Invest In The Disruptive Innovation Future With ARK Innovation ETF (NYSEARCA:ARKK) | Seeking Alpha

ARK was founded in 2014 by Cathie Woods who acts as the CEO, CIO, and Portfolio Manager for their many funds. They invest in companies in the “disruptive innovation” space which they define as the “introduction of a technologically enabled new product or service that potentially changes the way the world works”.

Their main ETF is the ARK Innovation ETF (NYSEARCA:ARKK) which holds their preferred disruptive innovation companies across multiple sectors. They also offer specific sector disruptive innovation ETFs, ARK Autonomous Technology & Robotics ETF (BATS:ARKQ), ARK Next Generation Internet ETF (NYSEARCA:ARKW), ARK Genomic Revolution ETF (BATS:ARKG), and ARK Fintech Innovation ETF (NYSEARCA:ARKF). ARKK is a general selection across all four of these sectors.

Radical Transparency, Education, and Analysis

From their investor FAQ (which I highly recommend as a starting point to learn more about them and their funds), ARK describes how technological innovation blurs the lines between sectors and how traditional research is not sufficient.

Throughout her career, Cathie’s focus on innovation led her to recognize that technology increasingly is blurring the lines between and among sectors. As a result, she believes the traditional research world is not set up to follow innovative companies.

By researching across sectors, industries and markets, ARK seeks to identify companies that are leading and benefiting from cross-sector innovations such as robotics, energy storage, DNA sequencing, artificial intelligence, and blockchain technology

Additionally, ARK uses an “Open Research Ecosystem” which enables them to more perform better analysis on a quickly changing industry by speaking directly to thought leaders in the field and also crowd-sourcing insights via social media interactions.

ARK’s Open Research Ecosystem seeks to capitalize on rapid change through an open approach and the convergence of insights. ARK believes that a combination of top-down and bottom-up research allows us to size the investment opportunity of disruptive innovation, and then detect and evaluate companies best positioned to benefit.

To gain a deeper understanding of quickly changing themes, ARK employs an open research strategy to gather information, both helping to define and refine its internal research process. Inputs include Theme Developers, who are thought leaders in their fields, social media interactions, and crowd-sourced insights as people respond to ARK’s public research.

By applying technological concepts and external inputs to traditional approaches, ARK seeks to create a more transparent, creative, and interdisciplinary investment process.

This radical openness is something that is rare to find for most funds and investment companies as they prefer to keep their “secret sauce” private as to not give competitors an advantage.

I personally subscribe to their YouTube channel which contains uploads all of their podcasts with Woods herself, her analysts, and also interviews with leaders in the technology industry. It is a great way to get a deep dive into ARK’s investment thesis, thought processes and valuations, and also more industry perspectives. I recommend starting with their introduction video, and then, this interview with Woods that gives a more detailed overview of her and ARK’s thought processes.

ARK Innovation ETF

ARKK typically comprises between 35 and 55 different companies at a time and is actively managed, which means its holdings will often change. The average annual name turnover in ARK ETFs is 15%. ARKK even had a period with 70% turnover. This is common for actively managed ETFs and shows that ARK is diligently monitoring its holdings to ensure that its portfolio is balanced and not over or underexposed to certain holdings.

One example of ARK’s diligence and restraint is when it sold off some of Tesla (NASDAQ:TSLA), its largest holding, to ensure their funds were not overexposed during Tesla’s meteoric rise. This shows that ARK does not simply invest based on momentum or hype and considers valuation and exposure.

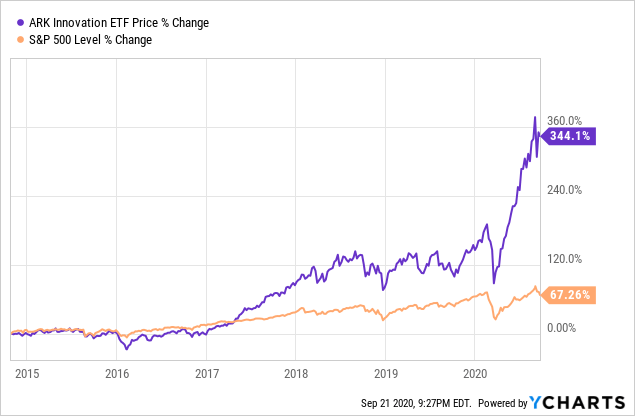

ARKK has a 0.75% expense ratio, which is pricey, but considering all of the research and active management that goes into the fund, it is well worth the price and typical of actively managed funds. Additionally, ARKK’s performance since inception, which includes the expense, has crushed the S&P 500 performance, even prior to the 2020 tech stock rise due to the pandemic.

