Unpacking the Black Box of Payer Policy: A Demand-Side Approach for Equitable Uptake of Cost-Effective Health Innovation | Center For Global Development

Over the past two decades, global health innovation has delivered important new tools for use in low- and middle-income countries (LMICs) and saved many lives. Nonetheless, the current innovation ecosystem suffers from significant limitations that are likely to worsen with aid transition. These include a dependence on donor push funding, which can distort research and development (R&D) priorities and crowd out private sector investment; “product pileup” of donor-funded innovations with little actual demand in LMICs; low diffusion and uptake of cost-effective innovations, leaving potential health gains on the table; and remaining gaps in R&D for major LMIC health needs, such as tuberculosis.

In this note we seek to better diagnose and address these challenges through a demand-side approach—that is, to consider how better payer policy in LMICs, supported by international actors, can create a more effective and sustainable ecosystem for developing and disseminating health innovation to individuals in need. We conclude with a proposal to establish an Innovation Uptake Institute to serve as an honest broker between country payers and suppliers, helping payers to bolster their strategic capacity through market intelligence, capacity-building, and shared technical resources.

Related Experts

Financing patterns for global health are changing rapidly, with important implications for health technology innovation. The number of low-income countries is shrinking (there are now 31 based on the latest World Bank classification), while the collective GDP of the Emerging 7 (E7) economies is set to overtake the G7 by 2030; in turn, aid is receding across low- and middle-income countries (LMICs). Recent CGD analysis suggests that governments are slow to increase expenditure on public health products following aid transition; instead, private expenditure—mostly out of pocket—rises quickly to meet growing demand. Scarce government expenditure is often not targeted to the most cost-effective health interventions but instead used to cover curative and higher-level care demanded by vocal, growing, urban populations. This spend is largely unorganized, often inefficient, and almost always inequitable.

These expenditure and behavioural patterns threaten both (1) the rapid uptake of cost-effective innovations; and (2) research and development (R&D) expenditure for health innovation targeting the needs of LMICs. When countries fail to adequately fund health innovation and/or systematically evaluate the appropriateness of new products for government subsidy or purchase, they also create market uncertainty and fail to send clear market signals, dissuading the private sector from investing its resources in R&D or the expansion of needed manufacturing capacity. And once innovative products come to market, countries are likely to make inappropriate adoption or non-adoption decisions—simultaneously using scarce resources to fund expensive treatments for a select, articulate, few while overlooking new cost-effective innovations with the potential to transform their citizens’ health.

In this note we seek to better diagnose and address these challenges through a demand-side approach—that is, to consider how better payer policy in LMICs, supported by international actors, can create a more effective and sustainable ecosystem for developing and disseminating health innovation to individuals in need. We first review the current state of innovation and uptake across LMICs, highlighting points of dysfunction. In this context, we identify the lack of coherent and strategic payer policy as a key constraint to widespread uptake—one that is largely unaddressed by current donor initiatives. We conclude with a proposal to establish an Innovation Uptake Institute (IUI) to serve as an honest broker between country payers and suppliers, helping payers to bolster their strategic capacity through market intelligence, capacity-building, and shared technical resources.

Today’s Innovation and Uptake Ecosystem

Today, most innovative health products that penetrate LMIC markets do so through one of two channels. The first channel—a limited private sector market—primarily targets the richest subgroups of LMICs with products that were already developed to serve more lucrative high-income markets. The wealthy in these countries can pay out of pocket or via some form of private insurance, but poorer populations remain largely neglected. And many innovative products never even reach LMIC markets; for example, of the 330 new chemical entities launched worldwide between 2007 and 2016, a recent CGD analysis found that only 21 were available at any price in French West Africa.

More commonly, donor push funding—primarily from the Bill & Melinda Gates Foundation and typically channelled through product development partnerships—helps maintain an upstream innovation pipeline for diseases of the poor. Downstream market shaping efforts and pooled procurement (using development assistance for health) facilitate some degree of product uptake, but at levels that frustrate donors, given the size of the investments they have made.

However, the current model of extended and intensive push funding is problematic for several reasons:

For now, despite ongoing push investments, major gaps in the innovation landscape remain. For example, innovation for new tuberculosis (TB) drugs is badly underfunded and largely reliant on public and philanthropic resources, (primarily the US government and the Bill & Melina Gates Foundation).[1] In the absence of coordinated demand and a credible market, private investment in TB R&D has been in steady decline; strikingly, multinational companies invest less than 0.05 percent of total private R&D money on the world’s most deadly infectious disease.

Even when push-funded innovative products targeting LMIC health needs make it to market, adoption can sometimes be slow or nonexistent—meaning anticipated health gains go unrealized. For example, Bedaquiline was approved by the US Food and Drug Administration (FDA) in 2012 and by the European Medicines Agency (EMA) in 2014 as a breakthrough treatment for drug-resistant TB. However, the WHO subsequently issued guidance on the use of Bedaquiline with restrictive, against-the-label indications (in 2013 and again in 2016). As a result, J&J (the manufacturer) is facing a limited market, exacerbated by weak country-level procurement mechanisms, no/limited volume commitments, high production costs, and calls for genericization by civil society, all leading to weak market penetration and shortages (e.g., China).

