Q1 2022: Global Health Innovation Funding on Pace with 2021’s Record Numbers

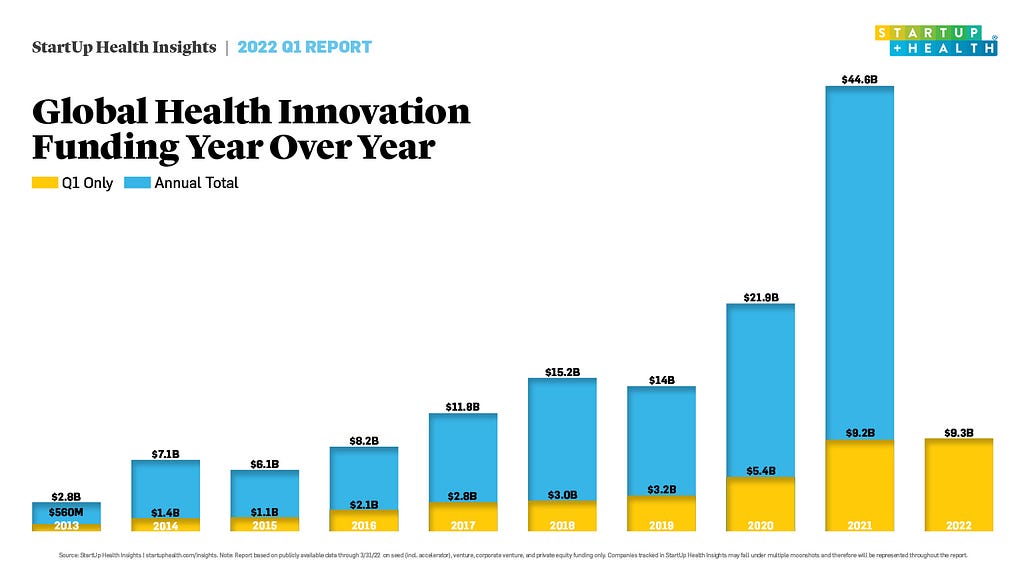

StartUp Health tracked $9.3B in health innovation funding in the first quarter of 2022, putting it even with 2021’s record-breaking pace. While we believe the flat year-over-year funding indicates a strong market, we may be seeing a slowdown in the funding growth curve due to macro trends like a sustained war in Ukraine, supply chain disruptions, and rocky public markets.

When you look back at the last 10+ years of global health innovation funding, it’s easy to get excited. After years and years of predicting the promise of digital health tools like telemedicine and remote patient monitoring, the last two years have turned the vision into a reality. Due to a range of market forces, like a COVID-induced push towards virtual medicine and relaxed reimbursement regulations, we saw annual investments in health innovation double in a single year. In fact, more health tech funding was raised in 2021 than in the five years of 2013 to 2017 combined. This unleashing of capital is historic and it unlocks the potential in health innovation that so many of us have been talking and writing about for a decade.

As we closed out the first quarter of 2022, the big question was: how long will this acceleration in health investing continue? In other words, the minute a market gets hot, someone starts asking if it’s a bubble.

This quarter Rock Health, which only reports funding in the United States, noted a $700M drop in investment dollars between Q1 2021 and Q1 2022. MobiHealthNews, in reporting the story, concluded that “digital health funding may be finally slowing down.” In our independent analysis, which tracks global funding, and funding at more round sizes and stages, we drew a different conclusion. We noted a small uptick in funding in Q1, year over year. It didn’t reflect the aggressive growth we’ve seen for the last two years, but what story does this quarter really tell?

Unity Stoakes, StartUp Health’s President and Co-founder (and digital health booster for more than a decade) is fond of saying that as hot as this market looks today, we’re still in the early innings. But he’s not the only one with this perspective. We recently caught up with Alyssa Jaffee, Partner at 7wire Ventures, who described the current market as “super bullish.”

“Livongo plus Teladoc was the tip of the iceberg,” says Jaffee. “The public markets are tough right now but healthcare isn’t going away. Our population is aging, chronic conditions are worsening, and mental health is declining. There is no reason we cannot have more and more companies that are exiting for billions of dollars.”

At StartUp Health we believe 2022 is positioned to be another incredibly strong year for health innovation, particularly when viewed through a global lens. Consider this: the first quarter of 2022 is on pace with 2021, which was by far the biggest year for health innovation investing in history, in spite of a war in Ukraine, global supply chain disruptions, and the BA-2 variant of COVID. Let’s not miss the big picture. So far this year we are keeping pace with a year of funding that media outlets described as “seismic,” “record-breaking,” and having “blown previous years out of the water.” That’s a strong start.

