Record-Breaking Year for Health Innovation Funding Sets the Stage for New Era of Health Moonshot…

Record-Breaking Year for Health Innovation Funding Sets the Stage for New Era of Health Moonshot Progress

In part I of StartUp Health’s Year-End Insights Report, we look back on how 2020 shaped health investment and how these trends will shape the year to come.

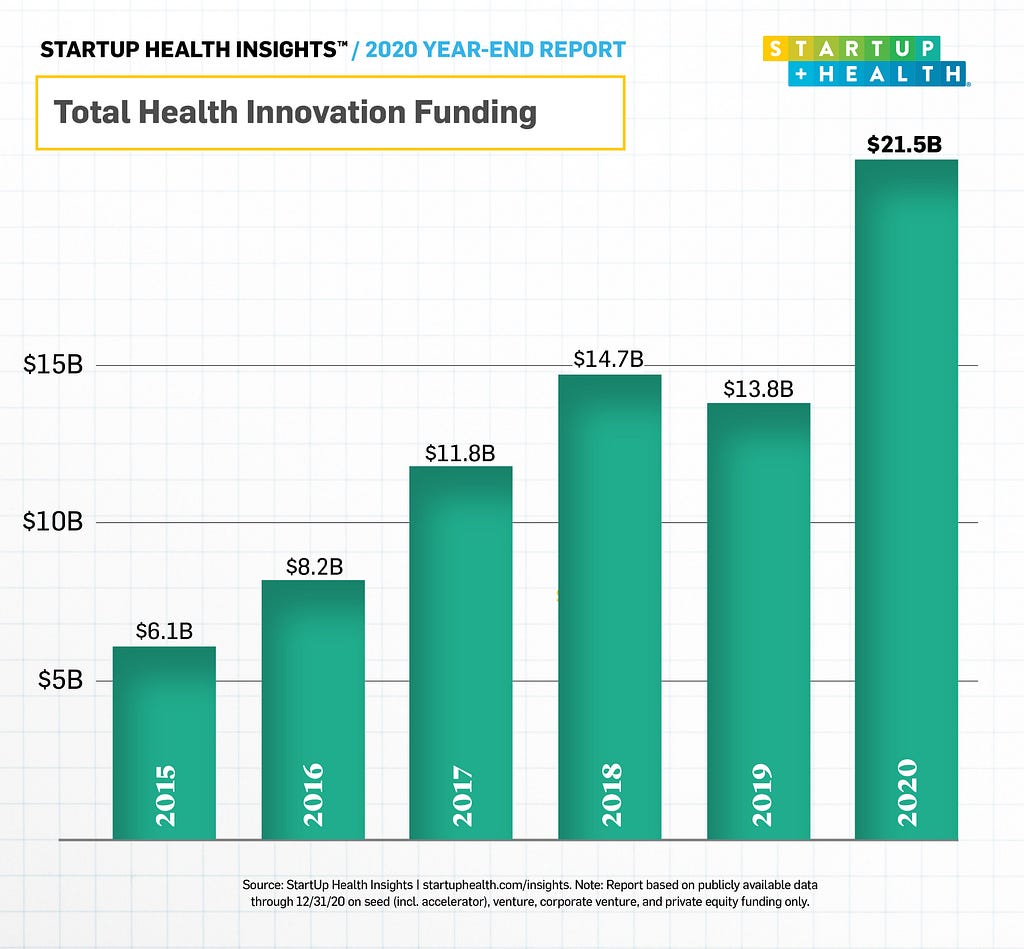

The books are closed on what has been a historic year for health innovation funding. Continuing the upward trend that began halfway through the year, we’re finishing 2020 with a colossal $21.5B raised globally across every sector of health innovation. That makes 2020 the most-funded year in history for health tech, by a mile. 2020 bested 2019 by 55% and 2018 by 46%.

