Does the Water Resource Tax Reform Bring Positive Effects to Green Innovation and Productivity in High Water-Consuming Enterprises?

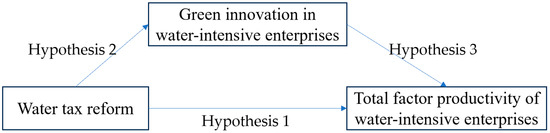

Does the Water Resource Tax Reform Bring Positive Effects to Green Innovation and Productivity in High Water-Consuming Enterprises? 1 2 * Water 2024 , 16 (5), 725; https://doi.org/10.3390/w16050725 (registering DOI) Abstract : 1. Introduction 2. Literature Review 2.1. Water Resource Tax 2.2. Corporate Green Innovation 2.3. Total Factor Productivity of Enterprises 3. Theoretical Analysis and Research Hypothesis Hypothesis 1: Hypothesis 2: Hypothesis 3: 4. Research Design 4.1. Sample Selection 4.2. Variable Measurement it = Treated i × Time t . The term Treated i is a policy group dummy variable and has a value of 1 if the province where the firm is located has implemented the water tax reform, and 0 if it has not. The term Timet is a time dummy variable. Based on timing and sequential differences in the water resource tax reform, this variable has a value of 1 in the year of the reform pilot and later; otherwise, it is 0. Hebei Province was the first to start the water resource tax reform pilot on 1 July 2016. In 2017, the pilot scope of the reform was expanded to nine provinces: Beijing, Tianjin, Shanxi, Inner Mongolia, Shandong, Henan, Sichuan, Shaanxi, and Ningxia. 4.3. Model Setup 1 in Equation (2) is expected to be significantly positive, which indicates that the water tax reform will significantly promote corporate green innovation. 1 in Equation (3) is significantly positive, which indicates that enterprise green innovation will significantly enhance total factor productivity. 5. Empirical Results and Analysis 5.1. Descriptive Statistics and Pearson Correlation Analysis 5.2. Benchmark Regression Analysis 5.3. Robustness Tests 5.3.1. Fixed Effects Model 5.3.2. Substitution of Key Variables 5.3.3. PSM-DID Model 5.4. Intrinsic Mechanism of Action Test 5.5. Heterogeneity Analysis 6. Conclusions Author Contributions Funding Data Availability Statement Conflicts of Interest References Yao, P.; Li, J. Determining industry by water: Fee to tax of water resources and industrial transformation and upgrading. Stat. Res. 2023 , 40, 135–148. [Google Scholar] Lv, Y.; Ge, Y.; Geng, Y. Has the water resource tax reform improved the green efficiency of water resource? J. Arid Land Resour. Environ. 2022 , 36, 77–83. [Google Scholar] Huang, B. An exhaustible resources model in a dynamic input–output framework: A possible reconciliation between Ricardo and Hotelling. J. Econ. Struct. 2018 , 7, 8. [Google Scholar] Ing, J. Adverse selection, commitment and exhaustible resource taxation. Resour. Energy Econ. 2020 , 61, 101161. [Google Scholar] Welsch, H. Resource dependence, knowledge creation, and growth: Revisiting the natural resource curse. J. Econ. Dev. 2008 , 33, 45–70. [Google Scholar] [CrossRef] Liu, H.; Ruebeck, C.S. Knowledge spillover and positive environmental externality in agricultural decision making under performance-based payment programs. Agric. Resour. Econ. Rev. 2020 , 49, 270–290. [Google Scholar] [CrossRef] Thomas, A.; Zaporozhets, V. Bargaining over environmental budgets: A political economy model with application to French water policy. Environ. Resour. Econ. 2017 , 68, 227–248. [Google Scholar] Höglund, L. Household demand for water in Sweden with implications of a potential tax on water use. Water Resour. Res. 1999 , 35, 3853–3863. [Google