Intel Selling One Of Its Six Pillars Of Innovation: A Losing Strategy (NASDAQ:INTC) | Seeking Alpha

On October 19, WSJ reported that Intel (INTC) was close to offering its 3D NAND unit for $10B, which Intel subsequently formally revealed: a $9B handle two parts. The first $7B phase will close by late 2021, while the 2nd $2B phase will just close in 2025 due to arrangements with former JV partner Micron (MU).

In short, while in the last couple of years I have primarily authorized Intel’s method, this latest relocation seems an action in the incorrect instructions (even though numerous experts were supportive of the sale).

Architecture Day

Just a couple of months back, Intel held its Architecture Day occasion. As somebody had actually remarked at the time, it was among the couple of occasions where a 233 slide discussion still seemed like it was hardly scratching the surface area: the event went into all of Intel’s 6 engineering pillars of semiconductor innovation, consisting of:

Clearly, no other company has such a broad computing and semiconductor portfolio. Nevertheless, a number of other companies in current times have actually similarly broadened their portfolios:

3D NAND

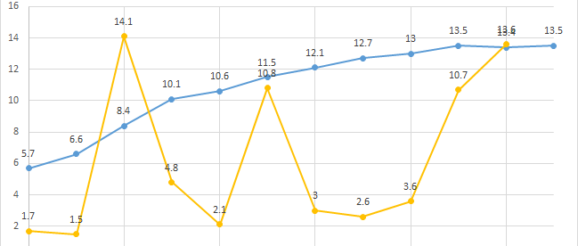

With the most recent news, Intel is doing the opposite as its competitors. By shedding its 3D NAND system, it would lose a service that (1) was a core part of its diversified development strategy, and (2) had actually been growing at a double-digit rate through the years.

Intel’s innovation is likewise distinguished and (near to) industry-leading: Intel is moving to 144-layer 3D NAND by the end of 2020, ahead of the industry target of 128 layers. It utilizes floating-gate technology instead of a lot of others’ charge trap innovation. This innovation allowed Intel/Micron to be the very first adopters of CMOS-under-the-Array (CuA), which (as the name implies) further enhances density.

While many call NAND a commodity, there are genuine methods to distinguish: simply like transistor density on the logic side, providing a higher bit density likewise provides one with a competitive advantage.

Efficiently, Intel is selling one of its six pillars of development, undoing financial investments that began in 2016 in the China Dalian fab. This hence means a turnaround in method.

On the Q3 revenues call, Intel stated the sale to SK Hynix would allow the latter to further scale the service. So here, Intel is on the opposite of consolidation that it has actually seen in its core reasoning business through its history (for instance, Worldwide Foundries a few years ago revealing it would not pursue the 7nm node).

Strategy, gross margins and profitability

The factor for the sale is rather clear, and the sale itself is not a surprise. For a long time currently (a minimum of because its Might 2019 Investor Meeting), perhaps to some degree pressured by analysts, Intel had actually suggested it was open to collaborations with regards to its 3D NAND service to enhance its profitability: with decreasing ASPs in late 2018 and 2019, business became unprofitable.

It ought to be noted that this sale would nonetheless be a reversal in strategy from Intel and Bob Swan. In the past, Swan’s position was that while dilutive to the business’s business gross margin, similar to its modem company, for example, it was however accretive to absolute gross margin dollars and profits.

In addition, Intel’s general technique is to play a larger role in its customers’ success, by increasing its addressable market (TAM). So likewise from that view, selling the 3D NAND unit appears like an action back in Intel’s capability to provide a complete portfolio.

Still, Intel’s memory company includes both 3D NAND and 3D XPoint, so the declaration that Intel is losing one of its 6 pillars is not rather right. Intel is selling what is really the most lucrative part of its memory company: 3D XPoint most likely continues to be unprofitable at the early phases of its ramp and provided its even smaller volume/scale.

