Online Feature: The IRA and digitalization: Accelerating innovation for U.S. sustainability programs

Authored by Paige Marie Morse, Sustainability Advisor, Aspen Technology

The Inflation Reduction Act (IRA) is an important step to move the US toward climate action with other major economies. Legislation in August capped a long process of assigning targeted investment toward efficiency improvements, renewable energy growth and supporting infrastructure.

Many of these programs offer significant incentives for energy and chemical companies to capture funds to improve operational efficiencies, boost renewable energy use, and develop carbon capture and hydrogen projects. Digitalization capabilities will be critical to capture the efficiency and innovation improvements targeted by this legislation while also enabling more cost-effective solutions.

The timing of this bill is especially important for the US this year as the world prepares to return to the global discussion table at COP27 – shorthand for the 27th Conference of the Parties to the United Nations Framework for Climate Change – set for Egypt in November.

Based on a preliminary assessment by the Department of Energy (DOE), the US is now in line with other economies toward a 40% reduction in greenhouse gas emissions in 2030 when compared to 2005. The DOE estimates that the $430 B investment from the combination of IRA and the Infrastructure Investment Act could help to reduce emissions by nearly 1,150 MMT CO2e compared to business-as-usual baseline1.

Expanding Sustainability Project Investments

The power sector will see the biggest improvement with the acceleration of wind and solar power generation, as well as investment in transmission and storage capabilities. The program also offers loans for technology development in carbon capture, hydrogen, geothermal, and energy storage projects.

FIGURE: Estimated emissions reduction in 2030 by combined legislation, MMT CO2e (DOE)2

Digitalization will be key to the rapid expansion of renewable power generation, shifting to distributed and microgrid systems and self-generation at industrial sites as companies work to integrate more electric power into their processes. Many companies are focused on electrifying energy and process heat, and some are working on developing catalytic solutions to high temperature petroleum-driven processes that will enable electric heat. Digital solutions provide the flexibility to integrate these diverse systems for production, storage and consumption while ensuring reliability demanded by the process industry.3

Two companies have moved quickly to benefit from the carbon capture incentives, using the improved structure for the US tax code, 45Q, that offers tax credits for CO2 capture, utilization, and storage projects. In addition to boosting the value of the credits to as much as $180/metric ton depending on the project scope (up from $35-$50), the law has also extended construction deadlines out to 2033.

U.S. climate tech company CarbonCapture, Inc. plans to build a direct air capture (DAC) project in Wyoming with new credits from IRA, and fertilizer producer OCI is planning a new ammonia plant in Texas.4 CarbonCapture CEO and CTO Adrian Corless highlighted the importance of IRA in their plans:

“With the passage of the Inflation Reduction Act, the proliferation of companies seeking high-quality carbon removal credits, and a disruptive low-cost technology, we now have the ingredients needed to scale DAC to megaton levels by the end of this decade,” said Adrian Corless, CEO and CTO, CarbonCapture Inc.5

CarbonCapture has been a major user of digitalization technology to speed up its project development6. The company uses industrial AI and rigorous modeling software to innovate its process and integrate solar energy sources to improve the overall economics. DAC technology opportunities are particularly enhanced by IRA because it lowers the high collection threshold for projects to within range for this technology, which accesses much more dilute CO2 streams than those from industrial emitters.

Many other companies are leveraging digital to accelerate their development and scale-up of carbon capture and storage projects, including Saudi Aramco, Kinder Morgan, Shell Cansolv and Fluor7.

Mitigating Economic Hurdles

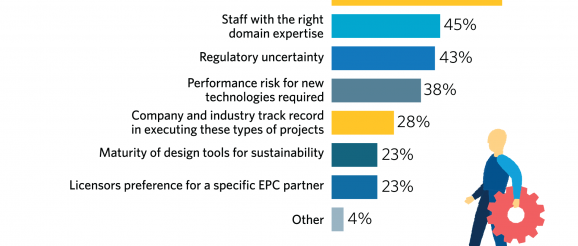

According to a recent survey by AspenTech and Hydrocarbon Processing of operating and EPC companies, more than 70 percent 8 of respondents say economics are the biggest hurdle for sustainability projects. Economic feasibility is impacted by external factors that include renewable energy incentives, as well as manufacturing risks associated with new low-carbon processes.

FIGURE: What are the main barriers to the successful execution of sustainability projects?

In addition to emissions reduction this decade, this legislation will also serve to accelerate the innovation needed and cost reduction for real progress to sustainability targets.

“Where the bill could be truly consequential is in planting the seeds for technology adoption that drives emissions lower in 2030,” Greg Ip wrote in the Wall Street Journal soon after its passage. This development activity will have particular impact on driving costs lower as seen for solar energy projects in recent years.

Ip adds that, “And these benefits will accrue to the whole world, not just the US.”9 This message comes just in time for the US to take its place at the negotiating table in Egypt.

7 Beck, R.; Plougoulen, A.; Munoz, G.; Optimizing Carbon Capture Utilization and Storage to Meet Ambitious Sustainability Goals; 2022

8 Beck, R.; Ryan, T.; Ponniah, J.; Decarbonization Investment: Opportunities and Implications for EPCs; 2022