On the demand side, there are some early signs of progress, but they are not, by themselves, sufficient to drive innovation uptake. Some countries are beginning to pool expenditure; others are building strategic, evidence-informed processes to drive product selection, the design of benefits packages, and procurement; and some others are making progress on both fronts. Of particular importance are the institutionalisation of Health Technology Assessment processes[2] and consideration of pooled procurement mechanisms,[3] though in many countries these efforts remain nascent, small-scale, or poorly integrated into the procurement process. Regulatory harmonisation has also been a major policy innovation but remains slow-moving in practice. Finally, WHO policy guidance can play a helpful role in informing product selection—but because guidance documents are developed centrally, they are understandably unable to fully reflect local feasibility constraints, priorities, and budgets, constraining their wide applicability. And despite the great degree of uncertainty on the comparative effect of new treatments in emerging markets, there is little appetite for experimenting with the use of real world evidence or market entry agreements now routinely used in high-income countries (HICs) systems.

The combined weight of these forces suggests a grim outlook for future global health innovation and uptake. We are likely to see:

Unravelling the Black Box of Payer Policy

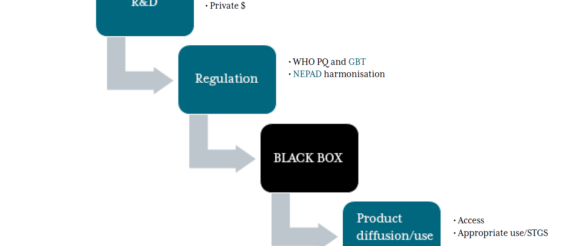

One key missing ingredient in this ecosystem—and the opportunity to change the current trajectory—is the understudied black box of payer policy (Figure 1). By building coordinated, evidence-informed, and well-governed purchasing processes, LMICs payers can increase the efficiency of their spending; improve the health of their populations; ensure wide access to and uptake of cost-effective health innovations; and incentivize private-sector R&D investments that target local health needs.

Figure 1. Unpacking the black box of payer policy

See links for GMRI, GBT, and NEPAD.

Importantly, however, payer policy cannot fully substitute for other steps in the value chain (Figure 1) that drive innovation uptake. Payer policy is most effective when complemented by a robust regulatory environment, improved fiscal space, and strong delivery platforms; investments in relevant policy initiatives in these areas by donors, manufacturers, regulators and the WHO should therefore be continued and strengthened.

Specifically, we see a need to strengthen country payers through (1) better national purchasing functions; (2) effective support from international bodies and institutions to inform national purchasing; and (3) international cooperation, with large middle-income countries at the helm, to coordinate and/or pool demand. Ten tools stand out as particularly promising:

Table 1 maps the problems identified earlier onto the 10 solution tools set out above. We do so by grouping the problems into the three component parts of the product lifecycle:

Table 1. Mapping challenges with support tools that can offer solutions

| Identified Challenges | Applicable Support Tools |

|---|---|

|

Discovery and Development (LMICs need more of the “right” new products and fewer “wrong” products) • Lack of clear market signals limits (i) efficient, equitable, uptake and, therefore, (ii) private sector investment in R&D and manufacturing to deliver innovative products to LMICs. • Donor-funded push funding may be generating products that are inappropriate or unaffordable for the intended beneficiaries, who may nonetheless be pressured to adopt them. Donor funding is also limited, and many high-burden countries face a transition from external health assistance. • Most multinational companies respond by focusing on out of pocket or richer population subgroups. Donor push funding has created upstream pipelines, but donor funded market shaping has had limited impact on uptake. • For now, despite ongoing push investments, major gaps in the innovation landscape remain. |

• Scientific advice/early HTA • Market Intelligence Templates • Appropriate use of domestic industrial/science policy • Strategic procurement and contracting including Value-Based Advance Market Commitment (MVAC)-type solutions |

|

Market Entry (Products do not get through the barrier of obtaining a licence, or a price, or a listing for public procurement) • There is evidence of improved procurement, use of evidence informed HTA, and regulatory reform, but much more needs to be done. • LMICs need to spend more on health care, but, importantly, they need to spend money efficiently. |

• Horizon-scanning • Value-based tiered pricing • Use of HTA • Pooled strategic procurement and contracting |

|

Delivery/uptake (Products do not get used in an optimal way to meet local health need.) • Tools used in HICs to facilitate and manage uptake, such as market entry agreements and the collection of real-world evidence, are rarely considered in LMICs. • Adoption of high-profile new interventions can sometimes be slow or nonexistent, and anticipated health gains often go unrealized. |

• Budget planning tools • Use of Managed Entry Agreements and collection of credible real-world evidence • Role of private multinational companies in improving access in-country, beyond pricing • Pooled strategic procurement and contracting |

The Way Forward: An Innovation Uptake Institute (IUI)

The opportunity cost of inaction is significant. To extricate the global community from the dysfunctional status quo, we propose a concerted, multi-stakeholder effort centred around and led by a new entity, the Innovation Uptake Institute (IUI). The IUI would serve as:

Such an institute would not be a panacea but would begin to address some of the challenges identified in the previous sections. The IUI would aim to crowd in private investment in disease areas currently deprioritised by conventional industry by quantifying potential market size and supporting better coordinated/pooled demand. We envision it having a broad remit, including products yet to be developed, under development, or already in the marketplace; and serving a broad coalition of country payers and development partners.