To that end, Intel kept in mind that in H1’20, 3D NAND produced $2.8 B in revenue and $0.6 B in operating income. A quick check reveals that NSG (as a whole) created $3.0 B in earnings and $0.3 B in operating income through this period. This suggests Intel offered $0.2 B worth of Optane SSDs in H1 at an operating loss of $0.3 B.

2 of Intel’s three huge bets have actually failed

As said above, while others are broadening their markets, Intel is divesting in addition to investing.

Recent financial investments (considering that 2019) include Moovit, Habana and Barefoot Networks. Even earlier ones are Mobileye, Movidius, Altera, Nervana, Easic, NetSpeed, and so on

. So while Intel has actually been adding some crucial organizations, the divestments are simply as large:

In fact, at its May 2019 investor conference, Intel laid out modems, 3D NAND and Mobileye as its 3 huge bets. I have tracked Mobileye’s development in multiple posts, but with the 3D NAND sale, Intel is now offering the second of its 3 big bets. That seems like a failed scorecard.

Bob Swan

Financiers typically indicate Bob Swan, given his non-engineering background, and some called this sale monetary engineering. However, I reviewed his efficiency early this year, and the conclusion was mainly neutral: INTC).

Still, as largest criticism, considering that his appointment as CFO in late 2016, Swan has possibly too heavily concentrated on minimizing non-core spending. At the 2017 Investor Satisfying, he revealed an initiative to decrease costs from 36% to 30% of earnings, followed by a further drive to 25%, revealed at the 2019 Investor Meeting.

As a result, R&D has actually seen nearly no net development, for instance, while the quantity invested on buybacks has actually increased significantly.

Perhaps this has actually led to decisions such as the NAND sale, to divest what was in fact among Intel’s main service units.

Optane production?

The sale also raises some questions about Intel’s 3D XPoint (Optane) production: Intel explicitly said it would keep the Optane service, given the more separated nature of this technology.

Intel presently sources its Optane from Micron, through a supply arrangement as part of the closing of the JV in late 2019. In the past, Intel had indicated that its Dalian fab could produce both Optane and 3D NAND. That obviously won’t be possible any longer.

Optane is still little (as suggested above), but its more disruptive kind aspect (DIMMs instead of SSDs) just launched in 2019 and Intel only anticipates a more comprehensive ramp in 2021 and beyond. Likely at some point Intel would have to construct its own capability.

The sale is not a surprise. Intel had actually recommended multiple times that it was open to 3D NAND collaborations. (For example, a China collaboration was once rumored.) Instead, Intel winds up offering the unit altogether.

This does not appear to be the ideal method. I have actually previously defined Intel as a semiconductor corporation, with a portfolio spanning all elements of computing. It is the only company with all 6 pillars of computing development.

Instead, Intel is now efficiently divesting among those 6 pillars, in spite of having differentiated 3D NAND properties. This also comes at a time when competitors are broadening their portfolios. To be sure, Intel is also investing with its Xe GPUs, Mobileye robotaxis and Habana NPUs amongst others, but it has also built a performance history of offering non-core service units. It is the second of Intel’s three ‘big bets’ that is being sold.

In that sense, while Intel promoted that it can now focus more broadly on its core businesses, NAND really was a core part of Intel’s method to become a data-centric company. This marks a turnaround in strategy.

Financially, Intel will be getting $9B for this organization. Previously this year, as an action to COVID-19, Intel had actually strengthened its balance sheet with $10B in financial obligation, while suspending its $20B buyback program. Intel has considering that renewed the buyback in the wake of the Q2 stock drop with an accelerated $10B buyback.

While Intel has the free capital to do buybacks, pay dividends and buy its company (capex and R&D) all at once, one might maybe state this $9B sale is really funding the $10B accelerated buyback. Also that would mark a turnaround in strategy, as formerly purchasing business had been Intel’s first priority.

Disclosure: I am/we are long INTC. I wrote this post myself, and it expresses my own opinions. I am not receiving payment for it (aside from Looking For Alpha). I have no business relationship with any company whose stock is mentioned in this post.