Sustainability | Free Full-Text | Bonding or Indulgence? The Role of Overborrowing on Firms’ Innovation: Evidence from China

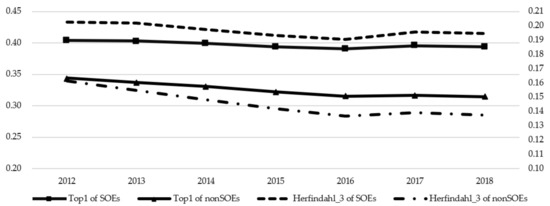

This paper examines the innovation spending gap associated with overborrowing in China’s state-owned enterprises (SOEs). Based on the double agency problem of the banking sector, the authors hypothesize that SOEs are more inclined to a higher level of overborrowing and therefore worsen firms’ debt governance system for innovation. We argue that obtaining excessive bank loans has an indulgence effect and is used by firms’ managers as an entrenchment strategy for underinvestment in innovation. We test our theoretical model under the unique institutional setting of China’s banks, in particular the administrative-economic governance. Using a longitudinal panel dataset that contains a cross section of Chinese listed companies from 2012 to 2018, we confirm overborrowing’s mediating role between state ownership and firm innovation expenditure, implying that enhancing the delegated monitoring of banks is also essential to firm innovativeness in transition economies. Additionally, we further test the role of political connections and managers’ R&D functional experience to leverage the benefits of SOEs’ innovation resource endowment. Our study demonstrates another debt governance channel through which government intervention has a negative impact on firm innovation resource allocation. It expands the understanding of the debt governance role for innovation in transition economies.