The Innovation Stack with Jim McKelvey, Square Co-Founder

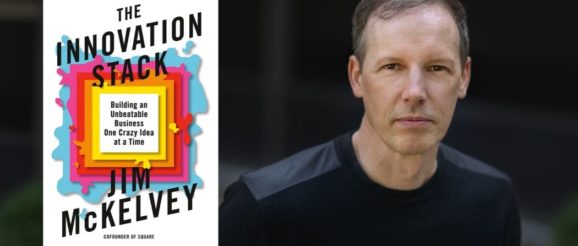

Roger Dooley: He’s a glass artist and owns a glass studio, and you probably aren’t expecting this one, he hired Jack Dorsey, best known as the co-founder and CEO of Twitter when Jack was just 16 and introduced him to the tech business. That hire turned out pretty well I guess. Beyond that he’s a serial entrepreneur, inventor, and philanthropist. Most notably among his entrepreneurial ventures our guest is the co-founder of Square and still serves on its board. He’s chronicled some of his adventures and business advice in the new book The Innovation Stack, Building an Unbeatable Business One Crazy Idea at a Time. Welcome to the show Jim McKelvey.

Jim McKelvey: Good morning Roger. This is going to be fun.

Roger Dooley: Yeah Jim I want to start with a story that dates back to yesterday morning. When I was preparing for this show, I had a guy come in to service my outdoor grill. He did a great job, now it really looks like new. It’s had nine years of smoke and grease and whatnot, really looks amazing. He’s preparing to leave and he’s using his phone to calculate the bill. I don’t write many checks these days, but a lot of these solo contractors are still hold outs so I had my checkbook ready. I asked if he took credit cards and I was expecting him to say no, but he smiled and said, “Sure.” He reached into his pocket, put a tiny little gizmo, about an inch or so in size or two and a half centimeters for our metric audience. He plugged it into his phone, slid my card through it and in a few seconds he handed me the phone so I could sign it with my finger. This whole process was really super fast and in no time I had an email receipt for the transaction.

Roger Dooley: Now needless to say this gizmo was a Square reader, and it was so super easy and fast. He got paid without worrying about bad checks and of course I got to use my preferred payment method. I looked online too and you can buy one of these things for under $10 at office supply stores. Jim I’ll start by congratulating you on making a complicated process way, way simpler. If I was giving out Friction Fighter awards you would be one of the first recipients. Maybe I’ll start doing that. Is that really typical would you say Jim?

Jim McKelvey: Oh yeah, so Square was designed for the small business people of the world, me being the first. It was a product that I wanted for myself, and I was in my glass studio one day trying to sell a piece of glass and lost a sale because I couldn’t take an American Express card. That afternoon I called my friend Jack Dorsey, Jack and I had known each other for 20 years and had already started another business together. Jack and I had decided that we would start a new company and we didn’t have an idea yet. I lost this sale, I looked at the iPhone in my hand, and I said, “This device ought to be able to process a credit card.” At the time it couldn’t, so Jack and I made that the mission of Square. That was 10 years ago, but our mission’s grown a little bit beyond credit card transactions now, but the core idea is the same, which is we want to empower people to participate in the economy.

Jim McKelvey: If you think about what happened with the guy who cleaned your grill, I mean he probably is selling more because he can take different forms of payment. So many small merchants have been excluded or lost sales because they couldn’t participate. We tried to open up the world of credit card processing to millions of more people. It’s great to hear stories like that. I always smile when I hear stories like that and I hear a lot of them, but I never get tired of it.

Roger Dooley: Right, well I’ve been in business for years and the most rewarding stories are the ones where you can see that something that you did had a positive impact on someone else’s business or someone else’s life. For small merchants there are… In our case, we were going to pay the guy either way and the check wasn’t going to bounce, it was all going to be fine. But there are a lot of customers that may not be able to pay cash or may not do checks or not have the money in their checking account at that particular moment. For them it’s really a huge difference. You give your own example of the lost sale of the piece of glass art that you couldn’t do it and you lost the sale. At that point that sale probably meant a lot to you.