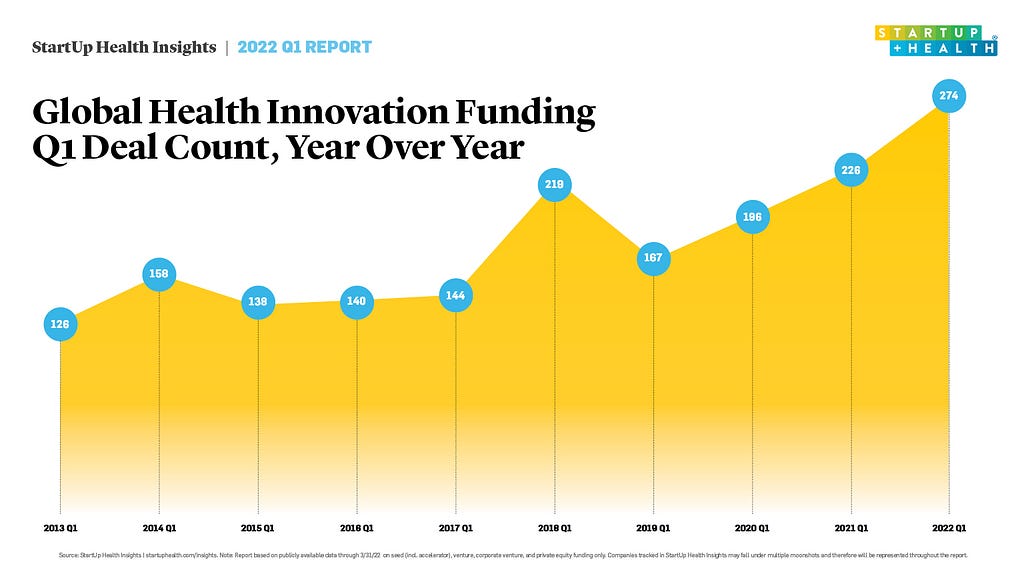

Another reason we’re optimistic is that this quarter we tracked 274 deals, making it second only to Q2 2021 in terms of total deal count over the last decade. In our 2021 year-end report, we wrote about the trend that funding increases were inordinately impacted by a small number of mega deals occurring in the most-funded cities in the world. We wrote then that “total deal count is an important measure of entrepreneurial activity, and one we’ll continue to watch closely. We believe that to achieve health moonshots it’s not enough to back a few unicorns. As an industry we need to invest in entrepreneurs at scale, at every stage, so that the best ideas and products have a chance to emerge.” We stand by this statement and this quarter is trending in the right direction.

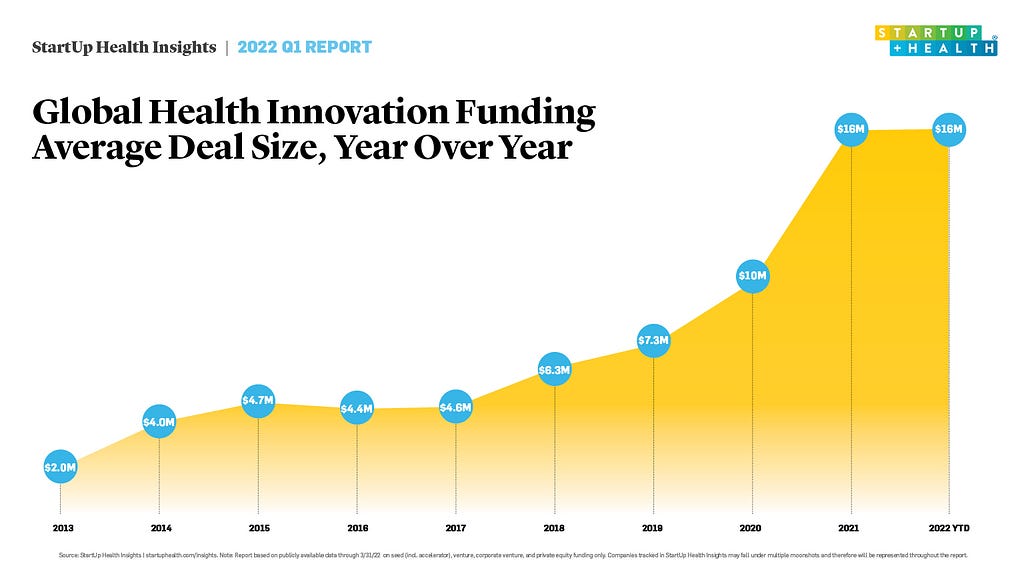

Median deal size is holding steady at $16M, equal to 2021, but $6M higher than 2020. Time will tell if deal size is cooling off in a larger way. StartUp Health believes in investing at scale. We just backed our 400th company this quarter and we have our sights set on 1000 companies and beyond. Improving health globally isn’t a horse race where you pick a few big winners. It’s about investing in health problem solvers everywhere. If that means more deals at smaller average deal sizes, we’re here for it.