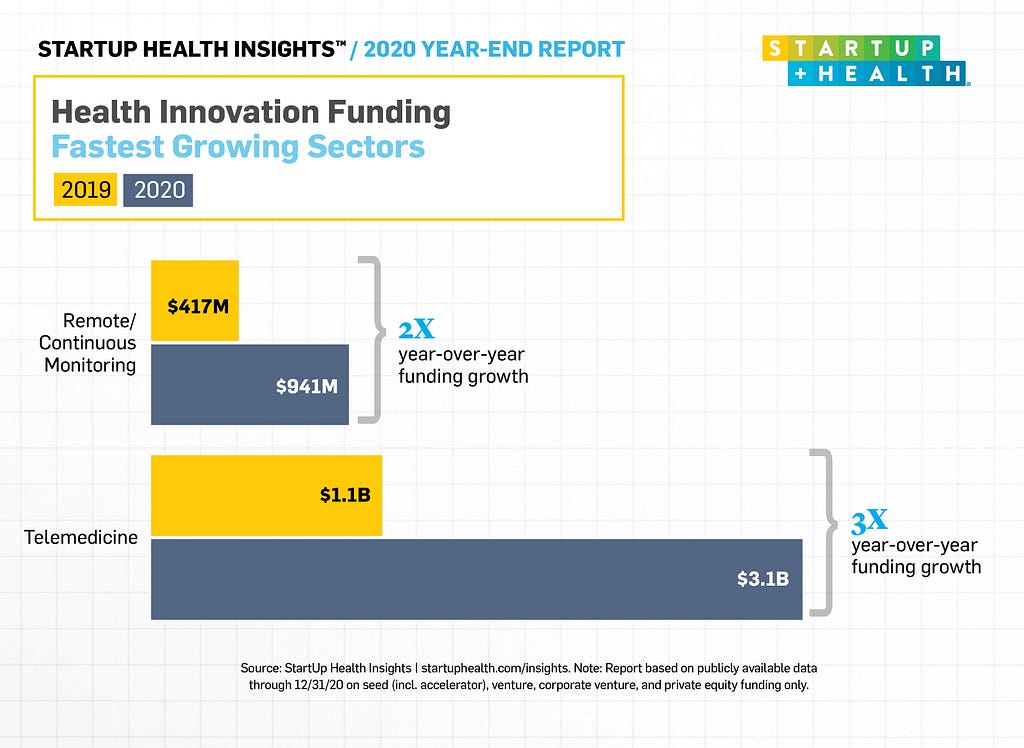

Thanks to a dramatic shift to virtual healthcare during the coronavirus pandemic, investment in telemedicine solutions nearly tripled between 2019 and 2020, growing from $1.1B to $3.1B, and the number of deals doubled. The funds invested in remote monitoring companies doubled over the same period, from $417M to $941M. This year we also saw a significant increase in funding in mental health with investment in the sector more than doubling from $599M in 2019 to $1.4B in 2020. More details on these trends below.

These numbers could stand alone — end of story. They’re certainly headline worthy all by themselves. But at StartUp Health we’re not just about analysis. We’re about understanding and unlocking the potential health impact behind the investment trends. By looking behind the data — which we’ve been collecting independently for nearly a decade — we become even more passionate about the health moonshots that this surge in investment can unlock. So let’s dive into that bigger story.

The Year That Was

It would be easy, sitting here in January 2021 and gazing back with the benefit of hindsight, to think that this meteoric investment trajectory was inevitable. After all, these year-end numbers cap off what has been an incredibly strong six-month run for health innovation funding. It’s only logical, you might say, that a global health crisis would lead to an increase in health tech investment. Not so fast. To understand the year that was, and the significance of these historic funding numbers, we need to take a walk down memory lane.

The first quarter of 2020 came out like a rocket. Thanks to deals that had been percolating in 2019, pre-pandemic, there was $5.0B in health innovation funding in Q1, the most-funded quarter on record. Then COVID-19 caused a worldwide shut-down and all bets were off. Between February 19 and the end of May, the S&P 500 fell 13%. We were in a recession with no end in sight. There was talk of a full-on depression.

On April 7, MedCityNews wrote that while digital health startups had a record-breaking first quarter, “now faced with a global pandemic, the trend is unlikely to continue.” And they weren’t the only ones who predicted that digital health funding would go into hibernation.

Indeed, there was a moment where all the gears seemed to stop. Every event and in-person meeting was canceled. Companies went into protection mode.

“The very first thing I saw with many of the larger venture capital and private equity funds was that they pushed pause on all the deals that were live,” said Andrew Isaacs, StartUp Health advisor. “They needed to recalibrate with their current portfolio companies who actually may need a capital infusion from the fund.”

But that didn’t last long. Looking back now, the speed at which that “pause” turned into an investment sprint is shocking. What followed April’s doomsday pronouncements was a record-breaking quarter for health innovation funding.

“We’re not just seeing a solid performance in health innovation, we’re seeing a dramatic departure from market norms,” we wrote in our 2020 Midyear Insights Report.

And then it happened again, with Q3 posting $7.0B in funding, another “most-funded quarter on record.” Steven Krein, CEO, co-founder and managing partner at StartUp Health, called the third quarter of 2020 a “tipping point for digital health,” noting that “health innovation is now a priority for every nation, organization, and person on the planet as a result of the global pandemic.”