Jim McKelvey: It did, and I have something in common with your grill cleaner, and that is we both sell things that people don’t need. You don’t need somebody to come and clean your grill. It’s a nice thing to have, but if it was too much of a problem you wouldn’t do it. I sell art and almost by definition the stuff that I make nobody needs. If you make too much friction in that transaction it destroys it in many cases. What we notice, because we can see the sales data for our customers once they sign up for Square, we see the businesses growing. As soon as they start using Square to accept payments and do the other things like loyalty programs and their tools that we give them, we can watch their sales grow.

Jim McKelvey: It’s so gratifying because it’s what we should be doing. We should be enabling a lot of small startups to get into business. Because business is this big intimidating thing, it’s scary, people have all sorts of excuses, but every time you can remove a little piece of friction it works better. We want people to do these things, so it’s good for the world to get as much friction out of the system as possible.

Roger Dooley: Yeah, one thing that you said is interesting and that you and Jack had decided to start a business but you didn’t know what yet, which is I think counterintuitive to the advice that some experts might give. It’s more like, well come up with the idea, come up with the problem you’re going to solve, and then find the appropriate co-founder or whatever, but I think… Well your method obviously worked in your case, but I think that that is really sometimes a good way. If you’ve got somebody who has complementary skills and you know you’re compatible with and you know that together you can get a job done, to me that’s perhaps an even better way then saying, “Okay I’ve got this problem to solve, now I’m going to go out and find some stranger to bring in to help me solve it.”

Jim McKelvey: Well so I mean if I was giving advice I would say, “Don’t follow what we did. Start with a problem and then assemble the team.” In the case of Jack and me, the team had already been together, Jack and I worked together in the 90s at another company that I had, and so I knew him and he had just finished his first stint at Twitter and was looking for something to do. He asked me if I wanted to start a company with him and I was like, “Yeah sure, what do you want to do?” He’s like, “I don’t know, what do you want to do?” We went back and forth, but we’re lucky that we came up with a problem. The lost sale became a good focus of energy because what we could do then is we could say, “How do we fix this problem for these small merchants?”

Jim McKelvey: Initially I was the test case, but then quickly we expanded it to my friend Bob who I talk about in this book that I just wrote, and Bob’s a great artist but he was never able to sell his work. If you want to give credit card processing to guys like Bob you have to do things very differently. Because the banks and financial institutions don’t have services for people who have bad credit or don’t have a steady address or they assume you’ve got a fax machine. Well Bob sometimes doesn’t have a telephone let alone a fax machine. There are crazy impediments that keep people like myself and my buddy Bob out of the payments game, and so we were very lucky when we started Square that we had this problem we could focus on. I love working with Jack, but it was probably just good fate that around the time we were starting a business I stumbled upon this problem.

Roger Dooley: Right, well saying I’m going to go look for a problem usually doesn’t lead to an immediate discovery, at least not in my experience and that of other entrepreneurs I’ve talked to. Usually it smacks them in the face when they encounter it like you did. When you talk about the application process in the book, the application alone to get credit cards, assuming that you even qualified was 42 pages long and-

Jim McKelvey: 42 pages, the contract was 42 pages.

Roger Dooley: Right, yeah and then fine print. Of course I’m sure the language was not plain English.

Jim McKelvey: It was designed to confuse. Once we realized what was happening in the credit card business, we realized that there was not an accidental amount of complexity, and complexity hides a lot of crime. Complexity is one of those things, if you see things that are needlessly complex you should question why because it doesn’t have to be that bad and usually there’s a reason. A lot of the reasons in the credit card world were because these independent sales agencies, which stood between the banks and the merchants, were burying all sorts of fees and other charges inside that complexity. You’d sign this contract and you wouldn’t know what’s in the contract, but sure enough, over the course of a couple years you’d be watching money sucked right out of your bank account.