Scholar] [CrossRef] Clinch, J.P.; Dunne, L.; Dresner, S. Environmental and wider implications of political impediments to environmental tax reform. Energy Policy 2006 , 34, 960–970. [Google Scholar] Berbel, J.; Borrego-Marin, M.M.; Exposito, A.; Giannoccaro, G.; Montilla-Lopez, N.M.; Roseta-Palma, C. Analysis of irrigation water tariffs and taxes in Europe. Water Policy 2019 , 21, 806–825. [Google Scholar] [CrossRef] van Heerden, J.H.; Blignaut, J.; Horridge, M. Integrated water and economic modelling of the impacts of water market instruments on the South African economy. Ecol. Econ. 2008 , 66, 105–116. [Google Scholar] [CrossRef] Porcher, S. The ‘hidden costs’ of water provision: New evidence from the relationship between contracting-out and price in French water public services. Util. Policy 2017 , 48, 166–175. [Google Scholar] Porter, M.E.; Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995 , 9, 97–118. [Google Scholar] [CrossRef] Fan, T. Research on the reform and perfection of resource Tax system. Open J. Soc. Sci. 2021 , 9, 107943. [Google Scholar] [CrossRef] Jia, Z.; Lin, B. CEEEA2. 0 model: A dynamic CGE model for energy-environment-economy analysis with available data and code. Energy Econ. 2022 , 112, 106117. [Google Scholar] [CrossRef] Chen, X.; Yi, N.; Zhang, L.; Li, D. Does institutional pressure foster corporate green innovation? Evidence from China’s top 100 companies. J. Clean. Prod. 2018 , 188, 304–311. [Google Scholar] [CrossRef] Ambec, S.; Cohen, M.A.; Elgie, S.; Lanoie, P. The Porter hypothesis at 20: Can environmental regulation enhance innovation and competitiveness? Rev. Environ. Econ. Policy 2013 , 7, 2–22. [Google Scholar] [CrossRef] Mikhno, I.; Koval, V.; Shvets, G.; Garmatiuk, O.; Tamošiūnienė, R. Green economy in sustainable development and improvement of resource efficiency. Cent. Eur. Bus. Rev. 2021 , 10, 99–113. [Google Scholar] [CrossRef] Munguía-López, A.C.; González-Bravo, R.; Ponce-Ortega, J.M. Evaluation of carbon and water policies in the optimization of water distribution networks involving power-desalination plants. Appl. Energy 2019 , 236, 927–936. [Google Scholar] Ouyang, R.; Mu, E.; Yu, Y.; Chen, Y.; Hu, J.; Tong, H.; Cheng, Z. Assessing the effectiveness and function of the water resources tax policy pilot in China. Environ. Dev. Sustain. 2022 , 9, 1–17. [Google Scholar] [CrossRef] Biancardi, M.; Maddalena, L.; Villani, G. Water taxes and fines imposed on legal and illegal firms exploiting groundwater. Discret. Contin. Dyn. Syst.-Ser. B 2021 , 26, 5787–5806. [Google Scholar] Guo, J.; Chen, Z.; Nie, P. Discussion of the tax scheme for cleaner water use. Water Conserv. Sci. Eng. 2022 , 7, 475–490. [Google Scholar] [CrossRef] Chen, Y.; Li, J.; Lu, H.; Yang, Y. Impact of unconventional natural gas development on regional water resources and market supply in China from the perspective of game analysis. Energy Policy 2020 , 145, 111750. [Google Scholar] [CrossRef] Oltra, V.; Saint Jean, M. Sectoral systems of environmental innovation: An application to the French automotive industry. Technol. Forecast. Soc. Chang. 