Drug prices and the innovation trade-off

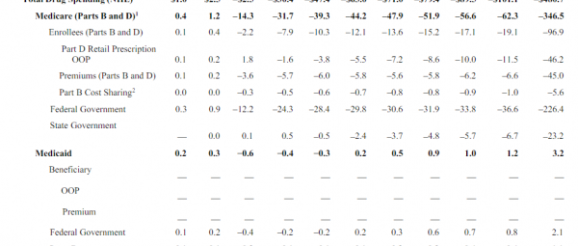

The Congressional Budget Office released a partial analysis of HR3, the House drug pricing bill. The headline numbers are big:

$480 billion dollars in lower drug spending over a decade is real money even in the context of federal health care spending.

However there is an innovation/introduction of new treatment cost:

its preliminary estimate is that a reduction in revenues of $0.5 trillion to $1 trillion would lead to a reduction of approximately 8 to 15 new drugs coming to market over the next 10 years. (The Food and Drug Administration approves, on average, about 30 new drugs annually, suggesting that about 300 drugs might be approved over the next 10 years.) The overall effect on the health of families in the United States that would stem from increased use of prescription drugs but decreased availability of new drugs is unclear.

This is the trade-off that economists worry about. What is the loss in innovation for cost savings?

The CBO does not project what type of new drugs that would have been produced won’t be produced. If those never approved counter-factual drugs are merely drugs that “cure” bushy eyebrows or are the seventeenth and eighteenth variants of a general use class of medications that have no specific targeting features, the loss of innovation is fairly low. If the lost counter-factual drugs are something that has the same impact as the (expensive) Hep-C cures, then the loss of innovation is significant.

There are very few free lunches. Almost everything has trade-offs. If we can get some more information on what types of drugs would not be developed/approved, that would be extremely valuable. Without that information, we instead need to assess best case, probable case and worse case scenarios to decide what types of trade-offs are acceptable for spending less on pharmacy. Half a trillion dollars over a decade is a real benefit, so figuring out what the costs are likely to be is a critical step to determine if that benefit is good enough.