Jim McKelvey: If you take a normal credit card account, they actually have the ability to charge you whatever they want for whatever they want and they get to decide. It’s insane. As a small merchant I was familiar with how that worked, but when I switched sides and I started Square with Jack and the team and we started actually dissecting what actually needed to be there, most of that complexity was unnecessary. We created a much, much simpler system. It worked for millions of people.

Roger Dooley: Yeah, well I guess some of those processes are there to prevent fraud. I was a merchant many years ago when I had a mail order business, and I didn’t… Our volume was large enough that at least we didn’t have some of these ultra small business problems that you’re talking about, but still we had to deal with those really complex agreements and regulations and processes that added up to a huge amount of money for us on an annual basis. Not only that, things like a customer could process a large… They could give you a large order and while they still had the product in their possession they could tell the bank, “Oh we didn’t get it,” or whatever and the bank would immediately take that money out of your account, give it to the customer while they figured out what was going on. It was not pleasant for us but devastating.

Jim McKelvey: One thing that is not correct about what you said, they don’t give it back to the customer. A lot of banks keep it for themselves. As a matter of fact there’s a tremendous-

Roger Dooley: That’s even better business.

Jim McKelvey: Yeah, it turns out there were some banks, I can’t actually name their names because I got sued. There are some banks that keep the money from both sides during a dispute, and then they wait for the dispute to end and sometimes never settle it. I’d love to tell you the name. I can’t do it because I don’t want a bunch of lawsuits here, but it is not necessarily that you don’t have the money and the customer does. Many times that’s the case but a lot of times, especially in card not present transactions, both sides lose.

Roger Dooley: Well that’s good to know and fortunately not an issue that I’m dealing with these days. How did you deal with that as an intermediary in all this?

Jim McKelvey: What we did at Square was interesting. We had to reimagine the entire system because we picked a target that was so outside of the banking world that we couldn’t use any of the tools that existed. For instance there are standard contracts used for signing up for credit cards and we couldn’t use any of them because the people who those contracts were written for were not the people we were trying to serve, so those basic contracts didn’t work so we had to write different contracts. The people we were trying to serve had different credit scores, so you need typically a FICO score of a certain amount and typically history in business before you can apply for credit cards. Well our people had none of that and they weren’t going to have that, so we had to come up with our own underwriting.

Jim McKelvey: At the end of the day we had to invent so many different things that had never been done before, we did about 14 things differently from the rest of the credit card world. It was interesting because you would think, “Oh well Square is just like another credit card processor,” but in fact we’re not. We do so many things differently from the way you sign up, to the way we settle your funds, to the way we support you and give you software and hardware and don’t lock you into contracts. All these things have differentiated us significantly from the other companies. Because of that, an amazing thing happened and this is the reason I wrote the book, and that is about four years in Square was doing great and we got attacked by Amazon.

Jim McKelvey: When Amazon came in they did what they always do, which is they copy your product. They copied our hardware, they copied our software, they put the Amazon brand on it, which was a way bigger brand than Square’s brand ever was, undercut our prices by 30%, and this has always worked for Amazon. Amazon comes in, copies your product, undercuts you by 30%, and offers some stuff that you can’t offer, they win and they always win. When that happened a lot of people thought that Square was going to be destroyed, and for some reason we didn’t fall. A year later it was amazing, after running their standard playbook Amazon quit. To be fair, because actually I was pretty impressed with the way they quit. When Amazon relinquished their credit card operations, they actually mailed all of their former customers a Square reader and said, “Here, we’re giving up, go with Square.” Which I thought was super cool giving that they copied us to begin with and were trying to kill us for a year and then they turned it like, “Oh okay, well you guys. Here you go.”

Jim McKelvey: I couldn’t figure out why. I couldn’t figure out why we won. I mean I was happy we won, don’t get me wrong, but the question of how did Square survive when all these other companies, and I literally found a dozen companies that Amazon had run this playbook, copy your products, undercut your price, Amazon wins. That’s their game and they do it and they always win, and for some reason in Square’s case it didn’t work. I had to answer that question.

