Global Health Innovation Funding Hits $16B Despite Market Recalibration | by StartUp Health | Jul, 2022 | StartUp Health

Global Health Innovation Funding Hits $16B Despite Market Recalibration

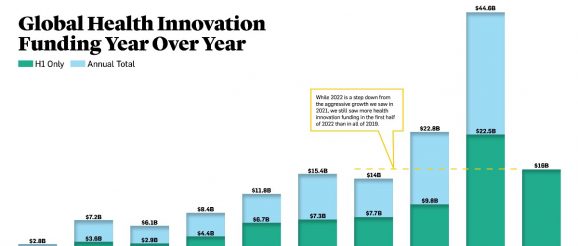

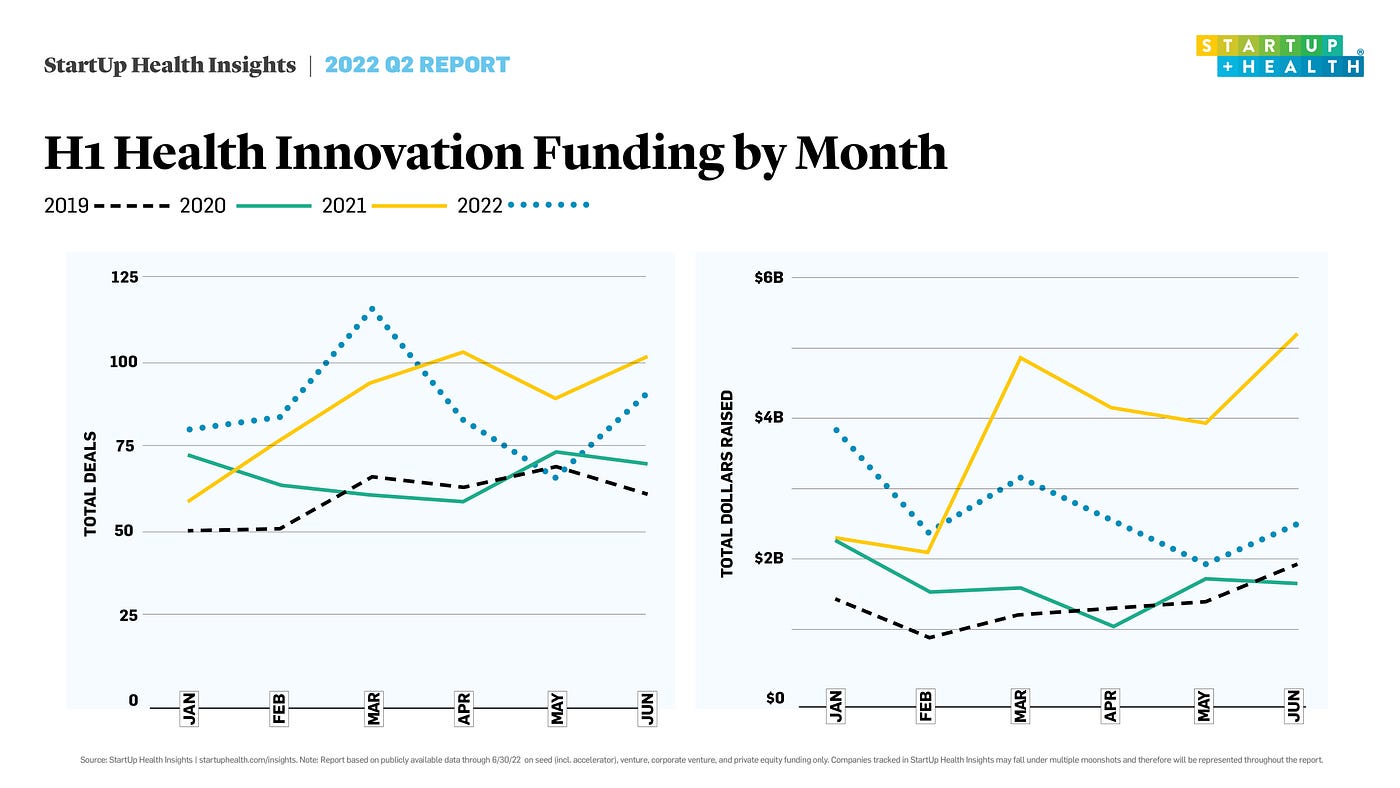

In the first half of 2022 StartUp Health tracked $16B in global health innovation funding, a 63% increase over H1 2020 and more than was raised in all of 2019. Funding is down compared to the unique exuberance of 2021, but a multi-year, health moonshot view shows a strong growth trajectory for the sector.

Every quarter for the last ten years StartUp Health has paused to consider the funding landscape within the world of global health innovation. For the first few years of these reports — call it phase one — the story was consistent. We saw steady growth in funding every year, but the market didn’t grow at the rate that we knew it could. Or should.

