Kyber Reserve Innovation Program: New Liquidity Models For DeFi

In this post we will explain Kyber Network’s flexible reserve system and share how DeFi developers can create new reserve models to be deployed on the network to provide liquidity for a wide range of unique use cases.

In order to enhance liquidity and capture greater value, it is imperative that the DeFi space is able to create new liquidity systems catered to different needs, and we believe that there is huge potential for Kyber to be the cradle for liquidity innovation.

To encourage liquidity innovation for DeFi, Kyber will be launching a Reserve Innovation Program, with up to $100,000 in total grants for selected projects. We are looking for talented developers who are interested in liquidity innovation beyond the current Automated Market Maker (AMM) landscape.

Kyber’s Reserve System Overview

Reserves are liquidity sources in Kyber Network that provide liquidity in terms of token inventory and prices on their smart contracts. Once a reserve is deployed to mainnet, it then needs to be added to the network by the KyberDAO. When a taker requests a trade, the protocol will scan the entire network to find the reserve with the best price and take liquidity from that particular reserve.

Reserve Models

Reserve models are unique smart contracts which can be deployed and added to the Kyber Network, catering to specific DeFi liquidity provision use cases. Once deployed and added, the liquidity the reserve provides is accessible to all the 100+ DApps integrated with Kyber.

Kyber has a very flexible reserve system, with different reserve models for different use cases. For example, one of the reserve models developed by Kyber, the Fed Price Reserve (FPR), is focused on allowing professional market makers to perform on-chain market making by feeding in prices in a highly gas and capital efficient manner. For token teams looking to provide liquidity in an extremely capital efficient manner with low slippage (with much higher capital efficiency than AMMs), they can use the Automated Price Reserve (APR) model.

Reserve models are either built for a one time deployment (like our Uniswap V2 Bridge) or for any developer to deploy when they want to provide liquidity on Kyber (like the FPR or APR).

Examples Of Reserve Models

Here are some examples of different reserve models that have been deployed by Kyber and the DeFi ecosystem.

Anyone can create new reserve models or customize existing ones. What new reserve model will YOU create?

Creating New Reserve Models

Anyone can customize existing reserve models or create new ones from scratch to suit their own use cases and requirements.

For example, a potential upgrade to the existing FPR model is the development of a secondary inventory pulling. A professional market maker might have inventory to market make from OMG to DAI, but not USDC or TUSD. With the ability for them to convert DAI to USDC from other markets efficiently, they will be able to market make for OMG and other stable coin pairs as well.

Another example could be a brand new enhanced AMM liquidity system, which can also create a bridge reserve to allow Kyber Network takers (DApps and end users) to access the liquidity from their system.

We believe that the potential for new reserve models is limitless, and creating new reserve models for many more unique use cases will benefit the entire DeFi space. Other interesting ideas include:

- New AMM models with unique parameters and contribution, with the potential for liquidity mining

- Initial DEX Offering (IDO) reserve models, where teams can dictate the precise price and release schedule of the tokens

- OTC style reserve model, where traders request big size trades, and makers authorize the takers to trade after a specific time period as they prepare inventory for the trades

Why Create New Reserve Models on Kyber?

1. A Flexible and Fully On-chain Reserve System

Kyber’s reserve system is the only advanced and proven liquidity system flexible enough to cater to different use cases, enabling developers to create a model that best suits their needs. In contrast to off-chain or hybrid/semi-off-chain models e.g. 0x, Kyber’s fully on-chain design allows for fully transparent transactions, as well as seamless composability with DeFi DApps, which require intricate smart contract interactions. In hybrid models, it is either not possible or very challenging to use within smart contracts, making it wholly unsuitable for more complex DeFi use cases.

2. Provide Liquidity for the Entire Decentralized Ecosystem

Kyber is one of the most used DeFi protocols in the world, with the highest number of integrations, including all the major aggregators. By creating and deploying a new reserve and providing liquidity on Kyber, price discovery for your token is possible and your token will get seamless exposure to over 100 DApps in the Kyber ecosystem. Kyber’s protocol has also been battle-tested, successfully facilitating over US$2 Billion and 1.5M+ trades entirely on-chain (Ethereum).

3. Market Make for Profits

Another reason for creating and subsequently deploying new reserve models on Kyber is the opportunity to market make for profit from each trade. Reserves are able to buy tokens at a lower price elsewhere, then set a fee% markup to earn a profit on Kyber. In addition, reserves deployed using the new reserve models created in our Reserve Innovation Program may potentially receive attractive grants (more details later in this article).