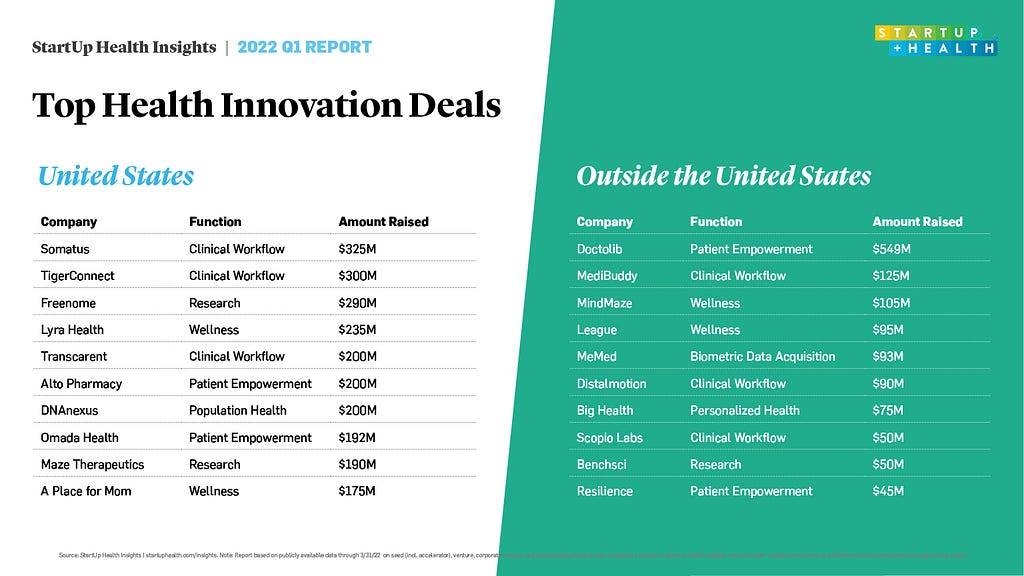

Top Deals

Topping our list of the quarter’s largest US deals is the $325M raise by Somatus that will power their value-based kidney care platform. Chronic kidney disease (CKD) is a concern for 37M adults in the United States alone. We’re encouraged to see money flowing into this sector because CKD disproportionally impacts Black and Hispanic communities, as well as communities with poorer social determinants of health (SDOH) like housing and food insecurity. Millions of kidney disease patients have suffered in the shadows for years, receiving in-clinic dialysis multiple times a week to stay alive. We’re hopeful that investment in companies like Somatus will encourage other health innovators to tackle this widespread problem.

“It’s clear that value-based, technology-enabled kidney care is the future,” says Tim Fitzpatrick, CEO and Founder of ikona health, a StartUp Health-backed company optimizing kidney care treatment pathways. “Kidney care-focused population health management companies are working closely with payers and large nephrology practices to reduce the cost of kidney care by delaying progression and improving the transitions to and treatment of kidney failure.”

Another notable top deal is A Place for Mom, which raised $175M to scale their senior care platform that aims to improve home care. While plenty gets written about our rapidly aging population and the need to innovate around Alzheimer’s and dementia, age tech companies rarely if ever make our top deals list. With this raise, A Place for Mom is purportedly valued at over a $1B. They are just one company, and so much more needs to be done, but we’re hopeful this raise will bring more visibility to age tech and senior care opportunities.

Outside the US, our top deals list was dominated by Doctolib’s $549M funding round, which raised its valuation to $6.4B and made it the highest valued startup in France. With this financing, Doctolib is poised to shape digital health in Europe for years to come. In the next five years they plan to grow their medical appointment booking platform from 2,500 employees to 6,000 employees while expanding operations to 30 European cities.

If the theme with Doctolib is digital health consolidation and market penetration, we may be seeing a similar trend in India. MediBuddy raised $125M to scale their full service telemedicine and at-home lab testing company, with the lofty goal of bringing accessible healthcare to a billion people in India.

“Digitization of the healthcare industry has helped people living even in the most remote parts of the country avail timely medical care by professionals,” Satish Kannan, Co-founder and CEO of MediBuddy, said in a statement. “With the latest round of funding, we will capitalize on strengthening our network of healthcare service providers and our team while launching new services on the platform.”

