SMH ETF: Innovation, Whaling, And The Elephant In The Room | Seeking Alpha

The semiconductor industry appears to have a vast runway ahead of it. This by extension makes the VanEck Semiconductor ETF (NASDAQ:SMH) an attractive fund for long-term investors. That being said, the realm of technology and innovation is wrought with creative destruction at every corner. Add the risk of a black swan event occurring and the investment case for semiconductors remains one of cautious optimism.

ETF Strategy and Holdings

SMH has a 0.35% expense ratio and a 0.71% dividend yield.

This is what VanEck has to say regarding the investment strategy of SMH:

VanEck Semiconductor ETF (SMH®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Listed Semiconductor 25 Index (MVSMHTR), which is intended to track the overall performance of companies involved in semiconductor production and equipment.

The ETF is heavily focused on the semiconductor industry and we can clearly see that by looking at their top holdings.

SMH Top Holdings (VanEck)

Concentration Risk

SMH has an extremely high level of concentration in the semiconductor industry. In addition to sector concentration, the ETF has an almost 20% position in just one company (Nvidia) which results in a large amount of single-stock risk. This level of concentration could lead to poor performance if the industry undergoes a period of difficulty or a tail-risk event occurs. For this reason, investors may be better off viewing SMH as a component of a diversified portfolio rather than a portfolio cornerstone.

Price Action

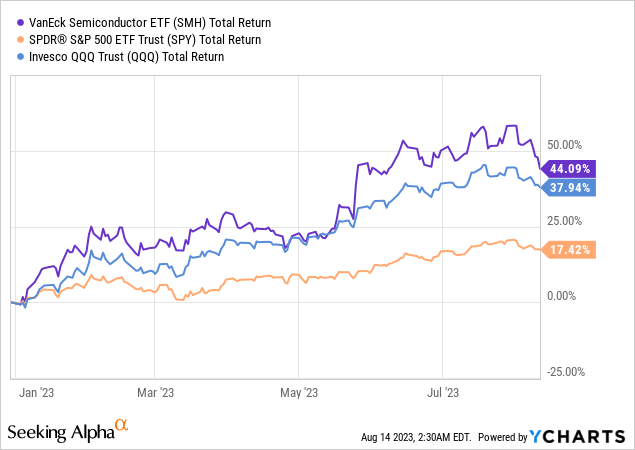

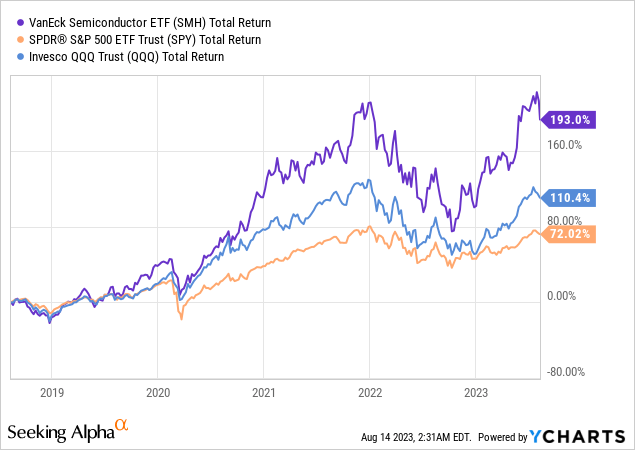

SMH has beaten both the Nasdaq 100 (QQQ) and S&P 500 (SPY) YTD and over the past five years. This outperformance may end up being repeated over the next five years if the need for computing power continues to increase and no tail-risk event materializes.

The Growth Story

Ever since ChatGPT gained mainstream appeal both public and private investors have been scrambling to gain exposure to the broad theme of “AI”. As is the case when an investing theme is so nebulous, companies have been quick to sprinkle the AI pixie dust across their investor communications and earnings calls. Legions of VC-backed private companies have shifted their business models to focus on AI and the money firehose has been pumping. All of these companies chasing AI face a key bottleneck: the availability of efficient computing. Much of the focus has been on LLMs, but virtually all applications of AI require large amounts of compute. Rather than try to invest in the gold miner who will eventually find the AI gold, why not just invest in those who sell picks and shovels?