Reserve Model Creation Guide

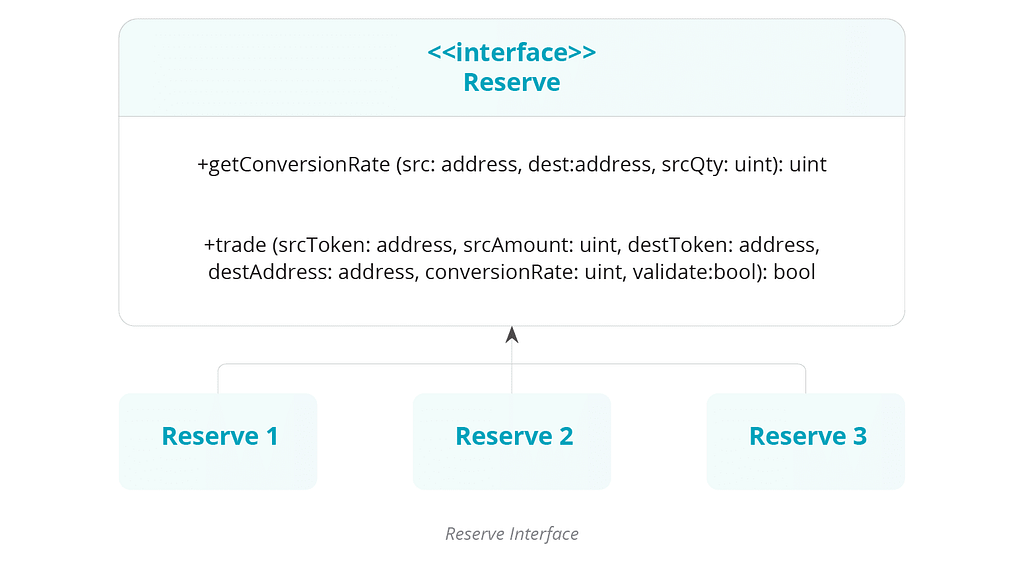

There is no limitation to the design of the reserve, as long as it is secure, adheres to the Kyber Reserve Interface, and does not introduce high gas costs for takers. The details for how reserves determine the prices and manage their inventory is not dictated in the protocol and is entirely up to the reserve operators.

Kyber’s reserve interface provides a generic template of the contract functions one should implement in their smart contract. All Kyber reserves that enable liquidity provision have to use this interface.

A) Customizing And Extending Existing Models

Developers can easily customize existing reserve models by using the contracts already developed but change or override certain key functions.

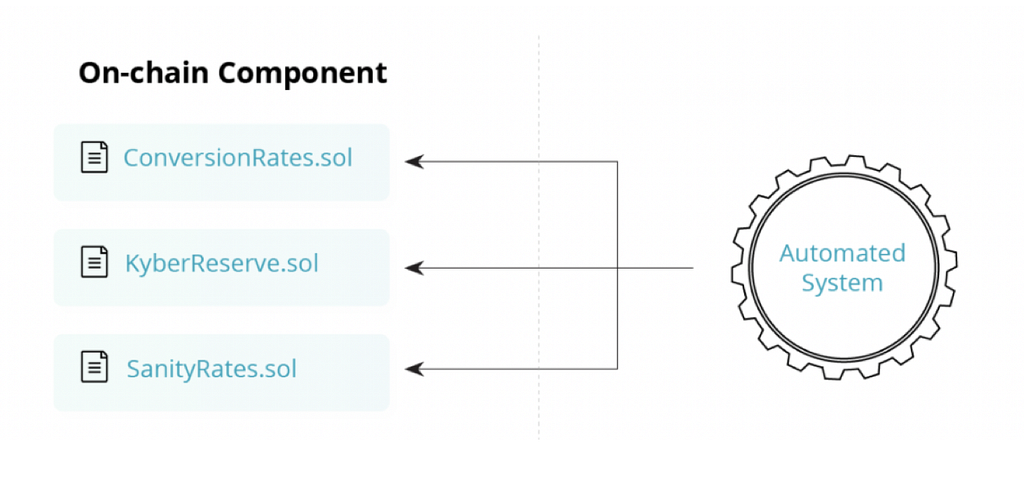

For example, the FPR uses a smart contact called conversionRates.sol, which determines the behavior for how rates change based on trade size and available inventory. By changing one or more of the functions in this contract, the developer can leverage much of the infrastructure already built up for FPRs but insert their own on-chain logic, including using on-chain price oracles or other types of on-chain data.

In addition, existing reserves can also be extended with custom smart contracts, allowing for more flexibility and capital efficiency. This will not entail any changes to the existing smart contracts, but involves inserting optional steps into the trade flow.

B) Creating A Brand New Reserve Model

Kyber is looking for talented developers to create new liquidity models that go beyond the typical AMM model or a simple customization/extension of existing Kyber reserve models. There is no restriction on the type of reserves that can be developed, as long as they follow the following guidelines:

- For getConversionRate, required statements should be avoided. Returning zero rate is suggested as the alternative.

- Developers must ensure that they are not using the same liquidity source for multiple reserves, i.e., must have unique liquidity sources for each reserve.

- Coders should not exploit taker’s gas, and be gas efficient.

Read this tutorial to learn how to create a new reserve model from scratch.

