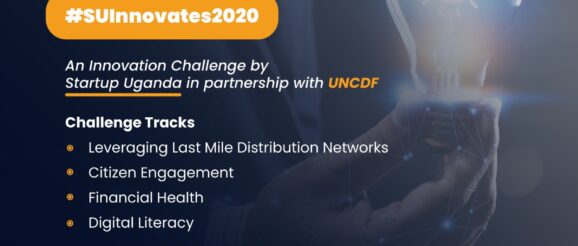

Startup Uganda’s Digital Innovation Challenge 2020 •

Startup Uganda with support from UNCDF and in partnership with implementing partners like Financial Sector Deepening Uganda (FSDU), Ministry of Local Government (MoLG), Mobipay, Danish Refugee Council and Ensibuuko, is launching an innovation challenge towards the development of use-cases that will be impactful for low-income populations with a focus on farmers, women, youth and refugees.

Startup Uganda, an association of Entrepreneurial Support Organizations in Uganda, has as part of its mandate, the commitment to source and build the capacity promising innovations in various sectors of the ecosystem.

The Digital Innovation Challenge

The Digital Innovation Challenge is looking to address the challenge areas below:

1. Financial Health for MSMEs

The economic effects of COVID-19 (C19) have exposed the financial fragility of individuals and businesses. Low-income individuals that do not have excess liquidity have been worst-hit. FSD Uganda’s analysis of the Finscope data set reveals that at least 23% of the population that depend on daily trade and business activity will be severely impacted. This innovation challenge is aimed at improving the medium-to-long term financial health of micro and small businesses in Uganda.

Are you an innovator with a potential solution to improve the financial health of MSMEs?

2. Citizen Engagement

The interaction between citizens and their leaders is paramount for good governance and effective service delivery. A proper engagement between citizens and government allows for constructive feedback on services delivery, appreciating the challenges involved and allows citizens to mobilize themselves to form stronger voices and networks to engage government leaders and provide input into improved service delivery from the leadership. There is an opportunity to leverage technology to come up with innovative ways for citizens to engage with their leaders.

Are you an innovator interested in improving citizen-leadership engagement in Uganda?

3. Leveraging Last Mile Distribution Networks

Mobipay and Ensibuuko have set up a last mile distribution network of over 500 Digital Community Entrepreneurs (DCEs) in Northern Uganda and West Nile. The network is distributing products like solar, airtime, mobile money and more to rural communities. The network of DCEs is seen as a distribution asset that can be leveraged by various innovators to avail digital and non-digital products and services to last mile customers and vice-versa.

Are you an innovator with the right products/services for rural communities but struggling to find the right distribution network?

Cash-based transfers are increasingly used by humanitarian actors to support refugees and their host communities rather than in-kind aid. These transfers now are sometimes operated through mobile money. However, many recipients of this assistance have low levels of literacy, are first-time users of digital wallets, and may not even be very comfortable using mobile phones. In an effort to ensure that these communities can manage their finances and be able to adequately and safely use these transfer services, the challenge around low digital literacy levels needs to be addressed. The Danish Refugee Council (DRC), our anchor partner is looking for solutions to improve and fast trainings on digital literacy.

The digital solutions should equip recipients with digital skills, help them with basic financial management and tips on how to best use their mobile wallets. The partner expects that the most successful solutions will be those that encourage peer-learning amongst community members for broader uptake.

Financial health for MSME’s

Citizen engagement

Leveraging last mile distribution

Deadline: 30th September 2020