Roger Dooley: Mm-hmm (affirmative), so and I think it’s particularly impressive because Amazon is such a customer focused company, even the fact that they then gave away your reader at the end shows how customer focused they are, but if you had said, “Well Citibank came in and we crushed them.” I said, “Well okay yeah, that makes sense.” But when Jeff Bezos targets a market you’ve got a great story there. What were the keys, why did you beat them? Before you answer that I think that one takeaway that we went by there was that your innovation at Square was not primarily the device. People who might be vaguely familiar with the story say, “Well okay, they came out with that really cool little reader. It’s so tiny and it plugs into your phone. Man that’s brilliant.” I would say that most of the innovation on your part was in the process piece in dealing with everything, the regulations, the rules, the making things work the way they had to work given all the constraints you had in this environment.

Jim McKelvey: Yeah, so you’re exactly right. As a matter of fact we never successfully patented the Square reader. We screwed up the patent application, it was my fault on that, but we blew the patent app and as a result you are freely able to copy Square’s reader, at least the original one. There’s nothing we can do to stop you legally, and Amazon did that and a dozen other companies did that, and none of them worked. People thought that the reader was the key and it turns out the reader and the software, which are the two pieces that were visible, I mean they were unique but they were not everything.

Jim McKelvey: What happened in Square’s case was because we were forced out of the world of normal credit card processing, into this world where banks wouldn’t touch us and the credit card associations literally had to change their rules in order to allow us to run, we were so far out of the norm that we couldn’t use the tools that everybody else had. We had to invent our own tools, and that invention process was what created this thing I call the innovation stack and it was this case where you would start with one problem, for instance let’s say you got to read the credit card. Well an iPhone has no way to read a credit card, so we had to figure out a way to read the mag stripe and I built this little reader and that worked, but now we were breaking some of the rules of credit card reading.

Jim McKelvey: We had to confront those rules and get those rules changed. Because we were non-compliant with the rules we had to have a different type of underwriting and that forced us to take the risk. If a normal charge is charged back, the business is directly debited. Well in Square’s case our businesses are so small that they don’t have bank accounts that pass muster with the credit card companies, so we have to put our own balance sheet on the line. Square actually pays for those things and then we try to work it out with our customers. Everything about what Square did was different and when you add up all these differences you end up with this system that is extremely difficult to copy. It’s easy to do one or two things, but it’s hard to do 14 or 15.

Jim McKelvey: What led me to this insight I guess it was was asking myself, “Why couldn’t Amazon copy Square?” Then I looked at what Square actually was and it wasn’t just the reader and the software, it was all these different things. I thought about it and I was like, “You know, even Amazon, as competent as they are, would have a hard time doing 14 different things differently and doing them all well enough to displace us.” My guess is that at some point they were caught by one of the 14 things. They didn’t even know what they were getting into because this innovation stack is effectively an invisible asset of the company. A company does so many things differently that you don’t even know how they do it.

Jim McKelvey: What I did for the last three years was I’ve looked for other companies where this is applied and it turns out that at the beginning of every industry, you pick any industry like frozen food, or airplanes, or automobiles. You can pick anything, furniture, you will see one of these innovation stacks, you will see this process of really messy invention that leads to something totally new. Then usually the companies that develop that end up leading the world, they become the biggest, most powerful in that new vertical they’ve created.

Roger Dooley: Mm-hmm (affirmative), well and I think keeping that customer focused is important too. You describe in the book about how in the early days you had a choice in processing the credit card where one was a cheaper way of doing it but the other one would put a clear business name on the customer’s transaction as opposed to having multiple transactions show up from Square, which from a cost savings standpoint it would have been cheaper to put your label on everything, but you chose to take the more expensive way of doing it. Which it cost you money on every transaction but definitely made for a much better customer experience.