2009 , 76, 567–583. [Google Scholar] [CrossRef] Vasileiou, E.; Georgantzis, N.; Attanasi, G.; Llerena, P. Green innovation and financial performance: A study on Italian firms. Res. Policy 2022 , 51, 104530. [Google Scholar] Frondel, M.; Horbach, J.; Rennings, K. What triggers environmental management and innovation? Empirical evidence for Germany. Ecol. Econ. 2008 , 66, 153–160. [Google Scholar] [CrossRef] Horbach, J. Determinants of environmental innovation—New evidence from German panel data sources. Res. Policy 2008 , 37, 163–173. [Google Scholar] [CrossRef] Borsatto, J.M.L.S.; Bazani, C.L. Green innovation and environmental regulations: A systematic review of international academic works. Environ. Sci. Pollut. Res. 2021 , 28, 63751–63768. [Google Scholar] [CrossRef] Stucki, T. Which firms benefit from investments in green energy technologies?–The effect of energy costs. Res. Policy 2019 , 48, 546–555. [Google Scholar] [CrossRef] Fernando, Y.; Tseng, M.-L.; Sroufe, R.; Abideen, A.Z.; Shaharudin, M.S.; Jose, R. Eco-innovation impacts on recycled product performance and competitiveness: Malaysian automotive industry. Sustain. Prod. Consum. 2021 , 28, 1677–1686. [Google Scholar] Zhang, Y.; Zhang, J.; Cheng, Z. Stock market liberalization and corporate green innovation: Evidence from China. Int. J. Environ. Res. Public Health 2021 , 18, 3412. [Google Scholar] [PubMed] Segarra-Ona MD, V.; Peiró-Signes, A.; Verma, R.; Miret-Pastor, L. Does environmental certification help the economic performance of hotels? Evidence from the Spanish hotel industry. Cornell Hosp. Q. 2012 , 53, 242–256. [Google Scholar] [CrossRef] Sáez-Martínez, F.J.; Díaz-García, C.; Gonzalez-Moreno, A. Firm technological trajectory as a driver of eco-innovation in young small and medium-sized enterprises. J. Clean. Prod. 2016 , 138, 28–37. [Google Scholar] [CrossRef] Keskin, D.; Diehl, J.C.; Molenaar, N. Innovation process of new ventures driven by sustainability. J. Clean. Prod. 2013 , 45, 50–60. [Google Scholar] [CrossRef] Ogbeibu, S.; Emelifeonwu, J.; Senadjki, A.; Gaskin, J.; Kaivo-Oja, J. Technological turbulence and greening of team creativity, product innovation, and human resource management: Implications for sustainability. J. Clean. Prod. 2020 , 244, 118703. [Google Scholar] Scarpellini, S.; Marín-Vinuesa, L.M.; Portillo-Tarragona, P.; Moneva, J.M. Defining and measuring different dimensions of financial resources for business eco-innovation and the influence of the firms’ capabilities. J. Clean. Prod. 2018 , 204, 258–269. [Google Scholar] [CrossRef] da Cunha Bezerra, M.C.; Gohr, C.F.; Morioka, S.N. Organizational capabilities towards corporate sustainability benefits: A systematic literature review and an integrative framework proposal. J. Clean. Prod. 2020 , 247, 119114. [Google Scholar] [CrossRef] Shahzad, M.; Qu, Y.; Zafar, A.U.; Rehman, S.U.; Islam, T. Exploring the influence of knowledge management process on corporate sustainable performance through green innovation. J. Knowl. Manag. 2020 , 24, 2079–2106. [Google Scholar] [CrossRef] Triguero, A.; Moreno-Mondéjar, L.; Davia, M.A. Drivers of different types of eco-innovation in European SMEs. Ecol. Econ. 2013 , 92, 25–33. [Google Scholar] [CrossRef] Wang, C.L.; Ahmed, P.K. Dynamic capabilities: A review and research agenda. Int. J. Manag. Rev. 2007 , 9, 31–51. [Google Scholar] [CrossRef] Lončar, D.; Paunković, J.; Jovanović, V.; Krstić, V. Environmental and social responsibility of companies cross EU countries–Panel data analysis. Sci. Total Environ. 2019 , 657, 287–296. [Google Scholar] [CrossRef] [PubMed] Sumrin, S.; Gupta, S.; Asaad, Y.; Wang, Y.; Bhattacharya, S.; Foroudi, P. Eco-innovation for environment and waste prevention. J. Bus. Res. 2021 , 122, 627–639. [Google Scholar] [CrossRef] Arena, C.; Michelon, G.; Trojanowski, G. Big egos can be green: A study of CEO hubris and environmental innovation. Br. J. Manag. 