The State Of Innovation 2023: Supplier Benchmarking

Over the spring and summer of 2023, PPAI Media asked industry suppliers of all sizes a series of questions to assess their status on a number of technological fronts.

The following survey questions, which were also used to score the inaugural PPAI 100’s Innovation category, reveal how suppliers at multiple competitive bands in the marketplace compare to one another.

Suppliers: How does your firm stack up to the competition, and are there areas you can improve or update?

Ideally, the percentage of suppliers offering real-time inventory should exceed 90% across all revenue brackets, according to Jeison Ortega, chief technology officer at Charles River Apparel, the No. 44 supplier in this year’s PPAI 100. The Massachusetts-based company ranked as the No. 44 supplier in this year’s PPAI 100, earning high marks in the innovation category.

“Given that most systems already have access to this data, the advantages of sharing it with distributors far outweigh the implementation efforts,” says Ortega, also a member of PPAI’s 2023 Technology Committee. “It’s important for the entire industry to recognize and act on this trend for optimal supply chain efficiency.”

“The data clearly highlights the promo industry’s shift toward technological integration in the ordering process,” Ortega says.

Notably, while 43% of suppliers with under $5 million in revenue are integrating through platforms like PDX or PromoStandards, only 29% offer real-time inventory on their websites (see Table 1). “This suggests smaller suppliers prioritize external platform integrations over their own real-time systems,” says Ortega, adding that this trend merits further exploration.

Through PDX, suppliers’ inventory and order status information becomes available to 45,000 SAGE users with a single integration. Joe Effertz, president of Minnesota-based supplier Black Forest, understands the impact of standards integration on customers.

“We believe that a more frictionless transaction will be the gold standard for our industry to grow and compete with the direct companies,” Effertz says.

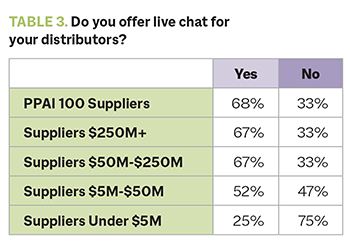

Effertz says offering live chat is imperative in 2023.

“As distributors hire more Gen Z, we need to meet them at their level and have this option available to communicate,” he says. “We’ve even explored Discord servers as an option, but the industry hasn’t embraced this avenue of communication yet.”

Given the popularity of live chat in customer service outside the promo industry, Ortega is surprised that there aren’t more suppliers offering the tool. “It’s likely that these numbers will increase as more companies recognize the shift in customer preferences towards chat-based inquiries over direct interactions,” he says. “The current trend among suppliers, especially smaller ones, underscores the need to adapt to evolving customer expectations.”

Shawn Reed, director of IT at Minnesota-based Showdown Displays – promo’s 14th leading supplier in the PPAI 100 – believes the results are on point.

“Larger suppliers typically have an IT group in place that they lean on for cybersecurity, which makes it less of a concern for senior executives – this is my case,” says Reed, a member of PPAI’s 2023 Technology Committee. “Whereas the smaller suppliers – if they don’t have an IT group – pay managed services to control the security and are sent the results usually on a monthly basis.”

Ortega adds that it’s reassuring to see most senior executives reviewing vulnerability reports within a monthly timeframe. “Given this attentiveness, I’d be intrigued to find out the portion of their budget allocated to cybersecurity measures,” he says. “Such data suggests a strong recognition of cybersecurity’s importance. This could be a prime moment for industry leaders to spearhead standardization efforts in how distributors and suppliers link their systems.”

Ortega expects the percentages indicating newer installations of enterprise resource planning systems to increase in the coming years across all supplier categories, especially those who updated their systems more than 10 years ago, because “the declining cost of storage and computing power makes it more feasible for companies to adopt newer, more powerful cloud-based ERP systems.”

However, he adds, it’s important to note that with the rapid integration of technologies like AI and machine learning, the ERP systems of today may undergo substantial transformations. “The ERP we know now could look markedly different in the next five years,” Ortega says, “incorporating smarter, more automated features and maybe even evolving beyond the traditional scope of ERP as we understand it.”

Reed says you can view these results in one of two ways:

“Find a good vendor, keep using them, and the data doesn’t need to change,” he says. “Or use a vendor in a pinch (good or bad) while your sourcing team is working on the next vendor or negotiating contracts with current vendors. The data shows that trend with most in the last six to 12 months.”

Considering that “most companies have multiple projects going on at the same time,” Reed agrees that time constraints and lack of resources are the biggest hurdles in most suppliers’ integration processes. It also makes sense that suppliers with under $5 million in revenue would cite money as a major obstacle.

Among those answering “other,” some said they had no hurdles. Common explanations tended to include complexities unique to the organization. Inadequate communication channels between supplier sales reps and technical liaisons at distributor companies were also cited, along with a general lack of adherence to industry standards.

No surprise here, according to Reed, who points to how busy suppliers are and how important it is to improve efficiency. “If I can have a client be able to find or get their purchase order without the need to call my customer service line, then I’m all for it,” he says. “I wonder if the smaller suppliers feel they add a personal touch by talking directly to the customers or if they don’t have the budget for a customer line.”

Effertz adds: “This builds on the frictionless data exchange that PromoStandards and PDX are implementing. Double-keying only creates the opportunity for mistakes.”

“Being cloud-based allows for reduced capital costs and for your partners to continually upgrade the product in terms of security and product features,” Effertz says. “We live in a connected world, and this allows for additional flexibility for work-from-home opportunities.”

Ortega adds that the presence of an on-premises active directory or print server would technically categorize an organization’s infrastructure as hybrid, which might not fully capture the essence of its cloud adoption strategy.

“A more revealing question might focus on the percentage of business-critical systems that are cloud-based as opposed to on-premises,” Ortega says. “If that were the basis of the inquiry, I would expect to see a significant uptick in the number of organizations that are 100% cloud-based for their mission-critical applications and services.”

“Microsoft was smart to include Teams as part of its 365 package, which is more attractive to companies as a whole,” Reed says. “Similarly, one for the other category – Google Chat – comes with the G-Suite of tools. In my travels, Slack was used primarily by internal IT teams at an additional cost to the company.”

Effertz adds: “Microsoft has done a great job giving smaller companies the ability to streamline and collaborate across multiple locations. This is super-important for our industry and will continue to allow us to grow.”