Marketplace innovation driven by crypto

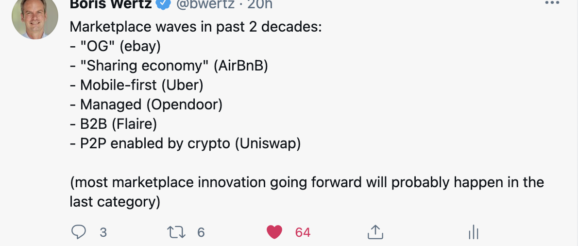

Marketplace innovation comes in waves and we can point to a handful of major trends over the past two decades:

Right now, the most exciting area in marketplace innovation is blockchain-enabled marketplaces, especially with what is happening in decentralized finance. The Ethereum ecosystem has enabled the emergence of a tremendous number of protocols, platforms and exchanges that power P2P interactions around trading (Uniswap), lending (Compound), option & derivatives (Opyn) and insurance (Nexus Mutual). It’s almost unbelievable to see total value locked (TVL) go from just under $1B to almost $70B in just one year!

So, what are the most important aspects of marketplace innovation in blockchain-enabled marketplaces? We can break it down to three things:

- Frictionless onboarding of supply

The composability of blockchains and the digital nature of the underlying supply has made onboarding of new supply incredibly easy. This is currently limited to on-chain assets, but we will see the tokenization of every asset over time (e.g. check out David Gabeau’s post on the “tokenization of natural assets”).

Even if you don’t have supplier mindshare to take their assets onto your platform, you can easily bootstrap a marketplace on the supply side given the public nature of on-chain assets.

- Incentives to solve the chicken and egg problem and drive ongoing engagement

Blockchain protocols can easily offer incentives to both the supply and demand sides to solve the chicken and egg problem, radically shortening the period until true network effects can kick in. These incentives can happen either ex-posteriori via an airdrop (rewarding early users of the protocol once a public token is launched – most famously pioneered by Uniswap) or with ongoing rewards to promote certain behaviours.

- Better business and governance models

Crypto marketplaces are P2P marketplaces without a middleman taking fees for connecting buyers and sellers. Governance rests in the hand of the community who can decide on what fees to charge (if any) and how to distribute those fees. The value that a protocol and platform is creating is hence accruing to the community of token holders and users – resulting in much better alignment.

Decentralized autonomous organizations are still early in their development and many of the governance aspects and processes still need to be figured out, but the general idea is so powerful that it might be the dominant business and governance model for any marketplace going forward.

Crypto marketplaces are marketplaces on steroids: frictionless onboarding of supply; better and more targeted incentives for buyers and sellers at any stage of a marketplace evolution; and a better and fairer business and governance model. This all creates a powerful combination that will be adopted by marketplaces across the board over time.