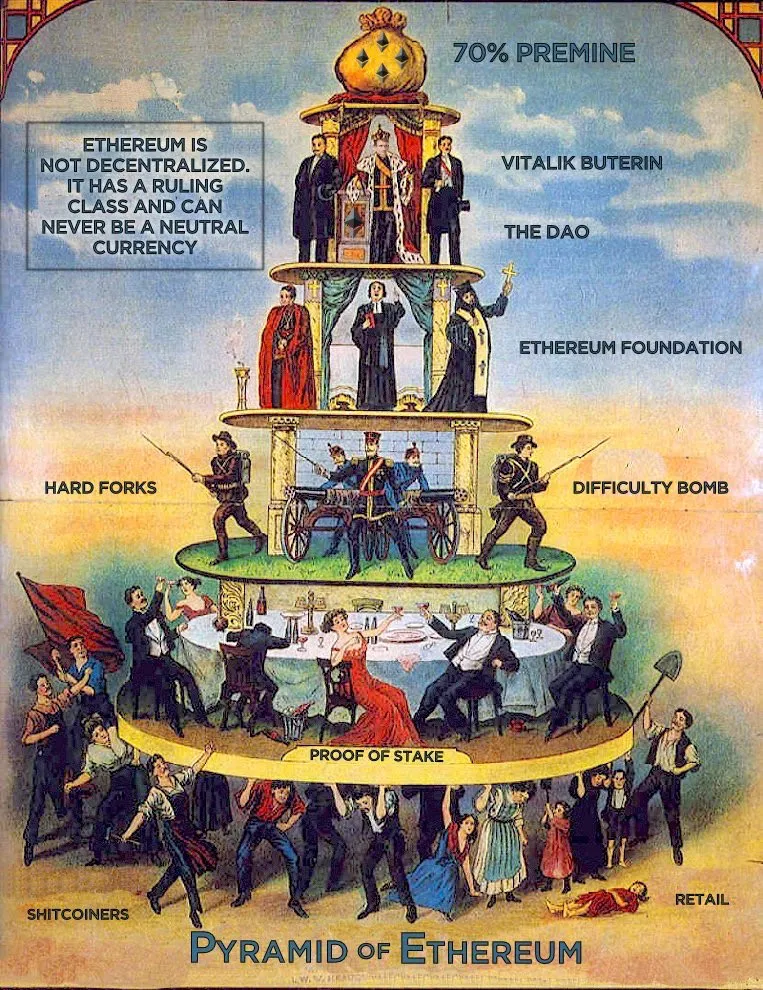

It would take ages to go through every crypto project and convincingly argue which are bullshit and which have merit. Instead, consider the questions below when evaluating. I’m going to pick on Ethereum a bit because it’s the second biggest crypto project.

How Hard Is It To Run A Node?

You can run a full Bitcoin node at home on a Raspberry Pi, a 600GB SSD, and over Tor, meaning the internet can be quite slow.

By contrast, a full “archival” Ethereum node requires much more expensive hardware such that most are run on AWS, which is a single point of failure itself. Additionally, it requires a 2TB SSD and the blockchain is growing much faster because Ethereum has bigger and more frequent blocks than Bitcoin.

(Editor’s note : Currently Ethereum full node size sits at 680 GB according to Blockchair.com data and a full archival node takes up about 15 TB of data according to data from Etherscan.io)

Ethereum advocates would say they have a some complex solution which allows sharding and pruning and in the end only a few people need to run archival nodes so this isn’t a problem. Ok, maybe, but regardless, with increased complexity comes increased risk that something doesn’t work as intended.

Has This Project Been Attacked Before? What Happened?

Bitcoin has been attacked many times. There’s even a book about it: The Blocksize War. Some people wanted to upgrade the protocol to allow for more flexibility and scale, but it broke a secret technique some miners were using to have an advantage. It led to a long debate in the community about how large a block should be. Eventually, the majority decided to preserve decentralization by keeping the block size small. This means the blockchain grows slowly which keeps it easy to run a node and encourages people to optimize how they batch transactions, build layer 2 solutions, etc.

Ethereum was attacked during the aftermath of the DAO hack: Understanding The DAO Attack. There was a smart contract that raised $200m. A hacker found a bug and started stealing money from the smart contract. The community was split into two camps:

- Let’s shut down Ethereum, undo the hacker’s transactions, and make it so that this never happened. This technology is new and mistakes will be made so we should be forgiving if enough people in the community agree.

- Transactions should never be censored. If Ethereum demonstrates that it can censor transactions now, it’ll be forced to in the future by governments. If a few charismatic individuals can convince the community to roll back a transaction, it sets a dangerous precedent.

This disagreement caused Ethereum to hard for into Ethereum (ETH) and Ethereum Classic (ETC). The majority of the network’s value went with ETH and now there’s the open question of what if this happens again? If Putin kidnapped Vitalik (the creator of Ethereum) because he didn’t like a certain transaction, can it be undone?

How Is The Network Secured?

In Bitcoin, the network is secured by proof of work mining and Nakamoto consensus. This protocol has stood the test of time and has been producing blocks every 10 minutes for over 13 years virtually unchanged despite numerous attacks. Miners are rewarded for their contributions by getting new Bitcoin for every block they mine as well as transaction fees.

Ethereum has recently switched away from proof of work to proof of stake. There’s a big debate on if proof of stake is: 1.) actually new and 2.) offers the same security guarantees. For the record I don’t think it’s new and I doubt it’s secure since it hasn’t stood the test of time, but smarter people than me have talked about this elsewhere. I just want to focus on two inarguable facts:

- Those with the most Ethereum will have the most authority and there was a massive Ethereum premine where a bunch of Ethereum was given out or sold to unknown parties. We don’t know if Vitalik + the Ethereum foundation own 60% of all Ethereum.

Summary

It’s not clear that a cyrpto project will invariably explode if it’s the least bit centralized. However, it’s certainly not suitable to be a global monetary system and all of the attacks that will come with that. Additionally, without decentralization, it’s not really new. We already have digital assets in the form of video game items. I have friends who have sold Counter-Strike knife skins for hundreds of dollars. We already have distributed computing platforms like Spark and Hadoop.

If something isn’t new or innovative, why do people care? Because we’re in a speculative craze. People want to be in on the ground floor for the next Bitcoin and hope that their chosen projects goes “to the moon” but they don’t realize that decentralization is the true innovation. Everyone’s money is corrupt and on fire, and they’re desperate, so they don’t think too deeply about threat models and the properties of sound money.

Stay humble and stack sats.

The post Decentralization Is The Innovation appeared first on Bitcoin News.