Singapore’s Blockchain Map Proves That It Is a Hotbed for Blockchain Innovation

Singapore has long established itself as the leading fintech hub in South East Asia, of late it also increasingly becoming a hotbed for blockchain innovation.

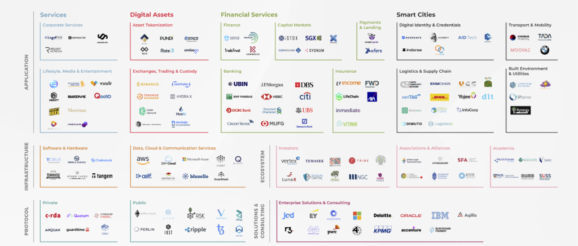

The city-state is home a healthy blockchain ecosystem comprising numerous players tackling areas ranging from asset tokenization, trading, and custody, to insurance, digital identity, and mobility.

This is according to a new landscape map produced by the Infocomm Media Development Authority (IMDA), together with Tribe Accelerator, which features notable local blockchain companies and initiatives leading the development of blockchain in Singapore.

Singapore Blockchain Landscape Map

Singapore Blockchain Landscape Map 2019, Info-communications Media Development Authority (IMDA) of Singapore

The map, which categorizes blockchain startups and projects into major sectors, aims to provide a representation of the application of the technology across various industries.

It notes the presence of global blockchain protocols like Corda, Quorum, Ethereum, and Ripple, as well as services providers such as EY, PwC, Microsoft Azure, and R3, which have all been serving the business community with blockchain-related products and services.

But the Singapore blockchain ecosystem also has several home-grown noteworthy startups and projects of its own.

In the corporate services category, the map cites LegalFAB, a legaltech startup that facilitates the creation of decentralized identity for e-authentication, collaboration and trusted transactions, Korporatio, which allows business owners to have a fully legal entity on the blockchain, and Legalese, a deep tech startup pioneering computational law.

In asset tokenization, Singapore is home to startups such as Digix, a startup that tokenizes gold, TenX, which offers a product suite aimed at making cryptocurrencies spendable, and Hashstacs, which develops blockchain solutions for the capital markets.

In the cryptocurrency trading and custody category, notable startups include Binance, one of the largest exchanges operators on the market, and Kyber Network, an Ethereum-based protocol that allows the instant exchange and conversion of digital assets and cryptocurrencies.

Other noteworthy blockchain startups and projects from Singapore include LifeChain, a blockchain initiative to automate life insurance claims verification, and Eximchain, a supply chain blockchain platform, according to the map.

Last but not least, the government itself has also been driving blockchain innovation through its own initiatives. These include OpenCerts, a blockchain-based platform for the issuance and validation academic certificates, and perhaps the most notable of all, Project Ubin, a project led by the Monetary Authority of Singapore (MAS) and the Association of Banks in Singapore (ABS) in collaboration with industry partners to explore the use of distributed ledger technology (DLT) for the clearance and settlement of payments and securities.

Singapore’s blockchain startups and initiatives are represented by trade groups such as the Singapore Cryptocurrency and Blockchain Industry Association (ACCESS), and the Token Economy Association, in addition, of course, to fintech-focused organizations like the Singapore Fintech Association, and to protocol-specific organizations like Hyperledger and the Ethereum Foundation.

In academia, the Nanyang Technological University in Singapore has its own student-led blockchain club called Blockchain at NTU Singapore, which aims to raise awareness of the technology and conducts research on blockchain, and the National University of Singapore’s School of Computing leads a blockchain community called Blockchain at NUS.

IMDA and blockchain

In line with Singapore’s Smart Nation national strategy, IMDA, the city state’s infocomm and media authority, has been pushing for blockchain innovation, promoting awareness and adoption of the technology through various means including the Blockchain Challenge, a competition focused on developing Minimum Viable Products (MVPs) or Proofs-of-concept (POCs) solving industry-facing challenges.

One of the authority’s earliest projects was a blockchain-based platform for know-your-customer (KYC) and customer identity. The proof-of-concept, completed in October 2017, included the participation of OCBC Bank, HSBC and Mitsubishi UFJ Financial Group (MUFG).

Another project in which IMDA has been involved in is TradeTrust, a blockchain-based platform for the trade and logistics community. TradeTrust aims to facilitate the interoperability of electronic trade documents exchanged between different digital ecosystems, and seeks to reduce inefficiencies and complexities of cross-border trade arising from the current usage of paper-based documentation.

The post Singapore’s Blockchain Map Proves That It Is a Hotbed for Blockchain Innovation appeared first on Fintech Singapore.