$100K Reserve Innovation Program

We aim to have many DeFi developers going beyond the existing models and utilise Kyber’s flexible reserve system to create new reserve models for a myriad of use cases. In support of our goal to enhance liquidity and deliver a sustainable liquidity infrastructure, Kyber is launching a Reserve Innovation Program!

This program is meant to incentivize and motivate developers to build new liquidity models using Kyber’s flexible reserve system and enhance liquidity in DeFi. Participants will learn first hand from the Kyber team about the intricacies of on-chain market making and providing liquidity on DeFi. As part of the program, we aim to set aside $100,000 in total grants to selected recipients to help bootstrap the launch of their reserve models.

These grants will fund research and development of important new reserve models that can be subsequently deployed on Kyber by anyone, opening up a world of different liquidity use cases.

Details

- Each grant recipient may be awarded up to $20,000 worth of KNC, subject to terms and conditions. Total grant pool of $100,000.

- Grants are only awarded if the applicant fulfils an approved use case / system. Full $20,000 grant may be awarded for a new mainnet and production-ready reserve model, partial grant for partial completion of a functional new reserve model.

- Incomplete or poor execution may result in no grants being awarded.

- The Kyber team has full discretion on the selection and grant disbursement process, and any decision made by the team is final.

Other Program Benefits

- Kyber will collaborate with applicants by designing the reserve model together, from ideation to production. Kyber will help applicants validate the system, conduct internal audits, and take care of external audits if needed.

- Grant recipients are able to receive mentorship and advice from the Kyber team during and after the program.

- Grant recipients and their new reserve models will be heavily featured by Kyber.

- Selected reserve models may receive extended marketing support from the Kyber team.

Many popular DeFi projects that built with Kyber went on to achieve incredible success in the space, including: InstaDApp (ETHIndia Winner), Zapper.Fi (#KyberDeFi Hackathon Champion), Gelato (#KyberDeFi Hackathon Finalist), and 1inch (ETHGlobal Kyber Bounty Winner).

For developers interested in joining our Reserve Innovation Program to enhance liquidity for DeFi, please reach out to the Kyber team on our and visit our Developer Portal.

Forging New Liquidity Systems For DeFi

The DeFi space is now ripe for innovation, especially regarding liquidity provision. While the AMM has been the dominant model for the space, it provides only one single rigid template for liquidity provision. Developers are currently unable to innovate on new liquidity models to be deployed on an existing network. If they want to create a new liquidity model for a special use case, they have to create a brand new maker and taker network, and grow a new user base from scratch. As such, although AMMs like Uniswap have contributed substantial value to the DeFi space, they present only a very tiny glimpse of DeFi’s full potential and what developers and liquidity providers are capable of.

We believe that Kyber’s flexible reserve system, coupled with our reserve innovation grants, will introduce many new and interesting liquidity models that were not possible before. This in turn will enable developers to deploy those reserves for a variety of use cases, leading to an influx of fresh liquidity to DeFi over time.

Our flexible reserve system perfectly complements our new KyberPRO framework for professional market makers, our existing APRs for token teams, as well as our continuously improving bridge reserves (to pull liquidity from other on-chain sources e.g. Uniswap, Bancor), greatly enhancing overall liquidity on Kyber. In addition, we are in the midst of researching and developing a powerful new permissionless system for liquidity contribution.

Creating new reserve models and providing liquidity via Kyber’s flexible reserve system allows this liquidity to be accessed by the largest DeFi taker network, including all the major aggregators. Ultimately, this will introduce many more quality liquidity sources to Kyber Network.

Reach out to us and build your own reserve model now!

Kyber provides takers and makers with a single on-chain endpoint for all their liquidity needs, creating a well-balanced and sustainable liquidity infrastructure for DeFi.

Onward, Kyber Network!

About Kyber Network

Kyber’s on-chain liquidity protocol allows decentralized token swaps to be integrated into any application, enabling value exchange to be performed seamlessly between all parties in the ecosystem. Using this protocol, developers can build innovative payment flows and applications, including instant token swap services, ERC20 payments, and financial DApps — helping to build a world where any token is usable anywhere.

Kyber is the most used and integrated decentralized finance (DeFi) protocol in the world, with over US$2 Billion worth of transactions facilitated since its inception. Kyber supports over 80 different tokens, and powers over 100 integrated projects including popular wallets Trust, Enjin, Argent, and the HTC Exodus smartphone, as well as DeFi platforms Fulcrum, DeFi Saver, InstaDApp, Set Protocol, Melon, DEXTF, Gelato, and many others.

Discord | Website | Blog | Twitter | Reddit | Facebook | Developer Portal | KyberPRO | Kyber Tracker | KyberWidget Generator | Github

Kyber Reserve Innovation Program: New Liquidity Models For DeFi was originally published in Kyber Network on Medium, where people are continuing the conversation by highlighting and responding to this story.