Data by YCharts

Data by YCharts

| Company (Ticker) | Weight % | Forward P/E Ratio |

| Tesla (TSLA) | 10.74% | 240.60 |

| Invitae Corp. (NYSE:NVTA) | 8.78% | N/A |

|

Square Inc. (NYSE:SQ) |

6.20% | 257.75 |

| Roku Inc. (NASDAQ:ROKU) | 5.53% | N/A |

| CRISPR Therapeutics AG (NASDAQ:CRSP) | 5.03% | 271.85 |

| Proto Labs Inc. (NYSE:PRLB) | 3.66% | 62.71 |

| Zillow Group (NASDAQ:Z) | 3.39% | N/A |

| 2U Inc. (NASDAQ:TWOU) | 3.13% | N/A |

| LendingTree Inc. (NASDAQ:TREE) | 2.86% | 166.53 |

| Slack Technologies Inc. (NYSE:WORK) | 2.84% | N/A |

| Total/Average | 52.16% (Total) | 199.88 (Average) |

Square Inc. (NYSE:SQ)

Source: ARK, Forward P/E Ratio from Seeking Alpha, as of 9/21/2020

ARKK’s top 10 holdings as of the publication of this article are split amongst several different sectors and comprise over half of the total weight of the fund. These are the companies that ARK believes to be leaders in disruptive innovation across its four target sectors. Interestingly, half of the companies here are not currently profitable, and the other half have incredibly high forward P/E ratios. The average of the profitable companies is nearly 200x, which is more nearly 10x higher than the S&P 500 (25x) and NASDAQ-100 (31x) currently.

However, Woods has made it clear on multiple occasions that current profitability or valuation is not a criterion when evaluating disruptive innovation. She believes that you must look far into the future, if and when the company has successfully disrupted and dominated across multiple sectors. Her prime example is Amazon (AMZN), which she mentions in a 2020 Big Ideas video. When she invested in them while at a company prior to ARK, many people doubted Amazon’s ability to grow and lambasted its high P/E ratio. Woods, however, saw that, on a discounted cash flow model on future revenues and earnings, Amazon was actually an incredible deal. When she invested in them, their market cap was about 5 billion. Now, it is over a trillion.

As stated in their FAQ, ARK looks at a long timeframe which gives their companies enough time to complete their disruption and achieve their expectations. They recommend investors invest for at least one market cycle (7 years).

Additionally, ARK only departs from a specific holding if they no longer believe the company will be able to successfully disrupt and innovate across multiple sectors or if there are higher upside opportunities. This helps them manage the risk of companies not performing to expectations by continually monitoring their progress in innovation.

I currently do not have a position with ARKK but intend to initiate one in the near future. I strongly agree with them that the greatest returns on investments in the future will come from companies with the greatest innovations. I also strongly believe, based on evidence from all of ARK’s freely available content on their investments, that ARK will be able to pick and management the best investments over time in this highly volatile and ever-changing environment. That makes the expense ratio worth it to me.

ARKK presents a high risk, high reward opportunity to trust your money with a trustworthy and forward-thinking group of people. Before investing with ARK, I highly recommend you get to know the people behind the scenes and only continue to invest if you believe in their analysis and viewpoints. Do not invest with them if you have a short time horizon or are risk-averse as the high P/E ratios are only justified if the companies ARK invests in actually perform to their expectations, which is the fund’s largest risk factor.

I also recommend continually keeping up with the top holdings of ARKK as well as ARK’s podcasts presenting their investment thesis and research. This is to ensure that your views are generally aligned with ARK and, if that is no longer is the case, begin to reduce your holdings with ARK.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ARKK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial advisor. All recommendations here are purely my own opinion and is intended for a general audience. Please perform your own due diligence and research for your specific financial circumstances before making an investment decision.