2018 , 29, 316–336. [Google Scholar] Zhang, Z.; Yang, L.; Peng, X.; Liao, Z. Overseas imprints reflected at home: Returnee CEOs and corporate green innovation. Asian Bus. Manag. 2023 , 22, 1328–1368. [Google Scholar] Papagiannakis, G.; Voudouris, I.; Lioukas, S.; Kassinis, G. Environmental management systems and environmental product innovation: The role of stakeholder engagement. Bus. Strategy Environ. 2019 , 28, 939–950. [Google Scholar] [CrossRef] Bernard, A.B.; Moxnes, A.; Saito, Y.U. Production networks, geography, and firm performance. J. Political Econ. 2019 , 127, 639–688. [Google Scholar] Aghion, P.; Cai, J.; Dewatripont, M.; Du, L.; Harrison, A.; Legros, P. Industrial policy and competition. Am. Econ. J. Macroecon. 2015 , 7, 1–32. [Google Scholar] Kiyota, K.; Okazaki, T. Industrial policy cuts two ways: Evidence from cotton-spinning firms in Japan, 1956–1964. J. Law Econ. 2010 , 53, 587–609. [Google Scholar] [CrossRef] Arizala, F.; Cavallo, E.; Galindo, A. Financial development and TFP growth: Cross-country and industry-level evidence. Appl. Financ. Econ. 2013 , 23, 433–448. [Google Scholar] [CrossRef] Méon, P.G.; Weill, L. Does financial intermediation matter for macroeconomic performance? Econ. Model. 2010 , 27, 296–303. [Google Scholar] [CrossRef] Caggese, A. Financing constraints, radical versus incremental innovation, and aggregate productivity. Am. Econ. J. Macroecon. 2019 , 11, 275–309. [Google Scholar] [CrossRef] Habib, M.; Abbas, J.; Noman, R. Are human capital, intellectual property rights, and research and development expenditures really important for total factor productivity? An empirical analysis. Int. J. Soc. Econ. 2019 , 46, 756–774. [Google Scholar] [CrossRef] Bennett, B.; Stulz, R.; Wang, Z. Does the stock market make firms more productive? J. Financ. Econ. 2020 , 136, 281–306. [Google Scholar] [CrossRef] Hsieh, C.T.; Klenow, P.J. Misallocation and manufacturing TFP in China and India. Q. J. Econ. 2009 , 124, 1403–1448. [Google Scholar] [CrossRef] Tian, G.Y.; Twite, G. Corporate governance, external market discipline and firm productivity. J. Corp. Financ. 2011 , 17, 403–417. [Google Scholar] [CrossRef] Ahamed, M.M.; Luintel, K.B.; Mallick, S.K. Does local knowledge spillover matter for firm productivity? The role of financial access and corporate governance. Res. Policy 2023 , 52, 104837. [Google Scholar] [CrossRef] Wang, H.; Yang, G.; Ouyang, X.; Tand, Z.; Long, X.; Yue, Z. Horizontal ecological compensation mechanism and technological progress: Theory and empirical study of Xin’an River Ecological Compensation Gambling Agreement. J. Environ. Plan. Manag. 2023 , 66, 501–523. [Google Scholar] Hancevic, P.I. Environmental regulation and productivity: The case of electricity generation under the CAAA-1990. Energy Econ. 2016 , 60, 131–143. [Google Scholar] Gray, W.B.; Shadbegian, R.; Wolverton, A. Environmental regulation and labor demand: What does the evidence tell us? Annu. Rev. Resour. Econ. 2023 , 15, 177–197. [Google Scholar] [CrossRef] de Medeiros, J.F.; Vidor, G.; Ribeiro, J.L.D. Driving factors for the success of the green innovation market: A relationship system proposal. J. Bus. Ethics 2018 , 147, 327–341. [Google Scholar] Magat, W.A. The effects of environmental regulation on innovation. Law Contemp. Probl. 