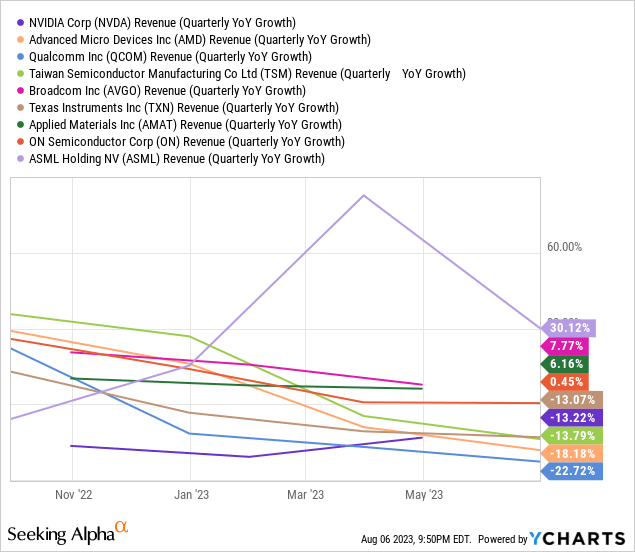

This train of thought has led investors to rush into the semiconductor sector in 2023. This newfound love comes after the sector was beaten down in 2022. Much of the excitement surrounds future results, as the current operations of many of the semis leave a lot to be desired as far as year-over-year comps are concerned.

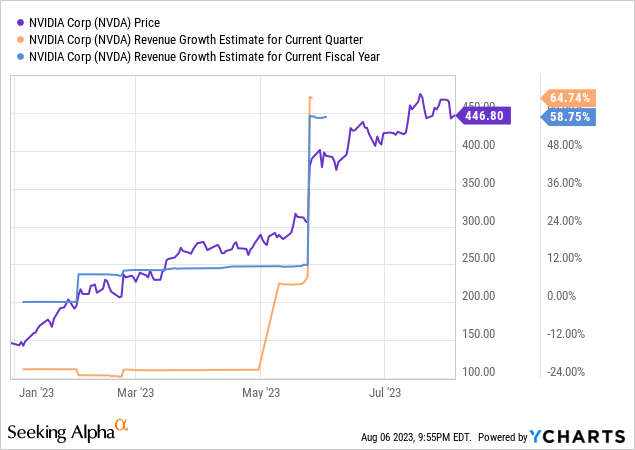

The main beneficiary of the AI hype cycle has so far been Nvidia (NVDA). Nvidia’s stock has been on a tear this year, and ever since the “guidance heard round the world” the question has been whether or not Nvidia and the broader industry is now in a bubble.

The potential for innovation enabled by advances in semiconductors/computing is remarkable and the future of technology appears to be shining bright. While the growth prospects for the industry appear to be vast and optimism is high, investors would do well to remember the lessons of the past.

A Cautionary Tale

Many people like to refer to cars replacing the horse and buggy as an example of disruptive innovation. While this is certainly a valid example, horse and buggies were not exactly “cutting edge” technology and had been around in some form for centuries. The horse and buggy business was extremely well established and not exactly a vector for growth and investor enthusiasm.

My preferred story of innovation and eventual disruption surrounds the US whaling industry. Investors who are interested in the economic history of whaling can read more here and/or read the book “Leviathan: The History of Whaling in America” by Eric Jay Dolin.

To summarize the whaling industry in America, in the 1800s the resources that a whale yields became increasingly valuable and the parts of a whale began to be used in new ways. Whale biproducts were useful for lighting as well as various commercial and industrial applications. If data is the new oil, then oil was the new whale. Investors and labor rushed into the sector due to the profitability and growth profile. In many aspects the whaling industry set the stage for the industrial revolution.

Over time many whale biproducts were disrupted by alternatives such as kerosene replacing whale oil for lighting purposes. While whales still had value, whaling itself became less profitable as the importance of whale biproducts declined. This led to the eventual disappearance of the once-dominant whaling industry (at one point the fifth largest industry in the US).

The lesson here is that there is always a bear case to be made against leading edge technology, but some of the time it hasn’t been discovered yet. Early investors in the whaling boom likely did well, and late investors (who invested as whaling was being disrupted) likely did poorly. No matter how good the prospects for a technology or industry look, it’s wise to remember that the train eventually stops and it will be time to get off. Those who remain will be wasting their time (capital).

The Elephant in the Room

The elephant in the room with regard to semiconductors is what actions the government of China will inevitably take to bring Taiwan under their direct control. The timeline of these actions and whether they are peaceful or confrontation in nature will have a big impact on the supply chain and end markets for the entire semiconductor industry.

It’s tempting to ignore the potential for tail-risk events to materialize, but that line of thinking is ultimately detrimental. If you’re standing in front of a volcano and hoping it doesn’t erupt, whether you wear a blindfold or not has no outcome on the event itself but it can negatively impact your survival when the event is taking place. Investors are always better off resisting the temptation to bury their head in the sand.

In our opinion, investors should still keep these risks in mind with regard to portfolio construction and avoid allocating too heavily towards semis due to the associated geopolitical risks.

Key Takeaway

The future for the semiconductor industry looks bright but don’t get married to the sector. There will come a time when the growth thesis is busted, whether that be due to innovation or geopolitics.