Then in 2020 COVID-19 happened. It forced us to isolate, which in turn forced us to learn new tools for managing a virtual life. Tools like telemedicine and remote patient monitoring. The pandemic also helped to open up regulations around reimbursement, making virtual health more profitable. What followed was a two-year period of funding exuberance. Annual funding totals in health tech went from single digit to double digit growth. We might call this phase two.

We may be entering a new phase of health innovation investing. In the first quarter of 2022 we saw funding totals cool considerably when compared to 2021. In Q2 2022 we tracked $6.75B in funding, just half of the $13.3B raised in the second quarter of 2022. Taken together, the first half of 2022 has seen $16B raised, compared with $22.5B over the same period last year. On top of this downswing, we haven’t seen any health innovation IPOs and SPACs in 2022, compared with 26 in 2021.

The billion-dollar question is whether this slowdown in the funding growth curve is evidence of more serious problems on the horizon, ripples from a macro economic slowdown that are soon to turn into six-foot waves. Or, is this simply a necessary rebalancing taking place after a frothy couple years. While this quarter did give us some important signals, it’s still too soon to answer that question.

In spite of the uncertainty, here are a few things we do know.

While 2022 is tracking below 2021 for global health innovation funding, it represents a significant step up in funding from 2020 (a 63% increase in H1 YoY). We also saw more funding in the first half of 2022 than we did in all of 2019. This means that a one-year loss still represents significant growth when viewed on a five-year window.

We also know there is significant dry powder in the market that needs to be deployed. By our count, in the second quarter of 2022 alone, there were 93 new funds created, totaling $114B. That’s significantly more funding than was raised by investors in Q1 of this year ($77B) and Q4 of 2021 ($83B).

Median deal size has slipped from $16M in 2021 to $15M for the first half of 2022. Keeping with the quarter’s theme, that $15M represents a significant increase from the $10M median deal size in 2020. In other words, median deal size is down year over year but indicates a strong 10-year growth curve.

At 238 total deals, Q2 is down year over year, but on par with the last decade in terms of investment activity. Over the last ten years we’ve marked only slow growth in total deal activity as compared to the dollars raised, suggesting an increased interest in larger, more mature funding rounds.

Each quarter we identify the largest health innovation deals inside and outside the United States. The largest deal of the quarter was a $600M raise by Ultima Genomics. This raise was outsized for the quarter, fully twice the amount raised by the next biggest deal for Q2, a $300M round by Biofourmis.

“The huge $600M deal by Ultima Genomics shows that health tech space generally and genomics specifically are alive and well as we witness a new record-breaking raise from some of the top VCs,” says Islam Mansour, CEO and Co-founder of MyGenoMD, which StartUp Health backed in 2021. “What is particularly interesting is the interest of tech giants in genomics as Google is partnering with Ultima to provide AI infrastructure for more powerful and cheaper sequencing. All of that could lead to the proliferation of clinical applications of genomic medicine that patients can afford.”

On the Front Lines of Fundraising

Using yesterday’s funding numbers to predict future trends is always going to be problematic. So this quarter, instead of putting one more speculation into the market, we decided to turn to our global community of entrepreneurs — our Health Transformers — and gather real stories of how the rocky public markets and gloomy economic forecasts are impacting real fundraising efforts.

We asked 85 founders who had attempted to raise some level of funding in 2022 to share their experiences in a survey. Respondents covered the gamut of health moonshots, from children’s health to ending cancer, and worked on three continents. While more than a dozen Health Transformers successfully raised funds in 2022 – including a $15M Series A for Us2.ai and a $77M round for Cala Health – many respondents reported facing a tougher funding market in 2022. Founders described those challenges as everything from “generally tougher” to “ice cold.”

“The investment landscape has changed dramatically from the frenzy of 2021 where there was great interest in any virtual solution to be bolted onto existing in-person care,” writes Howard Rosen, CEO and Founder of LifeWire. “With the essential failure of many of these one-off investments, investors are looking for more comprehensive solutions incorporating different successful, proven, revenue-generating technology.”

Many founders agreed with Rosen that while fundraising has undoubtedly tightened, the more significant trend is a change in investor priorities.

“I have been actively approached by a number of investors who are looking for profitable businesses, rather than growth,” says Victor Penev, CEO and Founder of Edamam. Dr. Alexandra Greenhill, CEO and Co-founder of Careteam Technologies, agreed, saying, “I expect the bar on revenue and future growth to be higher.”

For a couple founders in our survey, the tightening of the public markets has resulted in a greater appetite for acquisitions compared to straight investment rounds.

“It is difficult to raise capital, yet I receive at least four offers every other week for acquisition of the company,” says Chrissa McFarlane, CEO and Founder of Patientory.

Founders outside the United States cited similar challenges and shifts in investor priorities.