1979 , 43, 4–25. [Google Scholar] Weitzman, M.L. Optimal rewards for economic regulation. Am. Econ. Rev. 1978 , 68, 683–691. [Google Scholar] Montero, J.P. Market structure and environmental innovation. J. Appl. Econ. 2002 , 5, 293–325. [Google Scholar] Larson, D.M.; Helfand, G.E.; and House, B.W. Second-best tax policies to reduce nonpoint source pollution. Am. J. Agric. Econ. 1996 , 78, 1108–1117. [Google Scholar] [CrossRef] Marriott, L.; Kraal, D.; and Singh-Ladhar, J. Tax as a solution for irrigation water scarcity, quality and sustainability: Case studies in Australia and New Zealand. Aust. Tax Forum 2021 , 36, 369–402. [Google Scholar] Ambec, S.; Barla, P. A Theoretical foundation of the Porter hypothesis. Econ. Lett. 2002 , 75, 355–360. [Google Scholar] Wang, K.; Wu, Y. Research on the promoting effect of green tax system on total factor productivity of rare earth enterprises—Empirical analysis based on resource tax reform. Price Theory Pract. 2023 , 3, 116–119. [Google Scholar] Cannon, J.N. Determinants of ‘sticky costs’: An analysis of cost behavior using United States air transportation industry data. Account. Rev. 2014 , 89, 1645–1672. [Google Scholar] [CrossRef] Cai, W.; Li, G. The drivers of eco-innovation and its impact on performance: Evidence from China. J. Clean. Prod. 2018 , 176, 110–118. [Google Scholar] [CrossRef] Song, M.; Wang, S.; Zhang, H. Could environmental regulation and R&D tax incentives affect green product innovation? J. Clean. Prod. 2020 , 258, 120849. [Google Scholar] Gilli, M.; Mancinelli, S.; Mazzanti, M. Innovation complementarity and environ-mental productivity effects: Reality or delusion? Evidence from the EU. Ecol. Econ. 2014 , 103, 56–67. [Google Scholar] [CrossRef] Klette, T.J.; Griliches, Z. Empirical patterns of firm growth and R&D investment: A quality ladder model interpretation. Econ. J. 2000 , 110, 363–387. [Google Scholar] Carrión-Flores, C.E.; Innes, R. Environmental innovation and environmental performance. J. Environ. Econ. Manag. 2010 , 59, 27–42. [Google Scholar] [CrossRef] Fleming, L.; Sorenson, O. Science as a map in technological search. Strateg. Manag. J. 2004 , 25, 909–928. [Google Scholar] [CrossRef] Wurlod, J.D.; Noailly, J. The impact of green innovation on energy intensity: An empirical analysis for 14 industrial sectors in OECD countries. Energy Econ. 2018 , 71, 47–61. [Google Scholar] [CrossRef] Liu, B.; Cifuentes-Faura, J.; Ding, C.J.; Liu, X. Toward carbon neutrality: How will environmental regulatory policies affect corporate green innovation? Econ. Anal. Policy 2023 , 80, 1006–1020. [Google Scholar] [CrossRef] Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003 , 70, 317–341. [Google Scholar] Gramkow, C.; Anger-Kraavi, A. Could fiscal policies induce green innovation in developing countries? The case of Brazilian manufacturing sectors. Clim. Policy 2018 , 18, 246–257. [Google Scholar] [CrossRef] Filson, A.; Lewis, A. Innovation from a small company perspective-an empirical investigation of new product development strategies in SMEs. In Proceedings of the 2000 IEEE Engineering Management Society, EMS-2000 (Cat. No. 00CH37139), Albuquerque, NM, USA, 15 August 2000; IEEE: Piscataway, NJ, USA, 2000; pp. 141–146. [Google Scholar] Amore, M.D.; Schneider, C.; Žaldokas, A. Credit supply and corporate innovation. J. Financ. Econ. 2013 , 109, 835–855. [Google Scholar] Francis, J.; Smith, A. Agency costs and innovation some empirical evidence. J. Account. Econ. 1995 , 19, 383–409. [Google Scholar] [CrossRef] De Cleyn, S.H.; Braet, J. Do board composition and investor type influence innovativeness in SMEs? Int. Entrep. Manag. J. 