The five ‘innovation areas’ driving success in chronic diseases – PMLiVE

We have seen enough technology come and go in recent years to know that innovation alone isn’t enough to guarantee success.

Just think of Google Glass. Despite the huge buzz generated before its launch and declarations of a moonshot innovation by its creators, the product flopped. As well as the well-publicised privacy issues, the creators never fundamentally defined the problem that the product was solving for its potential users. There was an assumption that the product would sell itself and that its hype would be enough to appeal to everyone. It wasn’t.

The same is often true in the world of pharmaceuticals. Excitement in the lab doesn’t always translate to meaningful benefits in the real world. Every pharmaceutical company believes (or at least hopes) that the scientific innovation behind its latest product makes it truly differentiated – perhaps even the next big thing. But it doesn’t always work like that.

Remember Glybera? The world’s first gene therapy was launched to much fanfare in 2012, and rightly so in terms of scientific achievement. But commercially, it was unviable. Extremely limited patient demand (its indication was for a one-in-a-million ultra-rare genetic disorder), combined with significant maintenance and follow-up costs eventually led to its withdrawal.

With healthcare systems becoming increasingly complex as budgets are being stretched further and further, many new therapies are struggling to find their place in existing patient pathways. So, in identifying areas of unmet need to fulfil, where should companies focus? And how can they ensure that healthcare systems are ready for their innovation to thrive?

Chronic diseases: a hot house of innovation

To try to answer this question, we have focused on chronic diseases, as these represent a major health burden facing society today as well as a major area of focus for scientific innovation. Chronic diseases such as cardiovascular disease, cancer and diabetes kill 41 million people each year, equivalent to 74% of all deaths globally. They also represent the vast majority of health spending. In the US alone, a staggering 90% of the $4.1trn annual health expenditure goes towards treating people with chronic disease.

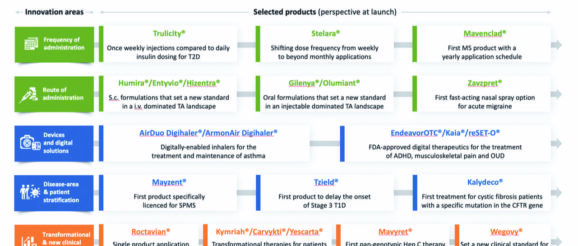

We looked at products for chronic diseases that have been launched in recent years, or are close to launch, with the aim of subdividing them into categories of ‘innovation areas’. Our approach was therapeutic area-agnostic in order to broadly identify the types of innovation that are currently driving commercial success.

The selected products can be found in Figure 1, divided into five identified ‘innovation areas’ that best define the products’ main source of value creation in the context of chronic disease treatment. Let’s take a look at these five innovation areas in more detail.

1. Frequency of dose administration:

People living with chronic diseases usually need to take medication very regularly. Many people with chronic conditions, such as diabetes, have multiple chronic conditions, meaning the intake of medication can be quite significant. This can have an impact on quality of life and, unsurprisingly, medication adherence. Indeed, as many as 40-50% of patients who are prescribed medications for the management of chronic conditions such as diabetes or hypertension miss their medication from time to time.

Reducing the dose frequency can be very beneficial for patients and can also help them in terms of adherence and health outcomes. Mavenclad for relapsing forms of multiple sclerosis (MS) is a great example of a significant advance in dose frequency – two very short treatment courses with pills taken for no more than ten days in a year and no injections or infusions. It improves MS treatment adherence and reduces the need for invasive procedures and intensive monitoring. For some patients, these are significant benefits.

2. Route of administration

Similar to dose frequency, the way a medication is taken can have a significant impact on patients’ quality of life. The ultimate aim is to deliver medication in a way that isn’t invasive or painful for patients, doesn’t involve significant inconvenience (ie, a hospital visit or stay), and minimises healthcare system costs.

Switching from injectables to oral solutions is a great example. Gilenya for relapsing-remitting MS and Olumiant for rheumatoid arthritis are both examples that set new standards for patients in predominantly injectable-dominated treatment landscapes at the time of their respective launches.

Innovative routes of administration can also pave the way to reaching wider patient populations. For example, the recently US Food and Drug Administration (FDA)-approved medication Zavzpret is the first nasal spray-formulated CGRP receptor antagonist for acute treatment of migraine, offering rapid pain relief for patients who cannot take oral medications due to nausea or vomiting.

3. Devices and digital solutions

Devices and digital therapeutics are increasingly becoming sources of differentiation innovation, particularly for more established therapy areas, and can play a big role in disease management.

A good example is the Digihaler range of digital asthma inhalers with built-in sensors that can detect when the inhaler is used and measure inspiratory flow rates. The data from the sensors is sent to its accompanying smartphone application via Bluetooth. Users can then review data over time and have the option to share it with healthcare professionals (HCPs).