“Investors in Latin America are wary, looking for more validation and traction than before,” says Luis Santiago, CEO and Co-founder of Pegasi. “They’re also more inclined to debate valuation than to accept proposed projections at face value.”

“There is a tremendous hesitancy [to invest], especially in a market like Africa,” says Ismail Badjie, CEO and Co-founder of Innovarx Global. “Raising funds has typically been harder with most firms not even having a mandate to invest in Africa. Despite all our traction it’s just as hard raising funds today than it was at the ideation stage.”

Despite the obvious challenges, some founders remain bullish, finding opportunity in the turbulence.

“We are in a good moment in healthcare, where the needs are greater than ever and now, in the post-COVID period, it’s easier to get ahold of our customers and prospects, so sales are growing,” says Dr. Alexandra Greenhill, CEO and Co-founder of Careteam. “The most frequent quote I hear in meetings with investors right now is ‘we all know the great companies are built in market downtowns so we are excited to meet you’!”

Joseph Schneier, CEO and Founder of Trusty.care, agreed, writing that while raising capital is hard for everyone right now, the inbound requests keep coming. “People are still deploying capital. Keep your valuation reasonable, hit your milestones, and likely you will be able to raise. Money is still out there, even if it is harder to find.”

Health Moonshot Perspectives

As negative headlines about the public markets emerged this spring, VC firms came out with their suggestions for how startups can thrive — or merely stay alive — for the next 18–24 months. While many of these slide decks and resources are great reading, we have a slightly different philosophy at StartUp Health. With that in mind, we gathered dozens of founders from the StartUp Health portfolio for a call led by StartUp Health co-founders Steven Krein and Unity Stoakes. The goal was to empower Health Transformers with the mindsets needed to thrive during any market conditions. These aren’t strategies for lowering expenses — though that is sometimes needed — but rather ways of thinking during downturns that will prepare you for success at every stage. Here are a few highlights excerpted from that discussion.

“I’ve had the chance to talk to so many Health Transformers at so many stages, and what is so fascinating is that some people are concerned about fundraising while others have just completed their raise and are faced by a unique set of challenges,” says Steven Krein, StartUp Health’s CEO and co-founder. “Others are experiencing global implications of our financial crisis. The key then, and where StartUp Health focuses, is on teaching principles that elevate a startup no matter the moment.”

For some founders on the call, the global economic crisis resulted in workforce challenges while for others it manifested itself in sales and marketing. The key, said Krein, isn’t the specific tactical hurdle, but rather developing a mindset of recalibration that allows you to regularly assess what’s working and what isn’t, and then play to your unique abilities.

“It comes down to focus, to always having on the front of your mind and on the tip of your tongue the list of top items you need to do to accomplish your top three objectives right now,” says Krein. “It also comes back to mission. If you’re on mission, if you’re thinking long-term, and you’re able to control — with clarity — your list of challenges, opportunities, and strengths, you’ll always be able to get back into the right zone.”

“It might sound simple, but during challenging times, so much comes down to being able to clearly articulate what you’re concerned about, what you’re excited about and what you’re confident about,” says Krein. “You need to be able to articulate the three components of your game plan for achieving your health moonshot. What’s unique about this moment in time is that there’s an opportunity to separate the signal from the noise.”

“It also comes down to communication and reach. Once you can clearly articulate your mission, your capabilities, your opportunities, etc., you need to make sure you’re out there, telling that story to your investors, partners, and customers, helping them understand how you’re going to deal with today’s economic challenges. And this isn’t the same narrative you’ve always told them. It has to be tuned to the times at hand. Make sure you’re keeping everyone up to date. These principles are true whether you’re raising funds, making sales, or building partnerships. Nobody wants to hear how overwhelmed you are or how depressed you are. They want to hear your plan of action. That will be much appreciated by everyone in your orbit.”

“Whether times are good or challenging, mission transcends,” added Unity Stoakes, StartUp Health’s President and Co-founder. “If you have your mission as a guiding light, and then you have systems and support structures around you to continually recalibrate, preferably at least quarterly, and you tie it to action, you can lean into dynamic, challenging moments. I’ve seen so many Health Transformers do this and come out the other side of challenging times thriving in very significant ways. There are so many great examples of great companies emerging out of challenging economic times. Those that focus on mission and recalibration and action really use these times as their biggest opportunities.”

“The opportunity right now is to be a bright spot in an otherwise turbulent world,” says Edwards. “Your mission has the power to inspire, and the opportunity now during difficult times is to actually reach out and talk to people, build relationships on the basis of our shared humanity, and leave people in those conversations better off than they were before. That’s what builds relationships and builds companies. People remember that. You have the opportunity to go out and make people feel great about what you’re doing.”

There are no shortage of tactical lists for startups — decks offering 50 pages of strategies for surviving market downturns. But at StartUp Health we lean into focus and clarity, finding the two or three strategies that fit with your mission and will move the needle this week. Then we roll up our sleeves and get after it.