Jim McKelvey: Yes, no MBA would have done what we did. It seems counterintuitive to lose money knowingly just to create a better customer experience. Look, experience is critical and if your focus is truly on the customer… Look everybody says, “Oh I focus on our customer.” But yeah okay, great. We’re all going to do that when it’s nice weather and there’s no sacrifices to be made, but the question is when you’re going to lose money because of your customer focus will you do it then? A lot of times the answer is no, we’re not going to. Businesses make these choices all the time, but it was very clear in our case because we could see how much it was going to cost us extra to do that, but we made the decision to focus on the customer and then hope that later we could fix the problem in some other way.

Jim McKelvey: Actually that drove a lot of our innovation was trying to figure out a way to get our method of serving customer accepted by the greater banking industry. There are a couple of examples of that. There’s the one you mentioned, but the bigger example in Square’s case was we had a flat fee. Everybody else in the credit card world had two fees. There was a fixed fee plus a variable fee and we just had the variable fee. It turns out if you run the math, the fixed fee becomes significant as the size of the transactions falls. In round numbers if you charge something using Square that costs less than $5, we would lose money because we still had to pay as if we were a normal credit card processor to the banks and other institutions this fixed fee.

Jim McKelvey: It was our decision to make it simple for the customers, even in the cases where we lost money. We’ve lost several million dollars, I mean millions of dollars actually cumulatively to that decision. But it’s created a better customer experience because now I don’t have to explain this complicated fee structure. I could just say, “Oh, it’s 2.75%.” They’d say, “Of what?” I’d say, “Of everything.” The beautiful thing about simplicity is that if it is simple enough your message travels far, far further, and because Square had no advertising budget, we had no media when we started, we depended on our customers to be our sales force. I had to take every opportunity I could to simplify and Jack was doing the same thing, and actually the whole team at Square was pruning out complexity. Simplicity is almost a religious value at Square. We believe that the software should be simple and understandable, that the fees should be straightforward, we’re not going to trick you.

Jim McKelvey: But the benefit of that is that your customers can then tell your story. If the story has a 42 page contract that goes along with the story, no customer’s going to say, but if your story has these very simple ideas and a box that I’m pretty sure a lot of people don’t read to say accept, that is magical and that became our sales force.

Roger Dooley: Mm-hmm (affirmative), yeah I can’t argue with that, particularly in that particular business where I recall some of the things we had to deal with where there were minimums and maximums and cap transactions and ranges. If you’re in this range you get a better rate and so on and so on. Makes a huge amount of sense. Skip over to again your early days talking to venture capital investors and there’s social science research that shows that you are more persuasive if you admit to a fault or give people something small as opposed to simply a glowing pitch for whatever you are trying to persuade them to do. You guys included a slide with 140 problems that could cause the company to fail, 140 is pretty extreme but apparently that worked out. Did that actually give your pitch credibility?

Jim McKelvey: Yes, so we put a slide in the pitch deck. Just when everything was going well we told them all the reasons we could fail from Visa not liking what we were doing to a robot uprising. We literally left nothing unturned and undisclosed. It had a very wonderful effect on the pitch meetings because normally there’s this attack and defend mentality in the room of a VC pitch, and typically the entrepreneurs are up there saying everything that’s good and the venture capitalists are sitting back trying to figure out every problem that the entrepreneur’s not talking about. By putting literally everything we could possibly think of up on one slide we changed the dynamic in that room and it became more collaborative.

Jim McKelvey: After we had discussed that the mood changed and the VC’s were more like our partners at that point discussing how we could solve those problems and if it was a real problem and a significant one. It changed the whole vibe in the room. As somebody who’s now a part-time venture capitalist, I would say if you’re pitching don’t hide the warts, don’t hide the stuff that is negative because first of all you’re probably not going to sneak it past any good VC, but secondly if you don’t try to sneak it past your credibility goes way up. I think it helped us because then we said some things that were positive and they believed us because we’d been honest.