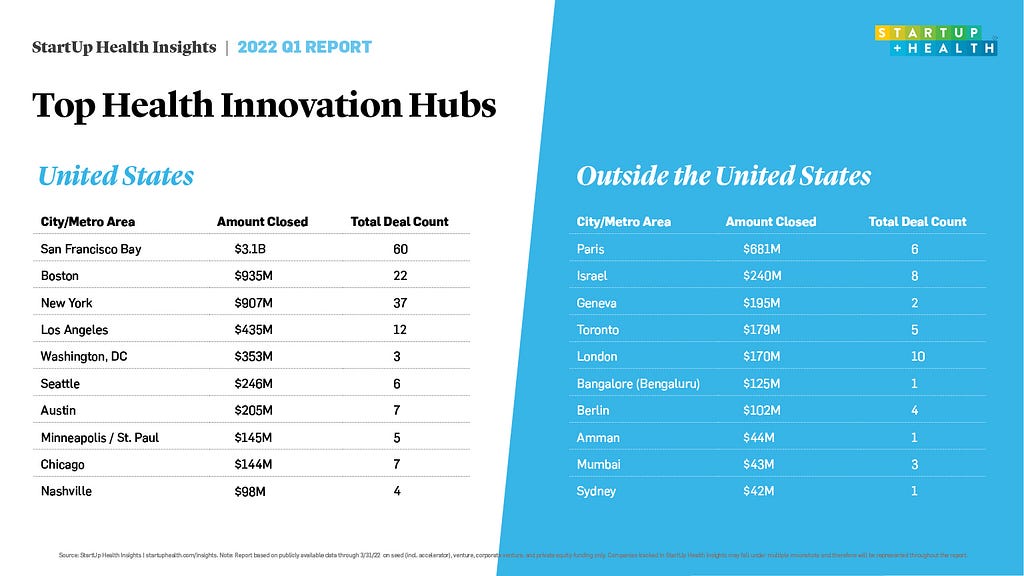

Health Innovation Hubs

In the United States, health innovation investing is still heavily skewed towards three top cities, San Francisco ($3.1B), Boston ($935M), and New York City ($907M). What’s more interesting, perhaps, is to see what new cities have made the list, and which may be carving out a reputation as a home for healthcare entrepreneurship. New to the innovation hub list this quarter is Nashville, which saw $98M raised across four deals. With 12 deals and $435M raised, Los Angeles has seen the most growth and is now one of the most active and well-funded health tech hubs in the country.

Our list of most-funded cities outside the United States has seen a shake-up. France is on top ($681M) almost exclusively due to the massive raise by Doctolib. Newcomers to the list are Geneva, Berlin, Amman, and Sydney. Notably in Amman, Altibbi, the first and largest telemedicine platform in the Arab region, raised a $44M Series B. Tel Aviv, Toronto, and London (still the most active with 10 deals) remain well-funded hubs for health innovation, while major cities in China have notably dropped from the list this quarter.

Conclusion

We might disagree with the Stat News headline that says health tech funding is “slipping,” but we can agree with them that the next quarter, Q2, is going to be one to watch closely. How will the rockiness of the public markets impact private investment? What about the economic impact of the sustained conflict in Ukraine? Or, to think more about global impact, will investors see beyond the mega deals to fund a generation of healthcare problem solvers?

Like many investors we have spoken with recently, we remain very optimistic about the health innovation market. That’s not because we see a few multi-billion dollar exits on the horizon, but because we work with hundreds of health tech founders at every stage and know the passion, experience and wisdom that they’re bringing to bear to improve global health. Our global healthcare challenges are growing, but so is the wave of ingenuity coming from thousands of entrepreneurs and startups on every continent. 2022 is off to a strong start, if less aggressive in its growth curve than the last two years. We’ll be watching closely to see how investors and startups respond to the market. Stay tuned.

This report was written and designed by Logan Plaster based on data collected and managed by Tara Salamone and Nicole Kinsey. Additional analysis by Priya Reddy, Padma Rao, Jay Poskitt, and Jennifer Hankin.

Data is from StartUp Health Insights, the most comprehensive funding database for health innovation. Get all our free quarterly reports and sign up for StartUp Health Insider™ to get funding insights, news, and special updates delivered to your inbox.

Investors: Learn how you can invest in Health Moonshots through StartUp Health’s impact fund.

Digital health entrepreneur? StartUp Health Community and how StartUp Health invests.

Q1 2022: Global Health Innovation Funding on Pace with 2021’s Record Numbers was originally published in StartUp Health on Medium, where people are continuing the conversation by highlighting and responding to this story.