Integra to buy Surgical Innovation Associates for $50M in bid to lead growing breast reconstruction niche | MedTech Dive

Dive Brief:

Dive Insight:

Integra suffered a setback late last year when a Food and Drug Administration advisory committee voted against the approval of SurgiMend. The company is continuing to try to get the device to market, with management targeting a mid-2023 amendment submission and approval in sub-pectoral IBBR in 2024.

That timeline would put Integra on track to be the first company to receive pre-market approval for an IBBR surgical matrix. Surgical Innovation is enrolling patients in a U.S. soft tissue support IBBR trial in hopes that it could become the second firm to win approval in 2025 or 2026 for sub-pectoral and pre-pectoral IBBR.

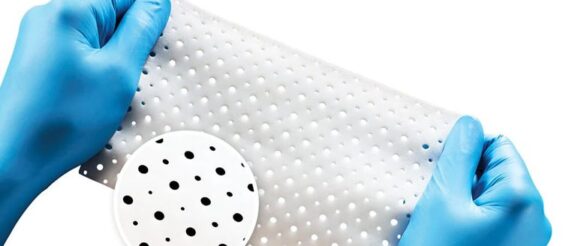

According to Integra, resorbable synthetic mesh and xenograft products accounted for 5% of U.S. breast reconstruction volumes last year. While the products are a small part of the market, which Integra values at $600 million globally, the company said the shift to hospital outpatient procedures, the limited sizes, inconsistent quality and supply of human matrices, and U.S. regulations are disrupting the sector.

“The global breast reconstruction market represents an attractive growth opportunity for our surgical reconstruction business. By offering two distinct product solutions, SurgiMend and DuraSorb, to plastic and reconstructive surgeons, we aim to address various clinical, contracting, and economic needs across different sites of care,” Integra’s president of tissue technologies, Robert Davis Jr., said in a statement.

The agreement includes up to $90 million in milestone payments. Integra expects its return on invested capital to exceed 10% by 2027, reflecting a belief that SurgiMend and DuraSorb will represent a $200 million annual sales opportunity by 2030.

Integra said it aims to offset the impact that the acquisition will have on earnings with a share repurchase program of up to $150 million next year.