Roger Dooley: Mm-hmm (affirmative), yeah and I think that can work not just in VC pitches or looking for financing, but even in selling a product, selling a service. Chances are your product or service is not perfect for every application at least and if you can point out where it might not work that’s going to make the positive things you say a little bit more believable. You see that all the time. Everybody wants to go in the yep, what we got is perfect and trust us so we got this. That really creates doubts in the minds of buyers, investors, and everybody else.

Jim McKelvey: Yeah, hey I’m not on Tinder. Couple of my friends are and I watch them swiping right and swiping left and look, nobody believes that stuff. It probably even works on the online dating world. This idea that you have to present perfection is laughable because nobody’s perfect. My God, and we all have flaws and look, if you admit your flaws others can decide for themselves if that’s something they can live with. If they can’t it’s not like you’re going to hide that flaw forever. They will figure it out, and believe me, the way the turn sheets look, they will probably figure it out before you get the money. Don’t waste everybody’s time trying to be perfect. I’d say be honest but that’s a terrible way to say it. I would say openly discuss the problems and watch how the conversation changes.

Roger Dooley: Right, well if you don’t bring up a problem then chances are the person across the table is going to be the one that is mentally figuring out what those problems might be and bringing it up there and then realizing that if you haven’t said it either you aren’t being totally candid or that you’re too dumb to have thought of it. Neither is a good way to go.

Jim McKelvey: Yes, and there’s another psychological trick here, and that is if I’m the person to think of something I put a stronger emphasis on that. If I think there’s a problem and it’s my idea, then I am going to defend that idea, I’m going to try to make myself right, we all do this. But if you are pitching me and you say exactly the same thing before I formed the thought then it’s your idea and I’m like, “Oh well, Roger I don’t care as much about your ideas.”

Roger Dooley: Maybe you’ll even decide to attack it because it’s my idea not yours. That is great advice Jim. I hadn’t looked at it from that standpoint but that’s really totally true. While we’re on the topic of psychology, one other thing that I found interesting was in your early market research phase where you were comparing product designs and you showed people prototypes and you had a little tiny prototype and then a larger one, and people found the tiny one remarkable and cool but oddly only if they saw it alone, not next to the bigger one. What was going on there do you think?

Jim McKelvey: Since this is audio only I’m going to have to describe the readers for those of you who had not seen Square readers. The typical Square reader is about an inch long and the credit card mag stripe is about three inches of metallic particles on plastic. In order for that to read correctly it has to travel smoothly across the read head, in other words not wobble. If you’re putting something that’s three inches long like a credit card across a base that is one inch long it wobbles, and everybody has problems with this. When we tested our little readers, which used to be even smaller. The ones I originally built were even smaller, they wobble, and as a result of that it screws up the read so that the small readers read at best 80% of the time in the hands of a novice.

Jim McKelvey: What I did is I saw this problem and I said, “Oh, well I’ll build a wider reader that won’t wobble.” If you look at actually any of our competitors they’ve adapted the wide reader because it works better, it’s physically better, it’s absolutely superior. I tested these two readers. I built both and I showed them to people and we actually manufacturer both. I did a little test and what I noticed was really interesting. If I tested them together everybody liked the wider reader because it worked better and they were less embarrassed. But if I showed them the readers separately, I showed them the wide reader they were like, “Oh well, you ran a credit card, big deal.” But if I showed them the little reader they were blown away.

Jim McKelvey: They were so captivated by its size it was impossibly small. It was so tiny and it really grabbed their attention. What I realized was that by sacrificing a little of the performance of the physical card reading I could get a tremendous payback in users attention, and when you see something that is impossibly small do something amazing like read a credit card, it gets your attention if only for a couple of seconds. That was one of the critical decisions that we made at Square was to take a giant risk and build something that was really cool and really attractive but didn’t work as well as it could, but boy it got your attention. Then what we noticed was that people, because it didn’t work perfectly, would have to practice a little bit so now I’ve got customers literally rehearsing using my product. Then when they learned how to use it they were so proud of themselves they’d show other people. They’d be like, “Oh I can do this. Oh look at me.” They’d start these conversations.