2012 , 8, 285–308. [Google Scholar] [CrossRef] Belloc, F. Law, finance and innovation: The dark side of shareholder protection. Camb. J. Econ. 2013 , 37, 863–888. [Google Scholar] [CrossRef] Zahra, S.A.; Ireland, R.D.; Hitt, M.A. International expansion by new venture firms: International diversity, mode of market entry, technological learning, and performance. Acad. Manag. J. 2000 , 43, 925–950. [Google Scholar] Coles, J.L.; Daniel, N.D.; Naveen, L. Managerial incentives and risk-taking. J. Financ. Econ. 2006 , 79, 431–468. [Google Scholar] [CrossRef] Miller, D.J.; Fern, M.J.; Cardinal, L.B. The use of knowledge for technological in-novation within diversified firms. Acad. Manag. J. 2007 , 50, 307–325. [Google Scholar] [CrossRef] Yoo, Y.; Henfridsson, O.; Lyytinen, K. Research commentary—The new organizing logic of digital innovation: An agenda for information systems research. Inf. Syst. Res. 2010 , 21, 724–735. [Google Scholar] [CrossRef] Mikalef, P.; Pateli, A. Information technology-enabled dynamic capabilities and their indirect effect on competitive performance: Findings from PLS-SEM and fsQCA. J. Bus. Res. 2017 , 70, 1–16. [Google Scholar] Bronzini, R.; Piselli, P. The impact of R&D subsidies on firm innovation. Res. Policy 2016 , 45, 442–457. [Google Scholar] Lokshin, B.; Mohnen, P. How effective are level-based R&D tax credits? Evidence from the Netherlands. Appl. Econ. 2012 , 44, 1527–1538. [Google Scholar] Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986 , 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed] Variable Type Variable Name Variable Symbol Definition Explained variable Total factor productivity TFP_LP Total factor productivity calculated using the LP method Mediator variable Enterprise green innovation GI Add 1 to the number of invention patents applied for by the enterprise in the current year, taking the natural logarithm. Explanatory variable Water resource tax reform TT Whether to carry out pilot water resource tax reform, represented by the dummy variable TT, TT it = Treated i × Time t Control variable Company profitability ROA Net profit margin on total assets Company growth Growth Total assets growth rate Financial leverage Lev Asset–liability ratio Independent director governance Id The proportion of independent directors to the size of the board of directors Director board size Bs Total number of directors in the board of directors Governance of major shareholders Msg Shareholding ratio of the largest shareholder CEO duality Pt The value of the general manager concurrently serving as the chairman is 1; otherwise, the value is 0. Managerial ownership MS Proportion of shares held by company executives Executive compensation MC The total monetary compensation of company executives is calculated as the natural logarithm. Product market competition HHI HHI = represents the size of the i-th enterprise, and represents the total market size. Digital transformation DT Data calculation of text mining based on digital lexicon Financial subsidy FS (Government subsidies—returns of various taxes and fees received)/total assets Tax incentives TI Returns of various taxes and fees received/total assets Industry Industry Industry dummy variable Year Year Year dummy variable Variable Mean Median Max Min SD Obs TFP_LP 10.9894 10.8418 14.7543 4.4336 1.2855 8949 GI 0.2082 0 6.6983 0 0.5843 8949 TT 0.1406 0 1 0 0.3476 8949 ROA 0.0410 0.0363 0.6271 -0.6449 0.0709 8949 Growth 0.1326 0.0780 19.0954 -0.8490 0.4286 