FinTech NGR and Huawei Cloud unveils Fintech Cloud adoption whitepaper to empower the future of financial innovation

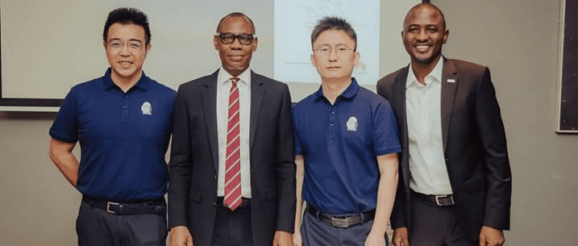

FinTech NGR and Huawei Cloud came together on a momentous occasion on May 26th to release the highly anticipated Nigerian FinTech Cloud Adoption White Paper at the Radisson BLU Hotel in Lagos. The launch event, attended by key industry leaders and executives, marked a significant milestone in the evolution of the Nigerian FinTech industry.

FinTech (Financial Technology), refers to the innovative application of technology in the financial services sector. It encompasses a broad range of digital solutions and services that aim to enhance and revolutionize traditional financial processes. Through the use of advanced technologies such as cloud computing, artificial intelligence, blockchain, and mobile applications, FinTech companies offer faster, more convenient, and user-centric financial services to individuals and businesses.

With Nigeria’s FinTech sector rapidly maturing into a major player in Africa, the release of the white paper highlights the growing international recognition and consumer acceptance of Nigerian FinTech solutions. The collaboration between FinTech NGR, the premier national FinTech Association in Africa, and Huawei Cloud, a leading global provider of information and communications technology (ICT) infrastructure and smart devices, aims to foster stronger synergies between FinTech startups and established enterprises, providing a platform for accelerated growth and innovation.

The ongoing COVID-19 pandemic, which has significantly impacted the Nigerian economy, presents a unique opportunity for FinTech to contribute to economic recovery and development. To realize this potential, it is crucial for entrepreneurs to scale up their operations, enhance their value propositions, and tap into the immense FinTech opportunities that Nigeria offers.

The Nigerian FinTech Cloud Adoption White Paper examines six broad segments within the industry: payments, mobile money, and digital banking; lending; savings, investment, and crowdfunding; enterprise services and infrastructure; cryptocurrency; and InsurTech. With its focus on innovation, efficiency, security, and reliability, FinTech embraces cloud-based infrastructure as a key enabler for achieving these goals.

Cloud computing plays a critical role in the future of FinTech in Nigeria. However, several challenges impede the rapid adoption of cloud services in the industry. These challenges include complex and outdated approval processes, data retention and security concerns, fierce competition, security risks due to fast development, external attacks stemming from big data channels, and difficulties with data isolation.

To address these challenges, the Nigerian FinTech’s Cloud Adoption White Paper emphasizes the importance of considering four key aspects of cloud adoption within the industry:

- Regulatory Compliance: The white paper provides insights into how Nigerian FinTech enterprises on Huawei Cloud comply with international and local laws and regulations, ensuring regulatory requirements are met.

- Cloud Security: Huawei Cloud presents a comprehensive security framework and success cases, assuring FinTech enterprises of robust security measures necessary for cloud migration.

- Cloud Native Infrastructure: The white paper emphasizes the significance of a cloud-native infrastructure and distributed FinTech architecture for successful digital and cloud transformation within the industry.

- Operational Costs: The management framework outlined in the white paper offers decision-makers in FinTech enterprises a thorough analysis of cloud operational costs based on a cloud architecture.

The Nigerian FinTech’s Cloud Adoption White Paper serves as a comprehensive analysis of the current state, requirements, and challenges of the FinTech industry in Nigeria, providing practical solutions through cloudification. By offering a cloud adoption framework, the white paper assists small- and medium-sized enterprises in migrating to, utilizing, and managing the cloud effectively, thereby facilitating accelerated cloud-based transformation within the FinTech sector. Its ultimate goal is to provide the fintech industry with cloud-based concepts, methods, systems, and best practices.

“Fintech NGR and Huawei Cloud jointly promote FinTech development and help Nigeria’s FinTech ecosystem through a white paper.” Emphasizing that the Cloud white paper involves a lot of efforts by the two parties, Lanre Oladimeji, the Group Head from Zenith Bank, declared that this launch which contributes to financial development in Nigeria deserves to be appreciated.

Also, Seun Folorunso (the Manager from FinTech NGR), Hugo Hu (the MD from Huawei Cloud), Paul Adigu (the Vice-President from Huawei Cloud), Henry from Fairmoney, David Isiawe from EcoBank, Wale Adewunmi from Lead Capital, Oyinye Okafor from UUBO, Yemi Keri from Herkerbella, Akkem Lawal from Intersweitch, Chika Nwogu from Palmpay, and Sogbetun from Flutterwave attended the launch event.

About FinTechNGR

The FinTech Association of Nigeria (FintechNGR) is the premier national FinTech Association in Africa. As a self-regulatory, not-for-profit, and non-political organization, FintechNGR envisions making Nigeria one of the world’s leading markets for FinTech innovation and investment. Its mission is to foster an ecosystem that supports all stakeholders in achieving a thriving and growing Nigerian FinTech industry. Governed by a Board of Trustees and a Governing Council comprising professionals of impeccable character, FintechNGR works towards creating a conducive environment for FinTech startups, established enterprises, investors, regulators, and other stakeholders to collaborate and drive innovation in the financial services sector.

About Huawei Cloud

Huawei, founded in 1987, is a leading global provider of information and communications technology (ICT) infrastructure and smart devices. In 2017, Huawei officially launched Huawei Cloud, its cloud services brand, which opens Huawei’s more than 30 years of technical prowess and product solutions in ICT to customers. Through Infrastructure as a Service, Technology as a Service, and Expertise as a Service, Huawei Cloud provides Everything as a Service to deliver reliable, secure, trustworthy, and sustainable cloud services for customers, partners, and developers. With a strong focus on innovation and technological advancement, Huawei Cloud is at the forefront of empowering industries, including the FinTech sector, to embrace cloud-based solutions and drive digital transformation.