Another interesting solution is EndeavorOTC, the first and only FDA-authorised video game treatment for people with ADHD. The treatment takes users through a multilevel interactive game that’s designed to stimulate the senses and aid attention levels. With many countries experiencing a shortage of mental health professionals, solutions like this represent a validated and easily accessible non-drug treatment option for patients.

4. Disease area and patient stratification

By their nature, chronic diseases are biologically complex and driven by multiple mechanisms. Because they can present over time with an array of different symptoms and comorbidities, this can result in patient subgroups that can have varied responses to treatment. This in turn lends itself to innovative approaches to targeting specific patient populations, which can lead to some significant breakthroughs.

For example, the recent FDA approval of Tzield heralded the first ever medication licensed to delay the onset of type 1 diabetes, signalling a major breakthrough for a disease area where historically fewer innovative treatments have been developed compared to type 2 diabetes.

Patient stratification in the treatment of chronic disease has even reached the precision medicine level. Kalydeco is the first treatment developed

for cystic fibrosis patients harbouring specific mutations in the CFTR gene, as identified by genetic testing. Precision medicine represents an exciting area of potential for chronic disease.

5. Transformational therapy and new clinical standards

Finally, the ‘Holy Grail’ of product differentiations – a truly transformational solution that sets a new gold standard in a given chronic disease area.

Excitingly, there are many such examples. Cell and gene therapy has opened the door to medicines with genuine curative intent, such as Roctavian for haemophilia A and CAR-T therapies such as Kymirah, Carvikti and Yescarta for certain types of cancer.

Most recently, Wegovy appears to have achieved a genuine breakthrough in obesity, where meaningful weight loss has been extremely difficult to achieve by pharmacological means for many decades.

The greater the innovation, the greater the level of complexity?

It is clear that, given the breadth of innovation discussed above, there is also a difference in the level of effort and complexity associated with successfully bringing these innovations to the market and integrating them into patient care pathways.

By proactively thinking about the patient pathway, companies can gain invaluable insights into the relevant patient population, the types of stakeholders involved, key decision points and, of course, the key barriers to potential success. This thinking needs to happen early in product development and continue to be re-evaluated throughout the R&D cycle. The level of complexity involved in preparing the pathway for your product will depend largely on which of the five ‘types’ of innovation it speaks to.

In Figure 2, we broadly map out the level of complexity involved against the five innovation areas.

The complexity drivers broadly fall into three categories: patient experience-related, disease- area-related, and healthcare system- and environment-related.

Products whose innovation is based on dose frequency or route of administration will likely lean towards low implementation complexity.

The focus here will likely be around HCP and patient education, adherence monitoring, dose titration, device implementation and more. All of these are primarily product-specific and rarely require any complex environment-shaping efforts at the disease- or system-level. However, it may be challenging to clearly quantify the incremental gains to patients and healthcare systems when implementing such innovation, which could become an issue, for example, in strong evidence- based public payer systems.

In contrast, as we start moving to the right-hand side of the spectrum, we observe increasing complexity and a growing multitude of considerations associated with implementing types of innovation for chronic disease treatment. With disease area and patient stratification innovation, for example, there is an increasing need to engage in disease-level thinking and environment shaping, whether that is identifying the right patient population for clinical trials or working with medical societies and patient advocacy groups to increase awareness.

When we come to truly transformational treatments for chronic diseases, the ground- breaking R&D efforts will need to be matched by the implementation efforts, likely requiring a more fundamental health system and even country-level environmental shaping.

With potentially curative gene therapies such as Roctavian, for example, there is a need to consider how pricing and reimbursement will be negotiated in the absence of long-term efficacy data. This might include considerations for innovative payment models that are available in the markets of interest. CAR-T therapies, on the other hand, require sophisticated medical and technical infrastructure to administer treatments to individual patients. The availability of such infrastructure might vary considerably from country to country, making the roll-out of these innovative treatments extremely challenging.

Not all innovation is created equal

Delivering on innovation drivers alone may not be enough to guarantee a product’s success, but it’s a very good start. By truly understanding its additional incremental value in the current (and future) environment, companies can start to shape the environment and ensure the product proposition becomes even more compelling. Remember Google Glass – define the problem you are solving for potential users and ensure the solution delivers real value for all stakeholders.

We have examined the different dimensions of innovation in chronic disease treatment advances and the complexities associated with their implementation. It is clear that there is a wide range, both in terms of the level of benefit to patients and healthcare systems and the amount of effort that pharma companies need to apply in order to maximise the commercial success of their treatments.

As always, doing the groundwork is key. Understanding the key unmet needs in the context of the current patient pathway and the potential value the product could bring is the first step. Then it’s a question of how it will fit. Where do the complexity drivers fall? How far along the patient experience/disease area/healthcare system continuum do they extend?

Understanding the key innovation area and how that maps against implementation complexity is a helpful exercise that can help you to prepare in the early stages of development and ensure that innovation is translated into real value for all stakeholders.

Meike Wenzel is a Partner, Alexander Kriz is a Director and Dmitry Gorbachev is a Consultant at specialist healthcare consultancy Executive Insight

5th October 2023