This brings us to the final quarter of 2020. The past three months saw $5.2B in health innovation funding, crushing the previous year’s $3.3B — a 58% increase.

At StartUp Health, we’re not surprised. This has been the surge in investor interest and confidence that we have been anticipating — sometimes patiently, sometimes less so — since StartUp Health was founded in 2011.

“It’s been said that there are decades where nothing happens, and then there are weeks when decades happen,” wrote StartUp Health co-founders Steven Krein and Unity Stoakes.

The progress that’s been made in digital health adoption in 2020 — highlighted by this upswing in investment dollars — tells us that it’s time to triple down on health moonshots. We’ve seen what urgency and investment and collaboration can do in health — just look at the speed at which the COVID-19 vaccines have been developed. Now it’s time to apply that energy and capital to the other great health challenges of our time (read about our 12 Health Moonshots here).

6 Things We Learned in 2020

What did we learn about health innovation investing this year, and the market as a whole? First, investors aren’t so risk-averse that they can’t respond to a challenge. There was a pause in investment during the initial wave of COVID lockdowns, but it was very brief and was followed by the most robust period of health investment in history. Investors didn’t just respond to opportunities (which were already present), they responded to the moment, to the crisis. This willingness to take risks in the name of impact is critical to achieving health moonshots.

In 2020, we also learned that priorities are shifting towards the populations with the greatest needs. Case in point: Cityblock Health. With their recent $160 million Series C, the startup spawned out of Alphabet’s Sidewalk Labs is paving the way for tech-enabled care for poor and marginalized communities. For years the focus of health investment has skewed towards healthy consumers with the ability to pay for services — think Peloton, Fitbit, or DoctorOnDemand. Startups like Cityblock, which joined StartUp Health in 2019, are shifting the focus — and the financial incentives — towards the people who need the most help. (.)

This year we watched as blockbuster acquisitions created the full stack health platforms of tomorrow. Teladoc teamed up with Livongo (in a deal that created a new remote care juggernaut valued at ~$37B) to extend the telemedicine giant into the chronic care arena. UnitedHealth Group’s acquisition of divvyDOSE for $300M and Walmart’s acquisition of CareZone (undisclosed amount) showed us that companies with significant reach are thinking about vertical tech integrations. Press Ganey, the global leader in physician reputation and patient satisfaction data, acquired StartUp Health company Doctor.com in a move that centralizes physician data. Other significant consolidations included Lululemon’s $500M acquisition of Mirror and Bayer’s $225M acquisition of Care/Of.

In 2020 we learned that, not shockingly, during a time of uncertainty, investors prefer to take part in later-stage, more-established, big-dollar deals. Over the course of the year, 33% of the deals were Series B or later (compared with 27% in 2019), representing 70% of the total funding dollars (compared with 59% in 2019). Top deals within the U.S. included Bright Health’s $500M Series E, Zwift’s $450M Series C, and Grail’s $390M Series D financings. Notable deals outside the U.S. included Waterdrop’s $230M Series D (China), Oxford Nanopore’s $207M round (UK), and KRY’s $155M Series C (Sweden) financings. By investing in established companies and mature rounds, investors were able to give themselves a modicum of risk protection, but we shouldn’t overlook the boldness of these moves, given the economic climate.