Most importantly, though the IUI would focus on demand-side strengthening, the IUI itself would be fiercely independent from both the demand and supply sides—from suppliers, payers, and advocates alike—in order for its products and support activities to be trusted and effective. In this way, the IUI is differentiated from typical market access functions, which are usually tasked with maximizing uptake of a product and related revenues. In contrast, the IUI will aim for optimal uptake of a technology from the point of view of LMIC societies, addressing problematic behaviour already observed on both the demand- and supply-sides that prevents access to cost-effective innovation. In some cases, it is payers that block or delay uptake of cost-effective products that their populations need. New HTA mechanisms can be used to block access and contain costs. In other cases, suppliers promote products whose prices, given their comparative effectiveness, do not represent good value for money within a given health system. IUI would seek to enable the most appropriate (timely, cost-effective, and clinically and culturally relevant) uptake of a given technology—with the understanding that not all innovations will or should be adopted in every environment.

Sitting downstream of regulation but working in close coordination with NEPAD and WHO’s GBT initiative, the Institute would carry out, commission, or encourage a series of activities critical to the equitable uptake of cost-effective and locally appropriate products. These efforts would both build national capacities for these functions as specific markets become wealthier and develop economies of scope[7] by offering differentiated but comparable support to a number of countries. By bringing all these functions together, the Institute would offer innovators and payers the chance to leapfrog the bureaucratic obstacles often faced by their counterparts in HIC settings. Figure 2 offers a list of possible functions.

Figure 2. Suggested Institute functions

With the triple role of a convening platform, a data observatory, and a problem-solving resource, the Institute could offer:

How would the IUI be financed?

The Institute would need to pursue a mixed funding model, albeit with a dependence on donor grants at early stages and when targeting the poorest geographies with very limited ability to pay. Industry funding should also be available, given the importance of getting clear market signals, and, increasingly, country payer and private insurance, all in the context of very strong conflict management rules. A stakeholder board with paying constituents including bilateral donors and large payers (UK, Germany, China, India, Brazil, RSA); philanthropists (BMGF, OPP, CIFF); WHO; industry (from HIC and MIC); and investors (CDC, Bridges, IFC) could be considered, including membership from emerging market payer schemes. The IUI could also consider spinning off self-funded social enterprises to tackle specific functions. For example, one could imagine a social enterprise intermediary between payers and industry to oversee/assist with HTA; use HTA to facilitate price negotiations in a neutral space; and take a small cut of subsequent sales to cover operating costs.

IUI could be linked with world class universities and with select in-country units incubated in existing institutions (e.g., Africa CDC; regulator networks/NEPAD) with a remit to carry out analyses to inform early pilots including gathering economic and market access data and developing product launch plans for the selected pilots in collaboration with payer entities.

In a crowded, dysfunctional, and likely unsustainable global health innovation ecosystem, payer policy remains an understudied and neglected function within the innovation value chain. By systematically and strategically strengthening payer policy, potentially aided through the establishment of a dedicated Innovation Uptake Institute, the global health community can begin to address some of the deep challenges related to misaligned innovation and low uptake of new and cost-effective products—improving access and health outcomes across LMICs.

We are grateful for helpful feedback and suggestions from Prashant Yadav and Ganesh Ramakrishnan. All errors and omissions are our own.

[2] See here, here, here and here for some examples.

[3] India, for example, is beginning to legislate use of HTA in the context of its fast expanding “Modicare.” China has also used basic HTA methods to inform its vast and growing procurement experiment (4+7); it now regularly uses HTAs to inform listing and pricing negotiations with domestic and multinational companies through the Medical Insurance Administration

[4] See Chalkidou, Yadav, Silverman, and Claxton, 2020 (forthcoming). Value Based Tiered Pricing for UHC: An Idea Worth Revisiting. for further discussion. Discussions on Tiered Pricing especially in the context of co-financing and aid transition are linked with global procurement architecture and market shaping. They are of direct relevance to GFATM and Gavi as well as to DFID and other national aid bodies.

[5] For a discussion on LMICs see here.

[6] Alignment with payers (HTA) and regulators (early scientific advice) is of the essence as is learning from early experience of European nations in this space (e.g. see here and here).

[7] Baumol, W J., 1982. Contestable Markets: An Uprising in the Theory of Industry Structure. American Economic Review.72, 1-15.