8949 Lev 0.4453 0.4448 0.9970 0.0080 0.2014 8949 Id 0.3724 0.3333 0.8 0.1429 0.0555 8949 Msg 0.3661 0.3468 0.8999 0.0029 0.1559 8949 Pt 0.2206 0 1 0 0.4146 8949 Bs 8.9136 9 18 0 1.9163 8949 MS 0.0507 0.0001 0.7259 0 0.1216 8949 MC 14.7365 14.7958 18.5844 0 1.1287 8949 HHI 0.1248 0.1049 1 0.0144 0.1138 8949 DT 0.7037 0 5.0689 0 0.9758 8949 FS 0.0048 0.0023 0.4212 0 0.0166 8949 TI 0.0006 0 0.1132 0 0.0029 8949 Variable TFP_LP GI TT ROA Growth Lev Id TFP_LP 1 GI 0.3779 *** 1 TT 0.1292 *** 0.1051 *** 1 ROA 0.1375 *** −0.0017 0.0267 ** 1 Growth −0.0140 −0.0230 ** −0.0273 *** 0.1735 *** 1 Lev 0.3670 *** 0.1195 *** −0.0223 ** −0.3497 *** −0.0057 1 Id 0.0271 ** 0.0287 *** 0.0157 0.0080 0.0020 −0.0521 *** 1 Msg 0.3281 *** 0.1503 *** −0.0397 *** 0.1236 *** −0.0196 * 0.0588 *** 0.0551 *** Pt −0.1547 *** -0.0693 *** −0.0547 *** 0.0394 *** 0.0297 *** −0.1432 *** 0.1180 *** Bs 0.2549 *** 0.1430 *** −0.0026 0.0115 −0.0265 ** 0.2334 *** −0.6101 *** MS −0.1822 *** −0.0633 *** −0.0630 *** 0.1026 *** 0.0461 *** −0.2433 *** 0.1246 *** MC 0.3162 *** 0.1719 *** 0.1081 *** 0.1823 *** 0.0099 −0.0474 *** −0.0033 HHI −0.0911 *** −0.0116 −0.0868 *** −0.0891 *** −0.0326 ** 0.0177 0.0093 DT 0.0149 −0.0194 −0.0187 0.0144 −0.0061 0.0153 0.0114 FS −0.0365 ** −0.0599 *** 0.0175 0.0504 *** −0.0037 −0.0074 0.0189 TI 0.1645 *** 0.0590 *** 0.0335 ** −0.0261 * 0.0237 −0.0068 0.0956 *** Variable Msg Pt Bs MS MC HHI DT Msg 1 Pt 0.0518 *** 1 Bs 0.0806 *** −0.0755 *** 1 MS −0.3995 *** 0.0803 *** −0.1653 *** 1 MC 0.1003 *** −0.0647 *** 0.4409 *** −0.1910 *** 1 HHI 0.0408 *** −0.0296 *** 0.0534 *** 0.0688 *** 0.0514 *** 1 DT −0.0002 −0.0015 −0.0218 0.0446 *** −0.0390 *** 0.0148 1 FS 0.0458 *** 0.0380 *** −0.0441 *** 0.0432 *** 0.0369 ** −0.0513 *** −0.0015 TI 0.0331 ** 0.0629 *** −0.0717 *** 0.0654 *** 0.2166 *** 0.0732 *** −0.0077 Variable FS TI FS 1 TI 0.0358 ** 1 Variable Model (1) Model (2) Model (3) TT 0.1147 *** (4.49) 0.1029 *** (5.73) GI 0.3547 *** (24.29) ROA 3.4274 *** (27.16) −0.0214 (−0.24) 3.4413 *** (28.14) Growth −0.0775 *** (−4.15) −0.0189 (−1.44) −0.0716 *** (−3.96) Lev 1.6378 *** (35.40) 0.1726 *** (5.31) 1.5783 *** (35.14) Id 0.9539 *** (6.07) 0.6019 *** (5.45) 0.7413 *** (4.85) Msg 1.3241 *** (24.11) 0.4250 *** (11.02) 1.1692 *** (21.83) Pt −0.1292 *** (−6.06) −0.0361 ** (−2.41) −0.1197 *** (−5.80) Bs 0.0644 *** (12.99) 0.0365 *** (10.47) 0.0522 *** (10.80) MS −0.3707 *** (−4.95) −0.0710(−1.35) −0.3620 *** (−5.00) MC 0.2051 *** (26.57) 0.0594 *** (10.95) 0.1834 *** (24.36) HHI 0.1317 (0.83) 0.1510 (1.36) 0.0730 (0.48) DT 3.7172 (1.36) 2.1639 (1.13) 2.9031 (1.09) FS −3.6460 *** (−7.71) −0.4637 (−1.40) −3.4948 *** (−7.62) TI 0.1054 *** (11.16) 0.0069 (1.04) 0.1019 *** (11.14) Constant 2.8642 *** (19.23) −1.7303 *** (−16.54) 3.4882 *** (23.80) Year/industry Yes Yes Yes Adjust_R 2 0.4800 0.2191 0.5113 Obs 8949 8949 8949 Variable Model (1) Model (2) Model (3) TT 0.1147 *** (4.49) 0.1029 *** (5.73) GI 0.3547 *** (24.29) Control i,t Yes Yes Yes Constant 3.1830 *** (21.53) −1.6088 *** (−15.49) 3.7774 *** (26.05) Year/industry Yes Yes Yes Adjust_R 2 0.4639 0.2048 0.4966 Obs 8949 8949 8949 Variable Replacing the Explanatory Variables Replacing the Explained Variables Model (2) Model (3) Model (1) Model (3) TT 0.3387 *** (13.49) 0.0732 *** (3.83) GI′ 0.3135 *** (34.20) GI 0.1303 *** (10.57) Control i,t Yes Yes Yes Yes Constant −2.7356 *** (−17.19) 3.7379 *** (26.46) 0.9412 *** (7.77) 1.1697 *** (9.56) Year/industry Yes Yes Yes Yes Adjust_R 2 0.2442 0.5264 0.2499 