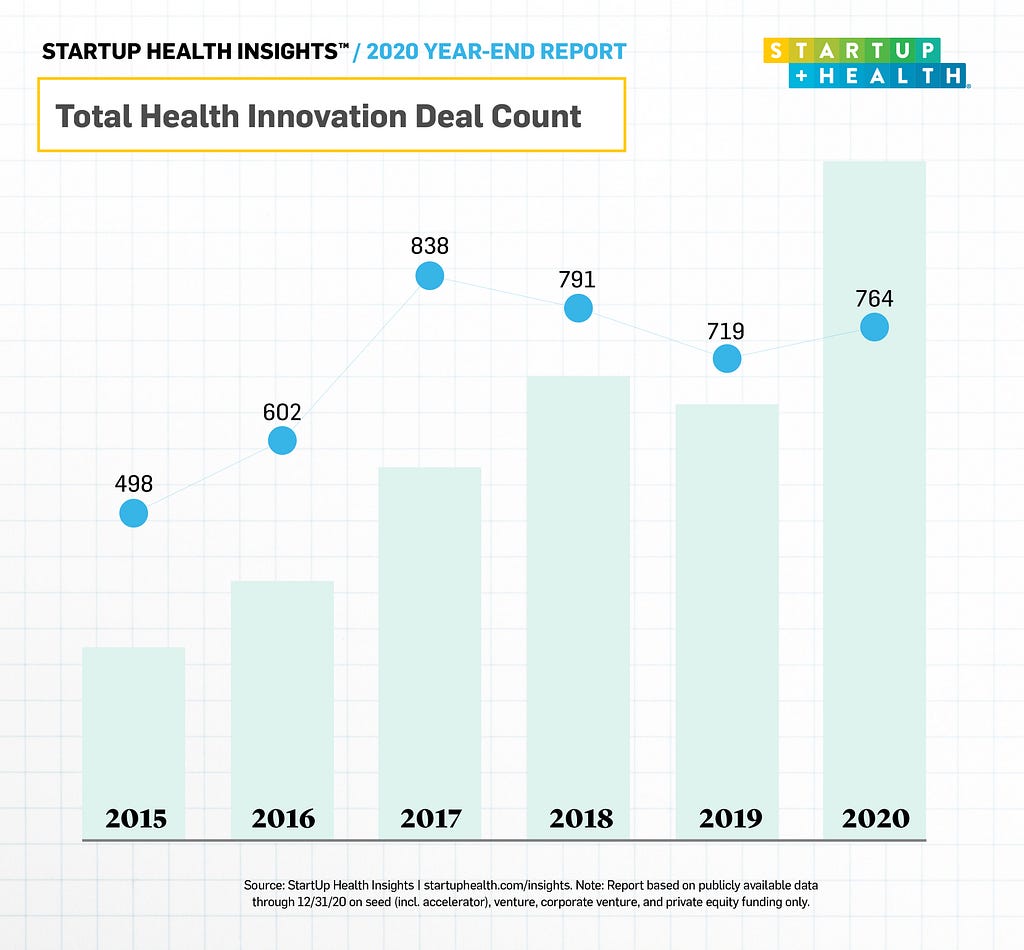

In 2020, we also learned a new way of doing business. Amazingly, it wasn’t just total funds raised that were up year over year, but actual deal count as well. The number of deals went from 719 in 2019 to 764 in 2020, representing a 6% increase. This represents a massive shift in the mechanics of health tech investing. In the past, no big investment deal happened without face-to-face meetings. But social distancing only slowed investment volume for a couple months before firms figured out the new normal and started inking deals virtually. This shift in the assumptions of health investing (that you need to sit across the table from someone to make investment decisions) promises to speed up opportunities and open up new channels for global investment where the cost of travel was a barrier to entry.

At StartUp Health we categorize every investment by health moonshot — the massive global goal that startup is seeking to achieve. This year, the health moonshot of improving women’s health saw the greatest growth in investment. In Q1, we reported that funding in women’s health companies was on the rise. With five quarters of growth, it was the health moonshot with the greatest growth trajectory. That trend continued in the third quarter, when we saw the largest amount of quarterly funding in this space across the last five years with $477M in funding, led by Ro’s $200M Series C and Sema4’s $121M Series C financings. (You can read more about how each of StartUp Health’s 12 health moonshots fared next week, when we publish part two of our year-end funding break-down.)

Early in 2020, we saw cities in China — which had topped the list for global funding for years — fall from view due to the coronavirus. By Q3, they returned to the top 10 most-funded list and in Q4, we saw Beijing as the most-funded city outside the United States ($740M). After Beijing, the top international hubs for health innovation funding were Tel Aviv ($486M) and London ($345M).

A Conclusion (That Is Just the Beginning)

If you ask social media writ large, 2020 was a dumpster fire inside of a category 5 hurricane wrapped in a cloud of hungry locusts. While that might be true in some ways, it’s also true that this was a good year for health innovation. The pain and uncertainty brought on by the coronavirus pandemic spawned a period of bold innovation, investment, and collaboration that is going to have positive effects on health and healthcare delivery for years to come. The pandemic forced the world to jump feet first into virtual healthcare and accomplish a decade of adoption in a few short months. Good things came out of dark times.

2020 also gave health moonshots a new level of momentum, making them a more tangible reality. With the COVID vaccine — and with all of the industry activity we’ve just written about — we got a front-row view of how urgency, investment, commitment, and collaboration can make impossible goals achievable. We did it this year with telemedicine and virtual care adoption. We did it with a vaccine. Now let’s bring that same health moonshot ethos to the other great health challenges of our time.

Data is from StartUp Health Insights, the most comprehensive funding database for health innovation. Get all our free quarterly reports.

Sign up for StartUp Health Insider™

Get funding insights, news, and special updates delivered to your inbox.

Record-Breaking Year for Health Innovation Funding Sets the Stage for New Era of Health Moonshot… was originally published in StartUp Health on Medium, where people are continuing the conversation by highlighting and responding to this story.