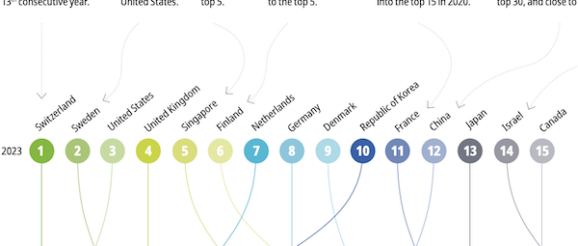

United States Slips Back to Third Place in WIPO’s Global Innovation Index 2023

“While the number of VC deals tracked by the Index increased by 17.6% in 2022, the total value of those deals saw close to a 40% decline.”

Source: WIPO Global Innovation Index 2023

On September 27, the World Intellectual Property Organization (WIPO) released the Global Innovation Index (GII) 2023, providing a snapshot of the relative performance of innovation economies across the world. While this year’s Index reflects mostly positive news about the state of global innovation, a slight drop in the United States’ overall ranking should encourage policymakers to advance efforts that would address issues with the country’s innovation engine.

U.S. Loses Grounds Despite Top Rankings in Unicorn Valuation, University Quality

While Switzerland remains the top innovation economy ranked by WIPO’s GII, a position it has maintained since at least 2019, Sweden has leapfrogged the United States to a second-place ranking in this year’s Index. Previously, the United States had held the third-place ranking in the GII from 2019 through 2021, so in some ways this year’s result is a return to normalcy. The U.S. ranked first in market sophistication criteria and second in both business sophistication and knowledge and technology outputs criteria, but the nation ranks 25th among all innovation economies in the GII’s measure of infrastructure criteria.

A more detailed breakdown of the GII’s profile for the United States shows that the nation is an outperformer when looking at innovation performance in relationship with income levels as measured by gross domestic product (GDP) per capita. Criteria assessed by the GII pushing the United States’ overall rank higher include the number of citable documents, the nation’s software spending as a percentage of GDP, and the intangible asset intensity among the nation’s top 15 intangible asset companies. Dragging the nation’s ranking downward were low implementation of international standards for both quality and environmental management as well as a low percentage of graduate students enrolled in science and engineering programs.

The combined valuation of unicorn companies, a new factor incorporated into this year’s GII, was another metric contributing positively to the United States’ ranking. The U.S. placed 1st overall in this metric, buoyed by large valuations for commercial space developer SpaceX, payment processor Stripe and software developer Epic Games. Our nation also achieved the top rank globally for university quality thanks to top scores for the Massachusetts Institute of Technology, Stanford University and Harvard University. Other key criteria for which the United States ranked first in this year’s Index include intellectual property receipts as a percentage of total trade and the value of venture capital (VC) investment received in 2022.

East Asia Achieves Dominance in Number, Size of Science and Technology Clusters

China did not see the kind of tremendous leap in innovation rankings during 2022 that the nation has been enjoying in recent years. China’s ranking dipped slightly from 11th to 12th overall in the most recent version of the Index, although it remained the only middle-income economy ranking among the top 30 innovation economies. Middle-income countries have made the strongest gains in recent versions of the Index and the GII’s top 65 innovation economies includes Turkey (39th), India (40th), Vietnam (46th), the Philippines (56th), Indonesia (61st) and Iran (62nd).

Source: WIPO Global Innovation Index 2023

Around the world, East Asia is perhaps the region currently enjoying the strongest environment for innovation economies. That area of the globe is home to the world’s five largest science and technology (S&T) clusters, with Japan’s Tokyo-Yokohama S&T cluster grabbing the top spot in the GII’s cluster rankings, which were announced one week in advance of the full GII’s publication. China is home to three of the world’s five largest S&T clusters and hosts a total of 24 clusters included in the GII’s rankings, although the United States hosts the second-largest total with 21 S&T clusters. WIPO’s S&T cluster rankings are informed by analysis of patent filing activity and scientific article publication to identify geographical regions with the highest density of inventors and scientific authors.

This year’s GII contained positive news regarding the value of R&D activities, although certain findings highlighted a shaky environment for VC investment. In 2022, the top corporate R&D spenders tracked by the GII increased their total expenditures by 7.4% up to $1.1 trillion USD. Globally, R&D expenditures increased by 5.2%, down from growth rates seen in 2021 but closely tracking pre-pandemic performance. While the number of VC deals tracked by the Index increased by 17.6% in 2022, the total value of those deals saw close to a 40% decline. High interest rates and other tight financial conditions are expected to continue creating uncertain headwinds for VC investment.