0.2580 Obs 8949 8949 8949 8949 Column 1: TT → TFP_LP Weighted variable(s) Mean control Mean treated Diff. |t| Pr (|T| > |t|) TFP_OLS 8.275 8.458 0.182 5.63 0.0000 *** ROA 0.037 0.039 0.002 0.88 0.3773 Growth 0.145 0.150 0.005 0.32 0.7504 Lev 0.493 0.491 −0.002 0.33 0.7419 Id 0.364 0.364 0.000 0.13 0.8999 Msg 0.384 0.390 0.006 1.12 0.2642 Pt 0.117 0.112 −0.004 0.45 0.6532 Bs 9.415 9.429 0.013 0.20 0.8416 MS 0.023 0.024 0.001 0.38 0.7046 MC 14.402 14.427 0.025 0.56 0.5783 HHI 0.134 0.139 0.005 1.02 0.3087 TI 0.001 0.001 0.000 0.18 0.8593 FS 0.004 0.004 0.000 0.35 0.7250 DT 0.311 0.310 -0.001 0.06 0.9529 Column 2: TT → GI Weighted variable(s) Mean control Mean treated Diff. |t| Pr (|T| > |t|) GI 0.128 0.219 0.091 5.18 0.0000 *** ROA 0.037 0.039 0.002 0.88 0.3773 Growth 0.145 0.150 0.005 0.32 0.7504 Lev 0.493 0.491 −0.002 0.33 0.7419 Id 0.364 0.364 0.000 0.13 0.8999 Msg 0.384 0.390 0.006 1.12 0.2642 Pt 0.117 0.112 −0.004 0.45 0.6532 Bs 9.415 9.429 0.013 0.20 0.8416 MS 0.023 0.024 0.001 0.38 0.7046 MC 14.402 14.427 0.025 0.56 0.5783 HHI 0.134 0.139 0.005 1.02 0.3087 TI 0.001 0.001 0.000 0.18 0.8593 FS 0.004 0.004 0.000 0.35 0.7250 DT 0.311 0.310 −0.001 0.06 0.9529 Variable Path c (Model with dv Regressed on iv) Path a (Model with Mediator Regressed on iv) Paths b and c’ (Model with dv Regressed on Mediator and iv) TT 0.2412 *** (9.64) 0.1550 *** (9.02) 0.1847 *** (7.59) GI 0.3646 *** (24.44) Control i,t Yes Yes Yes Constant 2.4059 *** (17.11) −1.9716 *** (-20.42) 3.1247 *** (22.43) Year/industry Yes Yes Yes Adjust_R 2 0.3682 0.0903 0.4077 Obs 8949 8949 8949 Column 1: Sobel–Goodman Mediation Tests Est Std_err z P > |z| Sobel 0.057 0.007 8.463 0.000 Aroian 0.057 0.007 8.457 0.000 Goodman 0.057 0.007 8.469 0.000 Column 2: Indirect, Direct, and Total Effects Est Std_err z P > |z| a_coefficient 0.155 0.017 9.021 0.000 b_coefficient 0.365 0.015 24.441 0.000 Indirect_effect_aXb 0.057 0.007 8.463 0.000 Direct_effect_c’ 0.185 0.024 7.586 0.000 Total_effect_c 0.241 0.025 9.637 0.000 Proportion of total effect that is mediated: 0.234 Ratio of indirect to direct effect: 0.306 Ratio of total to direct effect: 1.306 Variable SOEs Non-SOEs Model (1) Model (2) Model (3) Model (1) Model (2) Model (3) TT 0.0484(1.17) 0.0615 * (1.88) 0.1149 *** (3.79) 0.0640 *** (3.73) GI 0.3704 *** (19.84) 0.1708 *** (6.63) Control i,t Yes Yes Yes Yes Yes Yes Constant 3.0283 *** (15.46) −2.0909 *** (−13.49) 3.8029 *** (19.88) 3.4272 *** (13.03) −0.6637 *** (−4.46) 3.5634 *** (13.57) Year/industry Yes Yes Yes Yes Yes Yes Adjust_R 2 0.5202 0.3210 0.5613 0.4537 0.0834 0.4571 Obs 4237 4237 4237 4712 4712 4712 Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. © 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/). Share and Cite MDPI and ACS Style

Xu, C.; Gao, Y.; Hua, W.; Feng, B.

Does the Water Resource Tax Reform Bring Positive Effects to Green Innovation and Productivity in High Water-Consuming Enterprises? Water 2024 , 16 , 725.

https://doi.org/10.3390/w16050725

AMA Style

Xu C, Gao Y, Hua W, Feng B.

Does the Water Resource Tax Reform Bring Positive Effects to Green Innovation and Productivity in High Water-Consuming Enterprises? Water . 2024; 16(5):725.

https://doi.org/10.3390/w16050725

Chicago/Turabian Style

Xu, Chaohui, Yingchao Gao, Wenwen Hua, and Bei Feng.

2024. “Does the Water Resource Tax Reform Bring Positive Effects to Green Innovation and Productivity in High Water-Consuming Enterprises?” Water 16, no. 5: 725.

https://doi.org/10.3390/w16050725