Investment Overview

Lear Corporation is a leading designer and manufacturer of complete seating systems and E-Systems for car manufacturers around the world. Lear is on the front end of innovation in the seating systems industry with over 2200 patents and a team of over 3000 engineers worldwide (Source). Their team of engineers and large patent portfolio enable Lear to remain on the front end of the industry with technologies that differentiate them from competitors in the seating industry. Management is continuously multiplying Lear’s growth through intelligent acquisitions and internal capital allocation that has driven ROIC to 19% compared to the industry average of 14% (Source). I expect Lear’s large patent portfolio and effective management to allow Lear to capitalize on secular trends in the industry including, electric vehicles, SUV/crossovers, and autonomous vehicles. For these reasons and the analysis explained in detail below, I am recommending a buy for Lear Corporation with a target of $215 / share implying an upside of ~50% based on a DCF analysis.

Industry Overview

According to a research report by Barclays, light vehicle sales are expected to taper off over the next several years.

While this is a valid concern I believe that a large part of North American sales projections have already been priced into Lear’s stock price. It’s also important to consider the several other markets that Lear operates.

(Investors day presentation)

North American sales make up 39% of Lear’s revenue which is substantial but they are well diversified. I believe that investors are overemphasizing the North American production projections and underemphasizing the expected growth internationally, which Lear is set to capitalize on.(Barclays research report)

As represented in the table above, production growth is expected to decline in North America, Japan, and South Korea at some point over the next 5 years. However, Lear conducts 40% of their business in Europea and Africa according to the image above. Africa is expected to see outsized growth over the next 5 years while Europe expects production to increase slightly but at a decreasing rate. Overall, automobile production growth is a headwind for Lear corporation but the DCF model below is very conservative and accounts for these projections. These projections for automobile production are well known amongst investors and largely priced into the Lear shares.

Patent Portfolio and Technology Offerings

Lear corporation boasts a diverse patent portfolio with over 2200 patents and patents pending worldwide (Source). The sheer number of patents in Lear’s portfolio is important in building and sustaining a long-lasting economic moat within the competitive seating industry. The large OEMs that Lear works with are seeking suppliers with the most innovative products that will complement their automobile offerings. Recent industry-leading technological innovations engineered by Lear include the Intu™ seating system, SoundZone™ noise-canceling technology, ConnexUs™ communications, and ConfigurE+™ modular seating.

Lear’s Intu™ seat is stocked full of new technology and represents the potential for a $250-$750 increase in seat content for luxury vehicles (Source). The Intu seating system includes several market-leading features. The biobridge feature detects stress, drowsiness and heart rate variability, and can automatically respond with heat and massage functions. Intu’s personalized comfort capability switches between Sport, Touring and ProActive™ posture through a series of air chambers that expand and contract for easy adjustment. Lear’s trademarked Climate Ribbon™ technology weaves just below the foam of the seat to provide an even, climate-controlled surface. The Climate Ribbon™ system takes a conduction-based approach rather than the popular convection-based approach resulting in lower energy consumption.

Lear’s SoundZone™ technology has noise-canceling abilities that can create a “sound bubble” between two occupants and connect directly to audio streams. The SoundZone™ technology was produced in response to an increasing need for privacy within consumer vehicles and provides a similar functionality to a divider in Taxis and Limousines. Another recent patent is Lear’s ConfigurE+™ modular seating. The modular seating system allows for easy adjustments to a car’s seating configuration. People who drive for ride-sharing services can now adapt their car to the specific needs of both their everyday life and their job as a driver.

The key takeaway from Lear’s vast patent portfolio is the mix of industry-leading E-Systems technologies and seating systems. Due to the mix of product offerings, Lear is capable of capturing a greater content per vehicle compared to competitors and establishing a competitive advantage.

Management Driving Capital Allocation

When Lear went bankrupt in 2009 the company went through an overhaul of management and overall capital allocation strategy. I believe that the overhaul narrative is important to follow in evaluating Lear’s turnaround as a company and their ability to continue compounding capital going into the future.

A key contributor to ROIC growth over the last decade is management’s new focus on strategically and efficiently allocating capital. Management analyzes each one of their product segments and prioritizes on an ROIC and margin basis. From 2012 to 2017 Lear improved their E-Systems margin by 730 BPS from 7.3% to 14.6%, a doubling. In respect to their seating segment, Lear improved margins from 6.3% in 2012 to 8.3% in 2017 (Source). A key driver of margin growth over the last decade was an initiative to restructure global operations. Lear invested $1.0B in restructuring in the last 10 years and $1.2B in expanding manufacturing facilities in low-cost countries over the past 5 years. Largely as a result of the restructuring efforts Lear currently produces 80% of components and employs 80% of their staff in low-cost countries (Source).

A significant contributing factor to improved margins and ROIC is Lear’s continued focus on becoming a vertically integrated seat and E-systems manufacturer. By attempting to control several levels of the supply chain Lear is cutting down their costs and reliance on sometimes unpredictable suppliers. The success of Lear’s vertical integration efforts is evident in their professional craftsmanship with surface material textiles, premium leathers, and hand-sewn trim covers. Other car seat manufacturers outsource one or several of these steps but Lear maintains their focus and level of professionalism on each step of the process.