Jim McKelvey: The small reader was ultimately I think a very good way of getting people’s attention. It is so hard to get somebody’s attention. If you have a new idea, if you have invented something that is truly new one of the worst things that the world will do to you is they will look at it and lump it in with something that they already understand. Square, credit card processing, hey we’ve all seen credit card processing, who cares? Okay, and if I built a reader that looked like everybody else’s and they swiped your credit card who cares? You’re not going to notice.

Jim McKelvey: But I do it on this tiny little device and all of a sudden you’re saying, “What was that?” Then the response is, “Oh it’s this new thing called Square and here are all the other things that are cool about it. There are no fees, you can sign up instantly, they send you the hardware for free, there’s no cancellation, they settle the money to you the next day. You get all this cool software, you got these other tools to run your business.” Those conversations start because you get a moment of attention and getting that moment is so difficult, especially if you’ve invented something new.

Roger Dooley: Makes a huge amount of sense. One last question Jim. You’ve been working on Invisibly for a few years now, what can you tell us about that? The website doesn’t seem to give much away.

Jim McKelvey: That’s an experiment to figure out how to allow people to take control of how their eyeballs are bought and sold online. You may not realize this or you may, but nothing is free. All the stuff you think of as free you’re actually supporting it by giving your attention to advertisers who in turn pay the publishers, but that system is broken for a bunch of reasons that would probably take up the rest of your podcast time.

Jim McKelvey: I’ll say that it’s a broken system and all of us as individuals should have control of how our eyeballs are bought and sold, and Invisibly is an attempt to do that. The best I can say right now is it works on paper. We do not have a working system yet, but we have hundreds of media partners and a bunch of really good engineers and designers who are building something that we think will work or at least can work. Should we talk about the difference between business people and entrepreneurs, is that a good segue here?

Roger Dooley: Sure if you want to go in that direction.

Jim McKelvey: This is a differentiation that I have to make in order to have a conversation. The word entrepreneur today applies to every business person. You can open a coffee shop you’re an entrepreneur. But the thing is, coffee shops have been done. You don’t have to invent anything to open a coffee shop. You can find coffee shops, you can copy from half a dozen different models and open a coffee shop. That makes you a successful business person. The word entrepreneur originally when it was used, almost 200 years ago, was a term that applied to people who did stuff that had never been done before, it was not a business person. It was not somebody who was doing something that the world recognized, it was doing something that the world didn’t recognize.

Jim McKelvey: If you’re going to do something that the world doesn’t recognize you then have this thing that makes you different, it makes you an entrepreneur. What I do in the book is I say, “Look, most of the stuff we talk about in business turns out doesn’t work in the world of entrepreneurs. In the world where you have created something new that the world has never seen before, you have a different set of problems.” What we do is we discuss how those problems look. By the way, there’s no judgment here. If you want to make money start a business. Businesses are the way to make money. Entrepreneurship usually fails, but if you want entrepreneurship to succeed there are some tricks, and the reason we don’t discuss this is because today we don’t really have a vocabulary. If I say entrepreneur you think of any businessman, the words are interchangeable these days.

Jim McKelvey: The first thing I did when I had to write this book was I needed a new vocabulary so I started off by saying, “Look, if only for the next couple of chapters we’re going to talk about how different it is to do something that the world has never seen before because you have a different set of problems.” It’s one of those things that doesn’t get discussed.

Roger Dooley: Mm-hmm (affirmative), it’s a really great point because you’re right, today just about everybody who starts a business is an entrepreneur and there’s nothing wrong with that, but there are different grades and doing something that is really totally novel is really a small portion of those folks. Let me remind our listeners that today we are speaking with Jim McKelvey, co-founder of Square, founder of Invisibly, and author of the new book The Innovation Stack, Building an Unbeatable Business One Crazy Idea at a Time. I have to say what a fun read this book is. It’s got great ideas in it, but beyond that there’s really plenty of things that will make you laugh and maybe even out loud, which is a pretty rare combination in a business book. Jim, how can people connect with you and your ideas?

Jim McKelvey: The book is published by Penguin and there are links at JimMcKelvey.com. So little confession I don’t use social media, I’ve never been able to balance my life well enough to have an extra 50 hours a week to have an online virtual existence, but I did put up a website JimMcKelvey.com where you can go and not just see the book but see all these other interesting things that I think people should be aware of. The book’s for sale everywhere. I will tell you this, because you’re probably going to run this before March 10th and March 10th is when the book actually officially goes on sale. The book itself went through a radical change.

Jim McKelvey: When I was writing it a lot of the stories that I was telling about these entrepreneurs throughout history seemed to me like superheros, and there’s this one guy A. P. Giannini who’s this total badass from 100 years ago. I was writing a story and I thought, “Oh my God, this shouldn’t be told as a text narrative, this should be a comic book.” I switched to a graphic novel and I started drawing pictures. My book abruptly switches to be a graphic novel halfway through.

Jim McKelvey: I wrote the whole book and it switches graphic novel, text, graphic novel, goes back and forth. I send this into the publishers at Penguin and they go, “No, no way, you can’t do this because a lot of people use audio, they listen to books on tape, audiobooks, so graphic novels don’t work as audiobooks, and ereaders graphic novels are really disastrous ereader experience.” My publisher said, “Forget it,” so they cut out all of the graphic novel part and made me rewrite it as text. I was so in love with the cartoons that I actually made a comic book, which is a parallel version of the book and it’s not for sale, but if you go to JimMcKelvey.com I will give you a free copy of the comics because I love the drawings, I love the tale. Frankly, if you get the comics you don’t have to read parts of the book. You can skip chapter nine entirely and read it as a comic. I think it’s actually better as a comic.

Roger Dooley: We won’t tell your publisher that Jim.

Jim McKelvey: Well look, I told them. I mean this is what happens when you sign up as a publisher who’s a Batman villain. The Penguin, I should have known better. They signed the book and in the first meeting they’re like, “We got something to talk to you about.” I was like, “Oh no, you’re killing the fun part.” Look, have fun with this stuff. There is so much seriousness but look, if you’re going to do something new you are going to fail, you are going to have calamities, and buddy that’s the best comedic material you can possibly imagine.

Jim McKelvey: Nobody wants to talk about success, people want to talk about how’d you get that cast? Tell me about that scar Roger because that’s what I want to hear. You’re going to be doing these very different weird things and if you don’t have a sense of humor about it you’re missing so much joy. Yeah, there are a lot of jokes, a lot of bad jokes in the book, it’s not that serious a tone, it’s a quick read, and halfway through it turns into a comic because some of this stuff is silly. Also, because sometimes it’s fun to draw a guy in a cape.

Roger Dooley: Great, well one of our few guests capable of doing that I think too. In any case we will link to Jim’s website, to the book, and any other resources we mentioned on the show notes page at RogerDooley.com/podcast. We’ll have a text version of our conversation there too. Jim thanks for being on the show and good luck with the book.

Jim McKelvey: Roger thank you so much and all the best to you.

Thank you for tuning into this episode of Brainfluence. To find more episodes like this one, and to access all of Roger’s online writing and resources, the best starting point is RogerDooley.com.

And remember, Roger’s new book, Friction, is now available at Amazon, Barnes and Noble, and book sellers everywhere. Bestselling author Dan Pink calls it, “An important read,” and Wharton Professor Dr. Joana Berger said, “You’ll understand Friction’s power and how to harness it.”

For more information or for links to Amazon and other sellers, go to RogerDooley.com/Friction.