Looking forward I expect the main drivers of margin improvement to be in Lear’s E-Systems and premium seating segments. Their focus on premium seating is advantageous for margin growth because of higher pricing ability and margin expansion in the market. The E-Systems market is also a driver of growth due to a significantly higher margin at 14% compared to the overall company margin at 8.2%. According to their recent investors day presentation, management expects margins to improve to ~8.5% through 2023 (Source).

Capitalizing on Secular Trends

The automobile industry is constantly changing and rapidly evolving due to new technologies and trends shifting consumer demand. As a supplier to automobile manufacturers with ever-changing needs, Lear must stay on the cutting edge of innovation and position their research to capitalize on the secular trends driving the industry. A few key trends that are currently shaping the industry include electric vehicles, autonomous vehicles, and higher SUV / Crossover demand.

The electric vehicle industry is expected to achieve outsized growth over the next several years compared to the automobile industry as a whole. According to data from Lear’s investor day presentation, global production of electric and hybrid vehicles is expected to achieve 40% CAGR over the next 5 years and 12% CAGR from 2023-2028 once the industry begins to reach maturity (Source). Lear expects the potential for an increased content per vehicle (NYSE:) of between $300 to $2000 in their E-Systems segment as a result of the increased electrification of automobiles. As previously mentioned, Lear’s E-Systems segment has a higher margin at 14% so any growth in the electric vehicle industry is welcomed as an opportunity for both top-line growth and margin expansion leading to significantly higher earnings into the future.

Autonomous vehicles are far from mass production and I don’t expect autonomous vehicles to contribute to Lear’s growth in the short term, however, when choosing to invest in a company it’s important to evaluate their long-term sustainability. I believe that Lear Corp. is positioning their manufacturing and research processes to capitalize on the autonomous vehicle revolution. Their seating systems recent modular seating patents discussed above will prove beneficial in defining the new layout of vehicles when a driver is no longer necessary. On the connectivity side of Lear’s business, there is an abundance of opportunity in autonomous vehicles that researchers are working hard to capitalize on. Management expects autonomous vehicles to increase CPV by between $500 and $2000 by the year 2035 (Source).

In recent years SUVs and Crossovers have experienced increasing demand due to lower gasoline prices and overall popularity of the style of car. While low oil prices are a temporary phenomenon the projections going into the future still point to 4% CAGR in the SUV / Crossover market compared to ~2% in the automobile industry as a whole. The SUV / Crossover trend is especially attractive to Lear because these types of cars represent an increased CPV of 30-40% due to an increased number of seats and the overall size of the electrical system (Source). In the long run, I don’t believe this trend is sustainable, however, in the short-term Lear stands to benefit from the increased CPV.

Valuation

Lear is attractively valued based on several different methodologies including, historical metrics, public comparable analysis, and a discounted cash flow model.

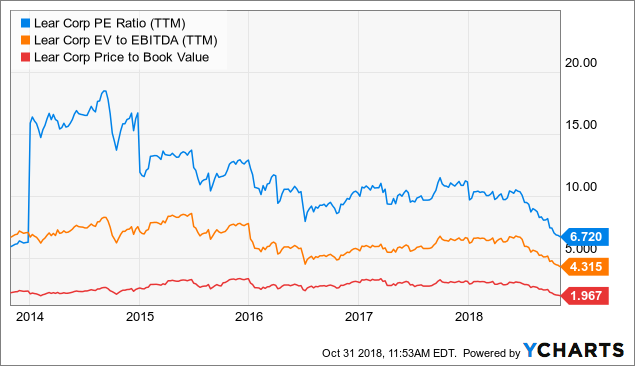

On a historical basis, Lear is attractively valued on several important valuation metrics.

LEA PE Ratio (NYSE:) data by YCharts

LEA PE Ratio (NYSE:) data by YChartsCompared to several of Lear’s closest competitors in their seating systems and E-Systems segment Lear is relatively undervalued on most metrics.

(produced by Asaf Katzir and myself, link to a larger image Imgur)

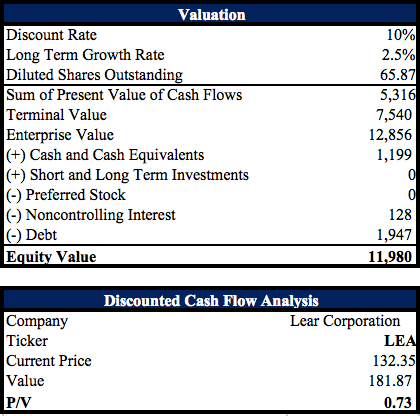

Finally, based on a 10-year discounted cash flow analysis with conservative projections, Lear is significantly undervalued at a P/V of .73.

(produced by myself, please see 181023_LEA_Model_MH.xlsx for model)

Conclusion

Lear Corporation is trading at historically low levels that I believe are unjustified given their impressive operating performance and highly innovative products that are set to roll out over the next several years. Overall pessimism in the automobile industry has driven down Lear’s share price to a bottoming out point that presents a great opportunity for investors. To reiterate, I am recommending a buy for Lear Corporation with a target of $182 / share implying an upside of ~37% based on a DCF analysis.

Key trends to actively follow aside from financial performance as an investor in Lear:

- Automobile industry internationally

- Acquisitions following vertical integration narrative

- CPV uptrends due to innovations being implemented in manufacturing

- Tariffs impacting Lear’s key manufacturing countries

Disclosure:I am/we are long LEA.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.